The financial year 2020-21 will long be remembered for the coronavirus outbreak that wrecked lives and upended businesses as lockdown brought economic activity to a halt but it will also be remembered for the remarkable turn around that the market scripted—more than 200 stocks turned multibaggers as the economy showed signs of recovery and earnings improved.

FY21, which ends March 31, has witnessed a V-shaped recovery in benchmark indices after a double-digit fall in March 2020 but it is the small and midcap stocks who are stars of the show.

The S&P BSE Sensex has risen 72 percent and the Nifty50 74 percent from March 31, 2020 to March 12, 2021. During the period, the S&P BSE midcap index gained 94 percent and the smallcap index rose 120 percent.

Small and midcaps outperformed as investors chased growth and most of the stocks in the broader market space were trading at attractive valuations after two years of underperformance.

As many as 230 stocks on the S&P BSE 500 index have risen 100-1,000 percent in FY21. These include CEAT, Axis Bank, TVS Motor, Aurobindo Pharma, CSB Bank, DLF, Tata Metaliks, Mahindra Logistics, NCC, Affle India, and Tanla Platforms.

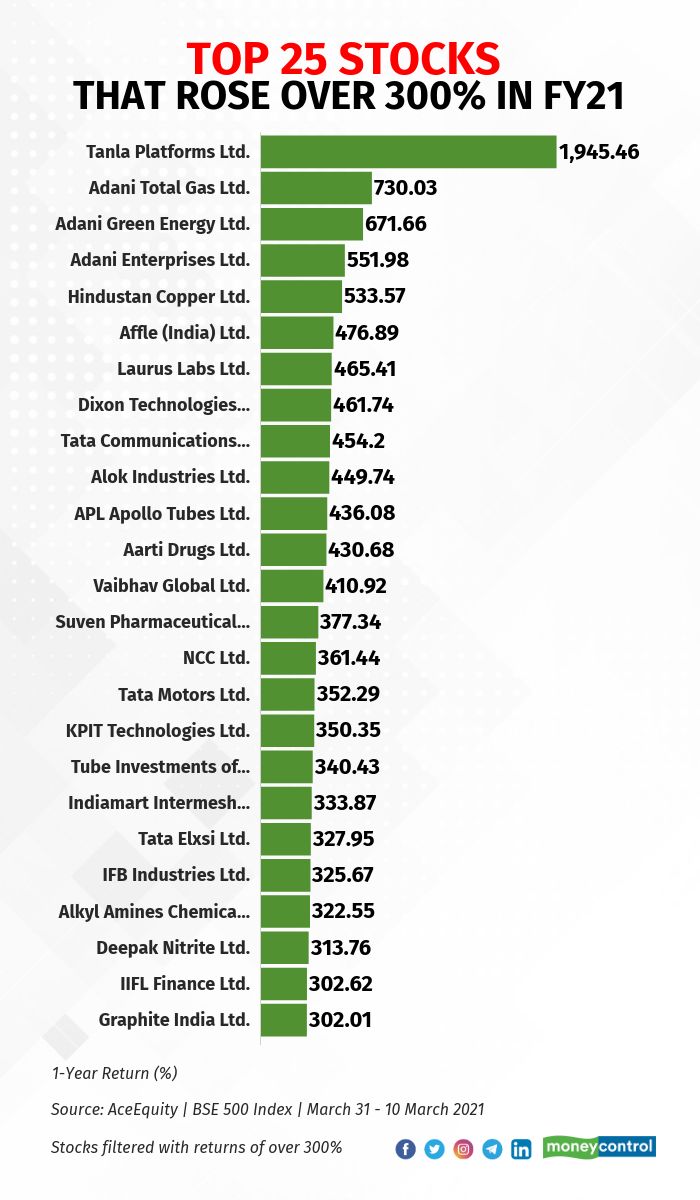

Here is a list of 25 stocks that have rallied more than 300 percent in FY21 in the S&P BSE500 index. Stocks have been filtered based on returns:

Most of the stocks that have multibagger returns are part of small & midcap indices and experts say that the momentum is likely to continue in this space in FY22 as well.

Small & midcaps are a play on the economy and with green shoots now visible across micro and macro data points, experts say mid and small-size firms that are sectoral leaders will continue to do well.

“We do expect mid and small caps to continue to do well as economy recovers further post-vaccination and more segments of the economy are opened up. However, not all mid and small caps will participate,” Gautam Duggad, Head of Research–Institutional Equities, Motilal Oswal Financial Services Ltd said.

“Only companies with healthy business models, strong balance sheets, leadership positions in their segments and durable competitive advantages will do well, in our view,” he said.

Investors should only look at good companies that are available at attractive valuations, say experts. Some newly listed companies could be part of the portfolio, while the recent correction in largecaps also makes them attractive.

“At current market levels, choosing the right company is key. Every segment of the market ie largecap, midcap or smallcap would have stocks where the risk-reward is in favour or vice-a-versa,” Chandraprakash Padiyar, Senior Fund Manager, Tata Mutual Fund, told Moneycontrol.

“I am cautiously optimistic for the largecap and the smallcap segments of the market. The midcap segment has very good businesses but valuation comfort is relatively lower.”

Valuations comfort

Small & midcaps were on the buyers’ radar in 2020, outperforming largecap peers largely on valuation comfort as well as growth outlook. Most of the recent IPOs could turn out to be sectoral leaders.

With the opening up of the economy, investors are looking for new ideas and the success of recent IPOs indicates an appetite for mid and smallcap stocks, say experts.

“Midcaps are trading at 12 percent premium to large caps. From a valuation perspective, midcaps look attractive versus large caps. Historically, during the bull phase of 2017, midcaps were trading at 45 percent premium to large caps,” Neeraj Chadawar, Head-Quantitative Equity Research, Axis Securities told Moneycontrol.

“The success of the recent IPO in which four-five IPOs were subscribed more than 100 times along with the latest IPO MTAR, which got subscribed by more than 200 times has further boosted the overall confidence for mid and small-cap companies which is supported by improved liquidity and overall risk appetite,” he said.

Chadawar added that the two-year rolling returns indicated that the market has turned in the favour of small and midcap stocks that are reasonably valued and offer greater upside potential.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.