A number of commodities made notable moves in 2023, with gold and frozen orange-juice prices reaching record highs, but key commodities indexes are on track to post their largest losses in five years, pressured by declines in natural gas, coal, and grains.

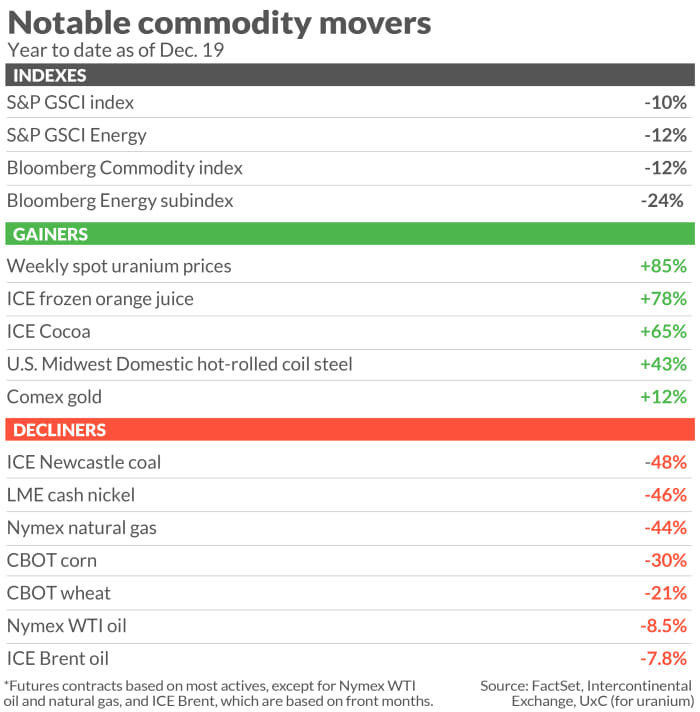

The S&P GSCI XX:SPGSCI, a benchmark for investments in the commodity markets, traded 10% lower year to date as of Dec. 19, FactSet data show. The energy sector posted the biggest decline, with the S&P GSCI Energy index XX:SPGSEN down 12%.

The Bloomberg Commodity Index XX:BCOM, which tracks 24 commodities, has lost 12% this year, with the Bloomberg Energy subindex down 24%.

Both indexes are on track to post their largest yearly percentage declines since 2018.

The commodity sector showed “its true nature as a collection of weather derivatives, for the most part, as 2023 unfolded,” said Darin Newsom, senior market analyst at Barchart.

Based on that, and the move from the La Niña to El Niño weather patterns, he said he wasn’t overly surprised by a number of commodity markets posting losses, but “there was much more to it than just weather.”

Gainers

The overall losses in the key indexes came in contrast to strength in a number of commodities.

Gold futures prices GC00, +0.28% GCG24, +0.28% climbed to an intraday record-high of $ 2,152.30 on Dec. 4 and have since pulled back. But as of Dec. 19, gold was still up 12% for the year.

Read: Gold just a record high. Is it too late for investors to add it to portfolios?

“With interest rates set to pause and eventually decline, the U.S. dollar falling, and disinflation continuing around the world, we have to throw all fundamentals to the wind when it comes to gold,” said Adam Koos, president at Libertas Wealth Management Group. “At this juncture, the gold trade is all about all-time-highs, selling pressure, shorts, and breaking out above this multiyear level that has posed such a problem for the yellow metal in the past.”

If gold can break out above all-time-highs and hold there, Koos said he expects the metal to have a great year in 2024, “at a point when perhaps fundamentals might start to come back into play.” For now, he sees gold as “purely a technical trade.”

The Year Ahead: Silver’s window of opportunity is closing, with prices poised for an ‘explosive move’ in 2024

Meanwhile, the so-called “soft” commodities, defined as those that are grown, not mined, have also rallied this year.

While the softs are weather derivatives at heart, “major growing areas around the world continued to have trouble,” providing support to commodities in the sector, said Newsom.

Frozen concentrated orange-juice futures OJ00, -2.82% OJH24, -2.84% touched an all-time high of $ 4.258 a pound on Nov. 20, with prices up around 78% year to date, and cocoa futures CC00, -0.49% CCH24, -0.49% have rallied by 65% this year.

