Donald Trump, the Republican former president, has won the Iowa caucuses and the New Hampshire primary and is leading Nikki Haley by a substantial margin in South Carolina, where she was governor from 2011 to 2017.

So it’s highly likely that Trump will be the Republican presidential nominee, and depending on what betting site is looked at, a coin flip possibility from being president again.

Strategists at UBS led by Bhanu Baweja in London looked at that possibility, and said investors might be making the mistake of projecting the first Trump term onto what would be the second.

Thirty six months into the Biden presidency, the S&P 500 SPX has gained 31%, compared to 41.5% during the first three years of Trump, and 58.9% during the first three years of Barack Obama, according to data from the website Macrotrends.

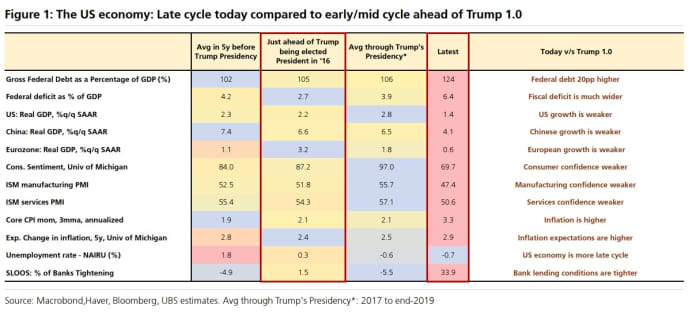

“Most investors we’ve spoken with seem to regard the 2016-17 experience as the template of how markets are likely to behave should Trump win; a very bullish equity view. We think the consensus is significantly underestimating how different the starting points in the U.S. economy, equity markets and broader risk premia are this time,” they say.

The UBS team said the reason is less an evaluation of Trump policies than the current situation in markets and the economy. “The economy is much later cycle; fiscal room, and very likely the bond market’s patience, are exhausted; earnings expectations are higher and, perhaps most importantly, risk premia are already much tighter,” they say.

They produced this chart, showing the difference in several factors now.

As for policies, the UBS team expects a partial extension of Trump’s 2017 tax cuts. A full extension of the Trump tax cuts would see marketable debt to GDP rising.

They say the knee-jerk reaction in financial markets is to favor a Republican sweep of both the presidency and Congress initially, but then the market gives back some of those returns, for an average gain of about 6% over 12 months. By contrast, Democratic sweeps tend to produce smaller three-month results, but better 12 month results.