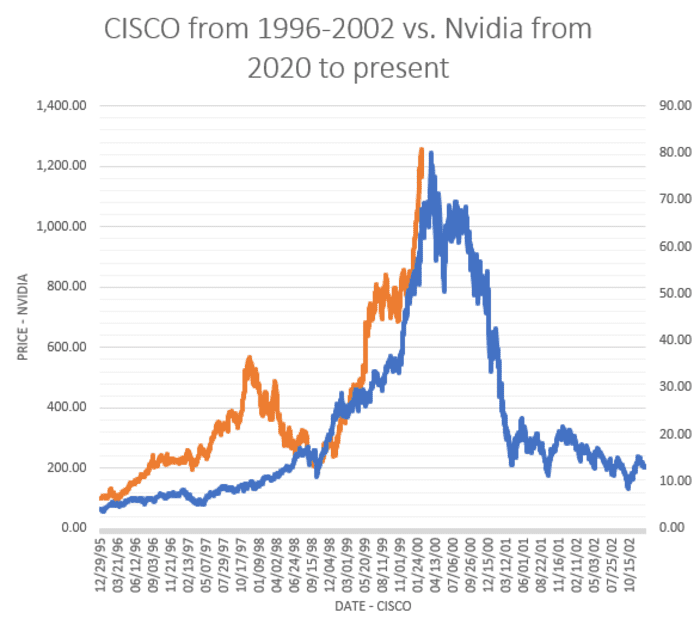

A chart comparing Nvidia Corp.’s performance to that of Cisco Systems during the dot-com bubble years certainly looks ominous.

Perhaps that is why the chart, or various versions of it, has been making the rounds on X, the social-media platform formerly known as Twitter, while also finding its way into Wall Street research reports — including a recent briefing from Evercore ISI’s Julian Emanuel viewed by MarketWatch.

Reproduced below, the chart reflects Cisco’s CSCO, +0.41% share price on a split-adjusted basis between Jan. 1, 1996 and Dec. 31, 2002. (Cisco shares most recently split just days before their peak, on March 23, 2000, according to FactSet data.) This is compared with Nvidia’s NVDA, -2.85% performance beginning Jan. 1, 2020, through Wednesday’s close.

FACTSET, MARKETWATCH

Although the company is still around, Cisco has earned a reputation as a cautionary tale from the dot-com boom and bust. Its shares soared more than 20-fold between Jan. 1, 1996, and the stock’s peak at more than $ 80 a share on March 27, 2000, on a split-adjusted basis, as investors bet that demand for servers and other hardware associated with the then-nascent internet would see stratospheric growth.

At the peak of the dot-com bubble, Cisco was the most valuable stock in the S&P 500 SPX, with a market value of nearly $ 560 billion, according to FactSet data.

By comparison, the company is worth just $ 197 billion as of Wednesday.

Nvidia’s market capitalization peaked at north of $ 1.8 trillion earlier this month, briefly establishing it as the third-largest U.S.-traded company by market cap. Following Tuesday’s selloff, the stock had sunk back into fifth place behind Alphabet Inc. GOOGL, +1.01% GOOG, +1.15% and Amazon.com Inc. AMZN, +0.90%

Valuations today aren’t as extreme as dot-com bubble peak

While Nvidia’s present valuation might look excessive compared with the S&P 500, it’s nowhere near the earnings multiple that telecom hardware companies like Cisco were fetching at the peak of the dot-com boom.

Nvidia’s price relative to its expected 2024 earnings stood at 54 on Wednesday just ahead of the company’s latest earnings report. Cisco was valued at a multiple of more than 150 times forward earnings in March 2000, when the stock hit its dot-com era peak.

Taking a look at the broader S&P 500, analysts would be hard-pressed to argue that valuations today have reached levels of froth comparable to the dot-com peak. While the trailing 12 month earnings for the S&P 500 SPX look historically stretched at 22, they are far from their bubble-era peak of 28 times, according to Emanuel.

