The bond world isn’t exactly known for embracing technology, particularly since until fairly recently most fixed-income trades were still conducted by telephone.

But bond traders in the notoriously niche $ 600 billion commercial mortgage-backed securities market (CMBS), now have more ways than ever to tap Big Data when betting on a recovery — or decline — of specific hotel properties or a cluster of shopping malls.

Like with so many things lately, the pandemic has been a catalyst.

A year ago, Empirasign Strategies, a New York City-based platform that tracks trading data in more opaque parts of the debt markets, joined up with geolocation analytics firm Advan to start mapping foot-traffic data to specific commercial-property bond deals.

“It was late March and everything felt like it was going to hell in the city,” said Adam Murphy, founder of Empirasign. “They had just announced that the Javits Center was going to be set up as a field hospital.”

That is when Murphy began talks with Advan about licensing its foot-traffic data, already used by hedge funds, private equity and the real-estate industry, to overlay with Empirasign’s bond-trading data.

“Everybody was thinking: Is New York coming back?” said Murphy, who kept commuting into the office several times a week during the pandemic. “I could witness foot traffic firsthand, but I could only see it with my own eyes, and only for a couple of blocks.”

Now that about 40% of the U.S. population has received at least one COVID-19 vaccination shot, more hotels, retail and office buildings across the country have reopened.

Empirasign’s platform has ramped up too, linking about 65% of all commercial-mortgage bond deals with data showing how fast, or slow, foot traffic has returned to specific properties, with a goal of reaching 95% by May 1.

“The underlying reason why many investors have been patient in the past year is their belief that workers will return to offices and tourists will return to hotels,” Murphy told MarketWatch. “This is how you can actively monitor the validity of that thesis.”

Related: Office property values could plunge by 54% if work-from-home lasts: Fitch

Hotel, mall woes

Take the hard-hit hotel sector, where last spring bookings plunged overnight, causing property bond prices to drop and borrowers owing billions in debt to line up for talks with lenders about potential relief.

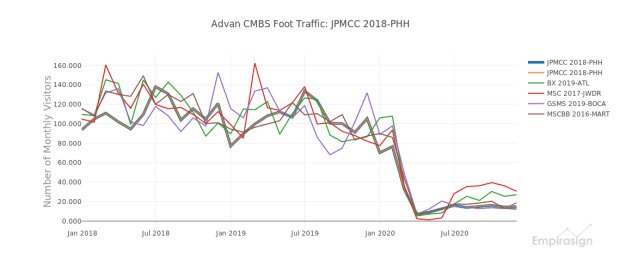

In the months since, foreclosure proceedings have begun at some distressed properties, even as foot traffic ticks back up. This Empirasign chart compared foot traffic at six hotels where loan payments were more than two months past due.

Foot traffic at hard-hit hotels.

Empirasign

The blue line represents foot traffic at JPMCC 2018-PHH, the name for a $ 328.9 million commercial-mortgage bond deal that three years ago helped finance the historic Palmer House Hilton in Chicago, the city’s second-largest hotel, which currently is in foreclosure proceedings, according to Trepp LLC.

Recent Empirasign bond-tracking data pegged junior slices of the hotel debt fetching dimes on the dollar, signaling a low expected recovery value.

Ed Reardon, a Deutsche Bank analyst, said some green shoots have been emerging, including hotel occupancy rates that recently reached a pandemic high of 60%, in a weekly note. On the flip side, hotel loans still have the highest delinquency rate, with 19% more than 60 days past due as of April 21, compared with 7% for retail and 6% overall for all property types.

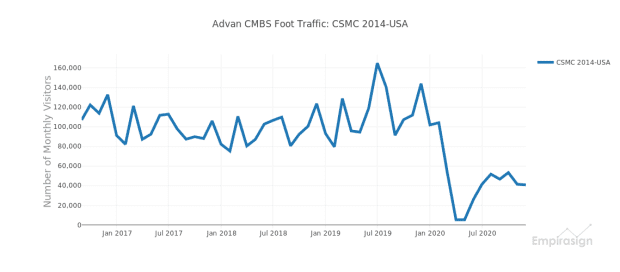

Away from hotels, foot traffic also has picked up from the lows at several of the nation’s gargantuan shopping malls, including at the Mall of America in Minnesota. The Wall Street Journal recently detailed the owner’s struggles to keep the mall’s indoor roller coaster open during the pandemic, as well as to stay current on the $ 1.4 billion borrowed in the bond market.

Mall of America foot traffic.

Empirasign

“There’s a tremendous amount of data out there that people have been using for a long time,” said Steve L’Heureux, a Loomis, Sayles & Company portfolio manager LSSAX, and global commercial real estate and CMBS strategist. “Some of it is far more sophisticated than the average industry participant might think of.”

But L’Heureux also cautioned that foot traffic doesn’t necessarily translate to sales, and commercial real estate still hinges on a property’s financials, borrowing rates BX:TMUBMUSD10Y, cash flows and the tangle of legal contracts between landlord and tenants, which often get renegotiated during periods of stress, as well as those between borrowers and lenders.

“That kind of information is harder to get,” he said. “I think the new stuff is interesting. And it is kind of a hot topic.”

Also read: This may be the post-pandemic economy’s most closely watched indicator