“Cocoa prices are up on supply concerns due to unrest in West Africa,” while orange-juice prices have found support on supply concerns related to weather, said Roland Morris, commodities strategist for VanEck’s active Natural Resources Equity Strategy.

In the energy sector, uranium bucked the trend among its peers as prices for the nuclear fuel soared.

Weekly spot uranium prices were at $ 86.35 a pound as of Dec. 18, according to UxC. Jonathan Hinze, president at UxC, pointed out that a deal at $ 89 a pound was seen on Dec. 20, which would be the highest spot transaction price since January 2008.

If the year-end price stays at around $ 89, that would mark a yearly rise of roughly 85%, he said.

Read: Why the rally in uranium that lifted prices to a 15-year high may not be over

The biggest factor affecting the uranium market right now is the passage in the U.S. House of Representatives of a bill that would ban Russian uranium imports, said Hinze. The bill is so far held up in the Senate but there are signs it could pass as soon as January, and that’s led several buyers to jump in, he said.

“If the U.S. ban on Russian imports becomes law, this could spur additional upward moves in price,” said Hinze.

Decliners

Among the commodity decliners, coal and natural gas were standouts.

Newcastle coal futures NCFF24, -1.25% have lost around 48% this year as of Dec. 19, based on data from ICE Futures Europe.

Demand for coal is forecast to decline amid a push around the world for cleaner energy.

In a recent monthly report, the Energy Information Administration said it expects renewable energy to take on a greater role in the new year, with solar and wind together expected to generate more power than coal for the first time ever in the U.S.

And earlier this month, at the United Nations Climate Change Conference, also known as COP28, nearly 200 parties reached an agreement to phase out fossil fuels.

Read: Here’s what the COP28 pact to phase out fossil fuels means for oil

U.S. natural-gas futures, meanwhile, have lost 44% this year as of Dec. 19. The commodity NG00, +3.35% NGF24, +3.35% traded on the New York Mercantile Exchange (Nymex), had posted a gain of 22% for the month of October before falling back sharply in the last two months of the year.

Strong U.S. production, combined with a “warm start to this winter heating season,” has pressured prices for natural gas, said VanEck’s Morris.

In the grain complex, corn and wheat led the declines, with wheat futures W00, +0.70% WH24, +0.70% traded in Chicago down 21% and corn C00, +0.69% CH24, +0.69% losing 30% year to date.

Morris said that among the big surprises in the commodities market was the fall in wheat and corn prices, particularly with the Russia-Ukraine war.

“That region is so important to the world supply of corn and wheat I would have expected prices to remain higher on supply concerns,” he said.

Production of crops this year in North and South America increased, generally speaking, said Barchart’s Newsom. Increased U.S. production, due to better weather, alongside continued slow demand led to losses for corn and soybeans, in particular, he said.

Oil prices have also declined, despite risks to global supplies posed by the continuing Russian-Ukraine and Israel-Hamas wars.

More recently, major shipping companies announced a halt in shipments through the Red Sea because of recent attacks on ships by Iran-backed Houthi rebels, providing a boost to oil, but prices remain lower overall for year.

Read: Attacks in the Red Sea add to global shipping woes

U.S. benchmark West Texas Intermediate crude CL.1, -0.42% CLG24, -0.42% was off 8.5% in the year to date on Nymex as of Dec. 19, while global benchmark Brent crude BRN00, -0.35% BRNG24, -0.35% on ICE Futures Europe has lost 7.8% this year.

The Year Ahead: Why oil may not see a return to $ 100 a barrel in 2024

“If Iran and their proxies are successful in shutting down shipping in the Red Sea and through the Suez Canal for an extended period of time, I would expect higher prices for grains and crude oil,” Morris said.

Outlook

Looking ahead, next year could be a strong one for commodities, analysts said.

“The Fed will start cutting interest rates at some point and the U.S. dollar is likely to decline, possibly sharply,” said Morris. “Emerging-market economies will also be able to lower interest rates stimulating growth in EM economies and increasing commodity demand.”

Libertas Wealth Management’s Koos also predicts a “positive year for commodities” in 2024.

He expects risk-on assets to complete with hard assets, primarily U.S. stocks and bonds, as interest-rate shock hits the economy.

“Compound that with strong potential geopolitical risks in an election year, and I think we’ll continue to see a bid in hard assets, overall,” said Koos.