The metal index has turned out to be the outperformer of 2021, supported by global reflation, a weak dollar index and an uptick in demand across the world. The Nifty metal index has rallied 37 percent in the year 2021, so far, compared to a 6 percent rise in the year-ago period, data shows.

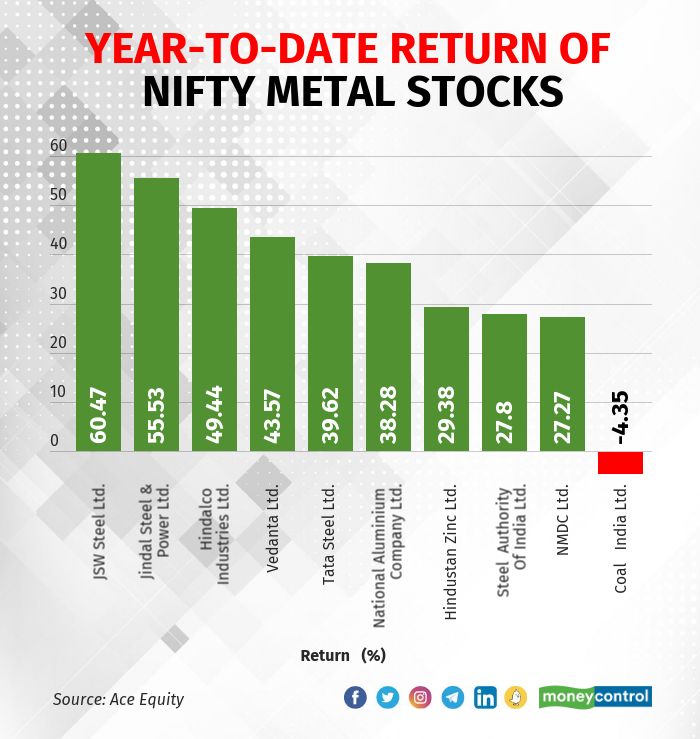

Nine out of 10 stocks in the metal index have delivered 20-60 percent returns. These include NMDC, Hindustan Zinc, Vedanta, Jindal Steel & Power and JSW Steel Ltd, data collated from Ace Equity shows. Coal India was the only stock that fell over 4 percent during the period.

What is fuelling the rise?

Base metals outperformed and reached a multi-year high in FY21 on a weak dollar and strong manufacturing and economic data from China and the US after vaccine news surfaced, Sunilkumar Katke, Head, Commodity & Currency, Axis Securities, told Moneycontrol.

“The demand is outpacing supply this year as overall output is also low compared to previous years due to mining lockdowns. The US spending on infrastructure and electric vehicle (EV) revolution to support overall base metal prices in FY22, especially the copper and nickel prices,” he said.

Following recent concerted price hikes by metal companies across the world, it was raising FY22E/FY23E domestic HRC (hot-rolled coil) price by 2 percent each (16 percent/22 percent lower than current levels), Edelweiss Securities said in a report.

“For the non-ferrous pack as well, we are raising LME aluminium (Al) estimates by 9 percent each for FY22 and FY23. Our FY22E/FY23E EBITDA is, hence, 20 percent/8 percent higher for ferrous companies and 10 percent for non-ferrous companies,” it said.

Deep production cuts in China and the possibility of a reduction in steel exports are propping up sentiment and prices alike. Apart from China factor, Edelweiss said favourable macros—global reflation, a weak dollar index and demand uptick—indicated that good times will persist a little longer for the metal space.

What should investors do?

Should investors buy at current levels? Momentum is likely to continue in the metal space but after a steep rally, there could be some consolidation, experts say.

Investors can opt to go long in the metal space on dips. “We have been bullish on the metal sector for the last two weeks. The sector had a short-term correction in the month of March that unfolded in a channelised manner,” Gaurav Ratnaparkhi, Senior Technical Analyst, Sharekhan by BNP Paribas told Moneycontrol.

“Towards the end of March, the channel broke out on the upside with which we turned positive. Since then the metal index has witnessed a swift rally. As a result, the short-term momentum indicators have been pushed into the overbought zone. So there is scope for a short-term consolidation,” he said.

Traders and investors need to have exposure in the metal stocks, however, they need to wait for a fresh setup to take a fresh entry, he said.

Rahul Sharma, Head, Technical and Derivatives Research, JM Financial Services, told Moneycontrol that the sector has been the dark horse and is also one of the leading sectors responsible for supporting the Nifty50 to a great extent.

“However, the risk-to-reward ratio is not favourable for entering fresh longs here. The bias for metal sectors is still positive and one can look to enter longs on dips or a minor correction for another three-five percent upside,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.