The long-awaited scheme of incentives to scrap old automobiles announced on March 18 is expected to boost demand for new vehicles and provide low-cost recycled components, potentially doubling the industry’s turnover if implemented effectively.

Experts say the ‘Voluntary Vehicle-Fleet Modernisation Program’ or ‘Vehicle Scrapping Policy’ will help the entire value chain of commercial vehicles including OEM players, tyre makers and ancillaries.

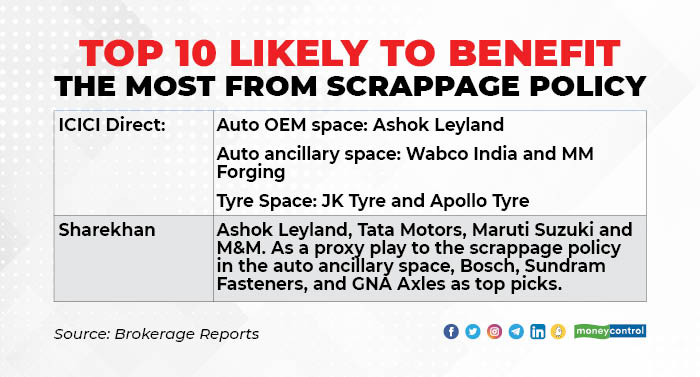

“Our preferred picks here are Ashok Leyland in the auto OEM space, Wabco India and MM Forging in the auto ancillary space, JK Tyre and Apollo Tyre in the tyre space,” ICICIdirect said in a report.

The government is expected to publish a draft notification in the next few weeks. It will lay down rules for fitness tests and scrapping centres by October 2021, and scrapping of government and PSU vehicles older than 15 years by April 2022.

According to CARE Ratings, the policy expected to be a ‘win-win’ for all as it helps reduce India’s oil import bill by improving fuel efficiency, reduce environmental pollution and improve road and vehicular safety by getting rid of old and defective vehicles, boost the availability of low-cost raw materials like plastic, steel, aluminium, steel, rubber, electronics, etc. for the OEMs.

“Potential to increase automobile industry’s turnover to Rs. 10 lakh crore from the existing Rs. 4.5 lakh crore. However, proper implementation of this policy is pivotal for it to be a success,” said the report.

The policy covers commercial vehicles of over 15 years of age and private vehicles of over 20 years of age, which fail fitness tests.

Also Read: Auto scrappage incentive scheme: Stakeholders look at it with optimism and doubt

The government has estimated that the country has 51 lakh LMVs older than 20 years and 34 lakh that are older than 15 years. About 17 lakh medium and heavy commercial vehicles are older than 15 years without a valid fitness certificate, said a Sharekhan note.

“We believe this fee hike needs to be supported by favourable incentives for scrapping older vehicles. The government has proposed incentives for owners such as 4%-6% of the ex-showroom price of a new vehicle, from a recognised scrapping centre and another 5% discount from OEMs after producing a scrappage certificate,” said a Sharekhan report.

The key beneficiary of the scrappage policy would be commercial vehicles, as fleet owners will get substantial benefits by purchasing new vehicles.

“We like Ashok Leyland and Tata Motors in that space. Other OEMs, which are expected to benefit from the proposed policy, are Maruti Suzuki and M&M,” said the Sharekhan report.

“As a proxy play to the scrappage policy in the auto ancillary space, we prefer Bosch, Sundram Fasteners, and GNA Axles as our picks,” it said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.