U.S. banks held an estimated $ 3.1 trillion of commercial mortgages to start the year, leaving the real-estate industry particularly vulnerable to a pullback in lending, according to a Goldman Sachs analysis.

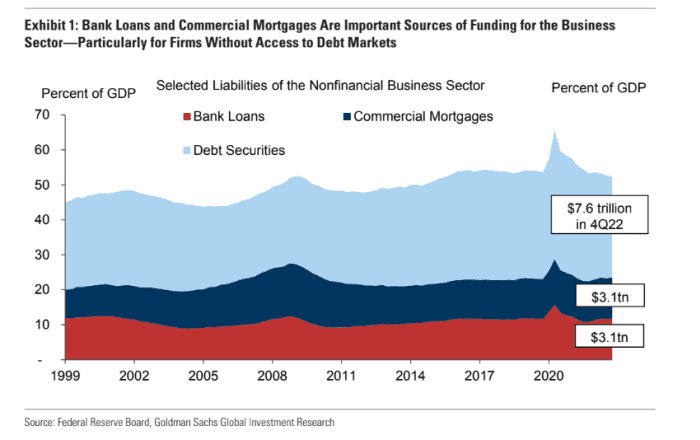

The new report offers a glimpse into how important commercial mortgages and bank loans have been over the last 20 years, for banks and the U.S. economy (see chart), with the two segments accounting for about 24% of U.S. gross domestic product.

Commercial mortgages are a big part of banks’ holdings, and a GDP driver.

Federal Reserve. Goldman Sachs Global Investment Research

Debt securities at banks, which often include Treasurys and agency mortgage bonds, totaled about $ 7.6 trillion, the chart shows.

Silicon Valley Bank’s sale of low-coupon, “risk-free” securities at a $ 1.8 billion loss by in early March helped hasten a run on the bank’s deposits, ultimately leading to its collapse.

A fear since early March has been of potential further instability at banks, particularly if a run on deposits were to force banks to sell low-coupon debt or loan holdings at a discount, realizing the loss. The Fed created a new facility in March for banks to tap, with the goal of averting forced asset sales.

See: ‘One or done’ scenarios seem likely for the Fed, economists say

While the 2-year Treasury yield TMUBMUSD02Y, 4.027% was around 2.3% a year ago, it was closer to 4.1% on Wednesday, showing why older securities would be worth less given today’s yields.

Furthermore, Goldman economists looked at the loan books of seven regional banks and quarterly Federal Reserve data to get a better gauge of industry-specific loan activity.

They estimated that manufacturing and the real-estate industry were the top two exposures within bank loans, at a combined 30%, but pegged the share as increasing to 50% when including commercial real-estate investment across other industries.

“These large shares—coupled with the large share of capex by the manufacturing and real-estate sectors—imply that the coming tightening in bank credit availability will affect the economy in part through its impact on these two industries,” wrote a team of Goldman economists led by Jan Hatzius.

On the other hand, they said weaker demand for office and retails properties could cut construction lending. “If so, the incremental drag from tight credit on commercial real estate activity could be smaller in magnitude.”

Stocks were higher Wednesday, with the Dow Jones Industrial Average DJIA, +1.26% up 260 points, or 0.8, while the S&P 500 index SPX, +1.44% was 1.2% higher, according to FactSet. Investors have been focused on inflation data due Friday and easing of worries around the banking sector.

Read more: Office property woes could be tip of iceberg if credit freezes up as $ 1 trillion bill comes due