Indian markets remained volatile in the truncated week largely on account of the rise in COVID-19 cases that led to partial lockdowns in various parts of the country, as well as a fall in the rupee against the USD, and selling by foreign institutional investors.

The S&P BSE Sensex fell 1.5 percent while the Nifty50 was down by 1.4 percent for the week ended April 16 compared to the 2.9 percent fall seen in the S&P BSE Midcap index, and a 2.6 percent drop in the S&P BSE Smallcap index in the same period.

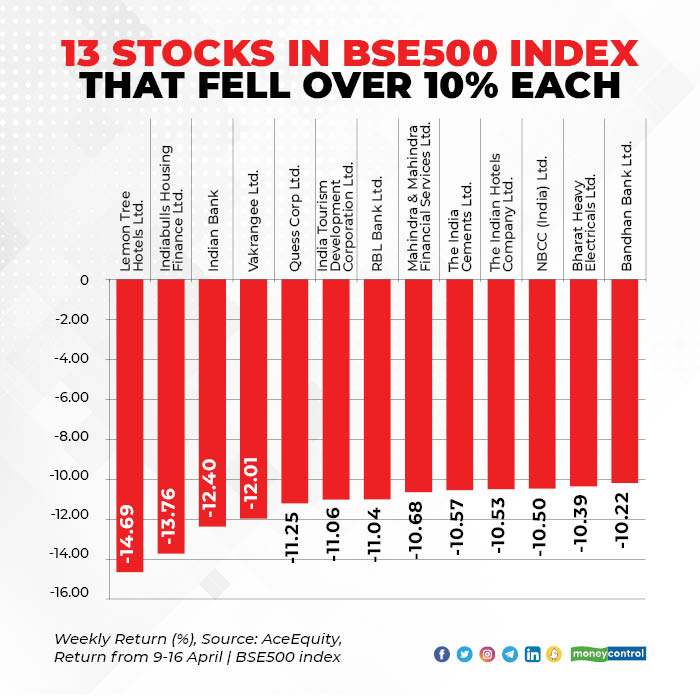

There are as many as 13 stocks in the S&P BSE 500 index that fell over 13 percent for the week ended April 16, which include Bandhan Bank, NBCC, India Cements, RBL Bank, Quess Corp and Lemon Tree, among others.

Foreign Institutional Investors (FIIs) turned net sellers so far in April pulling out nearly Rs 2,600 crore from the cash segment of the Indian equity markets, data on Moneycontrol showed.

“During the start of the week, Indian markets encountered increased volatility with VIX rising 16.22 percent while the US continued to hit fresh lifetime highs. Unlike in the past, FPIs have diverted from their usual buying behaviour and have turned net sellers so far this month, as India struggles to cope with the increased pace of infections,” Nirali Shah, Head – Equity Research, Samco Securities told Moneycontrol.

“Nevertheless, it is expected that once the vaccination drive starts in full-swing, things should come back in control. Investors are advised to look at corrections as an opportunity to rejig their portfolio and invest in quality companies,” Shah said.

Realty, IT sector take the hit

In terms of sectors, S&P BSE Realty plunged about 6 percent followed by IT that was down by 4.4 percent for the week ended April 16.

With various states initiating partial lockdowns pushed investors to book profits or take out money from small & midcaps as well as the realty sector, experts suggest.

“Concerns on COVID-19 second wave have dampened sentiments as the sector was just looking forward to the nascent recovery. This has resulted in some more pressure on realty stock,” Mehul Kothari, AVP – Technical Research at AnandRathi told Moneycontrol.

The S&P BSE IT index fell by over 4 percent in a week, largely on account of profit booking post recent results announcement.

“IT stocks saw profit booking after the announcement of results. Some realignment is taking shape in the IT sector wherein stocks like TCS and Infosys which are richly valued are seeing profit-taking,” Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities told Moneycontrol.

“Wipro is seeing re-rating on better-than-expected earnings. The way investors have reacted to leading IT stocks, we can expect profit booking in other leading companies which are due to come with results and where valuations are rich or fully valued,” Oza said.

Technical outlook

The Nifty50 closed below the 50-Days Moving Average for the week ended April 16 which suggests that volatility is likely to continue, but bulls are giving a tough fight to the bears.

The Nifty50 made a swing low of 14,248 on April 12, which will act as an important support level to track in the coming week as well. On the higher side, 14,800-15,000 will be crucial resistance levels.

“Market sentiment is becoming “cautiously optimistic” and the best strategy is to “buy on dips. In the coming week, the market should trade between the range of 14450-14850 on the Nifty,” Shrikant Chouhan, Executive Vice President (Equity Technical Research), Kotak Securities told Moneycontrol.

“Above the levels of 14,850, short-covering could come in that may lift the market to 15,000-15,150 levels. HDFC Bank’s quarterly numbers will determine the Bank-Nifty trend. They should be graded between the 32,600 and 31,400 levels,” Chouhan said.

Chouhan further added that during the week, FIIs were selling for Rs 1,500 crore due to the exceptional weakness of the Indian rupee. We expect value-buying in shares of financials and commodities should emerge in the coming weeks.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.