A revitalized 2023 stock-market rally finally ran out of fizz last week. And it might take some time to get back on track in the face of a dip in market liquidity and signs that a surge of buying fueled by “fear of missing out” has largely run its course.

“We don’t think the rally is over, but it may be difficult” for it to proceed in coming weeks “with liquidity coming out of the system,” said Michael Arone, chief investment strategist for the U.S. SPDR Business at State Street Global Advisors, in a phone interview.

He pointed to a “trifecta” of events that have or will likely continue to sap liquidity:

- Quarterly estimated corporate taxes were due beginning June 15. Those payments come out of bank demand deposits and go to Treasury, taking liquidity out of the financial system.

- The Treasury Department continues to issue T-bills to rebuild the Treasury General Account, which was depleted ahead of the resolution of the debt-ceiling showdown in Congress in early June. While around half the demand has come from cash parked by money-market funds in the Federal Reserve’s reverse repo facility, the other half is coming out of bank deposits, adding to the drain on liquidity, Arone said.

- The Fed’s so-called quantitative tightening process, in which the central bank allows Treasurys and mortgage-backed securities to roll off its balance sheet without reinvesting the proceeds, is set to drain another $ 55 billion from the system in coming weeks.

The S&P 500 index SPX, -0.77% fell 1.4% last week, ending a streak of five consecutive weekly gains after settling at a 14-month high alongside the Nasdaq Composite COMP, -1.01% on June 15. The Nasdaq pulled back 1.4% last week, while the Dow Jones Industrial Average DJIA, -0.65% shed 1.7%. It was the biggest weekly decline for all three major indexes since the week ending March 10, according to Dow Jones Market Data.

The setback was seen by many analysts as overdue given the S&P 500’s nearly 15% rally off its 2023 closing low set on March 13. The rally has also been notoriously narrow, led by a handful of megacap tech stocks, with those gains supercharged by a frenzy for artificial-intelligence-related plays.

“The rapid move in equities has created overbought conditions, and arguably has gone ‘too far too fast,’” said Mark Hackett, chief of investment research at Nationwide, in a note. “This sets the stage for a pause or consolidation of the gains in the near term, though as we approach second-quarter earnings season, we are reminded that the fundamental picture is substantially better than feared.”

Need to Know: The AI boom will stay with the S&P 500, says one of most pessimistic Wall Street firms heading into 2023

Meanwhile, much of the buying that helped fuel the surge appeared to come from fund managers and other professional investors who had missed out on the rally — a phenomenon known as the “pain trade.”

“A large part of the last month-plus has been FOMO, meltup, short-covering — choose your cliché as you see fit,” said Huw Roberts, head of analytics at research platform Quant Insight. FOMO is an acronym for “fear of missing out.”

For professional money managers, that fear can be fueled by disappointed clients and bosses.

“You can miss out on one month’s performance but we all know the significance of fixed calendar points,” Roberts told MarketWatch, referring to the looming end of the month, quarter, and first half. “For any money manager still underweight tech, how do you justify your fees in that scenario?”

The S&P 500 rally has come alongside improving macro fundamentals, Roberts said. The gains, however, have outpaced the improvement by the macro backdrop, likely a result of that catch-up buying, much of which appears to have run its course, Roberts said.

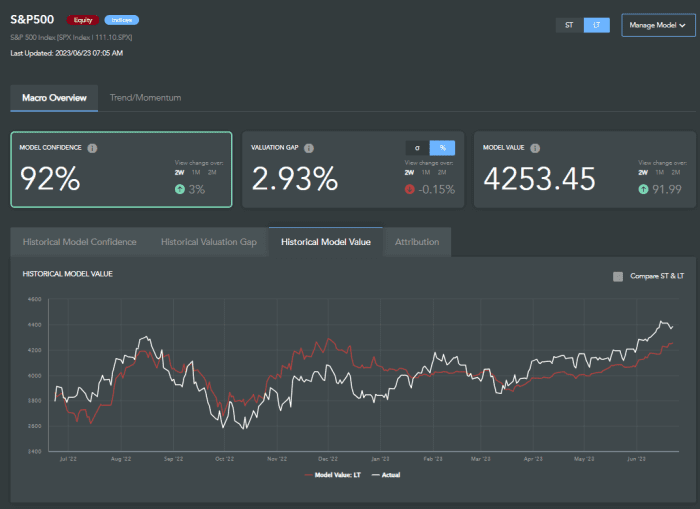

Meanwhile, Quant Insight’s macro-based model sees fair value for the S&P 500 near 4,350, slightly below its current level and likely justifying near-term consolidation, he said (see chart below).

Quant Insight

What will it take for the rally to resume?

Arone argued that the S&P 500’s breakout above previously stout resistance around 4,200 came after the resolution of the debt-ceiling showdown averted a potentially catastrophic federal default.

Market participants also thought the stage was set for a lengthy “pause” in interest rate rises by the Federal Reserve and had grown increasingly sanguine about the ability of the economy to avoid a deep recession.

See: Economist who anticipated bank failures this spring says U.S. recession may be just around the corner

The Fed did leave interest rates unchanged at its June meeting, but a lengthy pause now looks unlikely after Chair Jerome Powell reiterated this week that a “strong majority” of policy makers see two more quarter percentage point rate hikes in the pipeline.

Read: Bond-market recession indicator is saying ‘trouble ahead’ for U.S. economy

Now, investors are worrying about whether a pair of interest rate hikes “will either bring the timeline of recession forward or make it worse,” Arone said. “Clarity on these things is critically important.”

Check out: U.S. stocks head for punishing selloff as ‘unknown unknowns’ could drag market lower, JPMorgan analysts warn

State Street sees room for stocks to extend the rally later this year, but expects a bumpier path in the near term.

And for the rally to be sustained, it will need to broaden out. While breadth has improved somewhat in recent weeks, the equalweight measure of the S&P 500 remains up just 3.4% so far this year versus the gain of more than 13% for the market-cap-weighted index.

That means more gains are required for cyclically oriented stocks, small-cap stocks, value stocks and other parts of the market that have lagged well behind the tech-oriented rally, Arone said. Those stocks are more economically sensitive, underlining the importance of clarity on the outlook for the economy and the threat of a recession.

The week ahead is relatively light on U.S. economic data, but does feature personal-consumption expenditures index for May on Friday, which includes the Fed’s favored inflation measure.

Don’t miss: Option demand explodes in June as investors use bullish bets to chase stock-market rally