This brings us to another important difference between dot-com era Cisco and the Nvidia of today: the latter is much more profitable than the latter was at its peak.

“Nvidia is probably more profitable than Cisco was at that point,” said Kim Forrest, founder and chief investment officer at Bokeh Capital Partners.

The data back this up. Cisco booked an average net margin of 17.2% between 1996 and 2000, compared with a five-year average of 27.9% for Nvidia through January 2023, the latest full-year data available via FactSet.

Momentum also isn’t as intense

As of Wednesday afternoon, Nvidia shares had risen more than 500% off their bear-market low reached on Oct. 14, 2022.

While that is certainly an extreme move, especially for such a large company, Cisco still has it beat. The telecommunications equipment company experienced a 700% run-up between its October 1998 low and its March 2000 peak.

For Nvidia to notch a comparable advance, its shares would need to rise more than 20% from their current levels to $ 862 a share by April 2024, according to Emanuel’s calculations.

Of course, just because something is richly valued, doesn’t mean it can’t keep on climbing. Momentum-driven rallies often end abruptly, with little to no warning, Emanuel said, citing the meme-stock mania as one recent example.

With valuations already looking stretched but not ridiculous, investors might want to consider bulking up their allocation to defensive stocks that have underperformed Big Tech, according to Evercore ISI.

Concentration risk may be cause for concern

One area where Nvidia and its megacap peers have their dot-com-era brethren beat is the extreme level of concentration in today’s stock market. According to Emanuel, the top five largest U.S. stocks account for 25% of the value of the S&P 500.

That is well above the previous peak from the dot-com era, when the percentage of the S&P 500 contributed by the top five stocks briefly climbed above 15%.

EVERCORE ISI

“Concentration risk is elevated, far beyond the peaks in Y2K,” Emanuel said.

What Nvidia and Cisco do have in common: ‘picks and shovels’

The frequent comparisons between Cisco and Nvidia are rooted in an adage dating back to the California gold rush of the mid-19th century that has become baked into the conventional wisdom of investing.

“The rationale was always when there is a gold rush it’s more profitable to supply the picks and shovels to the miners than to mine the actual gold,” said Steve Sosnick, chief market strategist at Interactive Brokers and a former Wall Street equity trader.

As such, both Nvidia and Cisco have earned the “picks and shovels” label, with Cisco seen as supplying hardware that was essential to connecting people to the Internet, while Nvidia makes chips that are integral for data centers to power the generative artificial-intelligence technology pioneered by OpenAI and its competitors.

But there are a couple of key differences in their business models that Forrest said investors should keep in mind. One is that Cisco designed and manufactured its own products, whereas Nvidia outsources the manufacturing process to Taiwan Semiconductor Manufacturing Company.

Cisco’s products were also less complicated to design, enabling competitors to produce their own rival products and quickly undercut the market leader. Nvidia still has an edge with its specialized chips, but other competitors are closing in fast.

“I would bet that others, like Intel and AMD and many others are going to try to Cisco them,” Forrest said. “But I don’t think it will be as rapid as Cisco.”

More than 20 years have passed since Cisco reached its bubble-era peak. But the stock has yet to reach new highs. Whether or not a similar fate lies in store for Nvidia remains to be seen, but it would certainly disappoint many of the bulls who aggressively bid the shares higher over the past year.

“It has been essentially dead money for 20 years,” Sosnick said of Cisco.

Cisco shares rose 0.4% on Wednesday to close at $ 48.48, while Nvidia shares dropped 2.9%, adding to a more than 4% decline from Tuesday, as investors eagerly awaited the company’s earnings after the bell.

But the company’s shares were climbing more than 6% after hours after the chipmaking giant reported a 265% increase in its quarterly revenue to a record $ 22.1 billion.

See: Nvidia clobbers earnings expectations as AI demand hits ‘tipping point’; stock up 6%