Adios to February, which disappointed many stock investors who enjoyed a bullish start to the year.

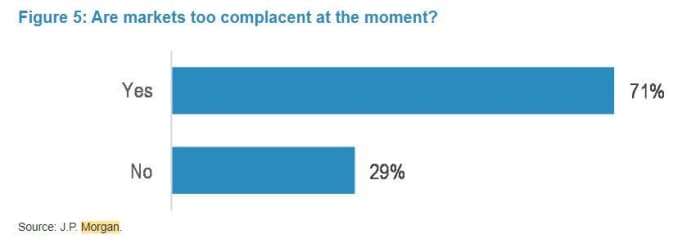

According to some analysts, equities just aren’t worth the risk right now. If this chart from a recent JPMorgan client survey is any indication, investors may be thinking the same:

But fears of a bigger meltdown by those swept up in Wall Street gloom may be in vain, says our call of the day, from the chief market strategist at Finom Group, Seth Golden, who says fears of a big recession, profit fall, housing and manufacturing crash haven’t arrived, despite a rapid pace of Fed hikes.

What investors are forgetting, and maybe Wall Street too is that “markets are forward-discounting mechanisms engaged in an ongoing operation,” said Golden, in a blog post.

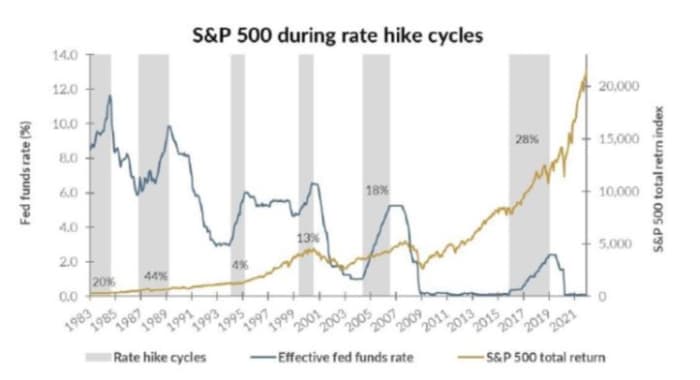

While Wall Street’s S&P 500 forecasts are wide-ranging, Golden’s own expectations are on the bullish side as he is targeting 4,350 for the end of 2023. And while Wall Street worries about rate hikes, the strategist offers another chart showing that apart from outliers, higher rates really have done little to hinder equities in the past:

Finom Group

As for those fearing recession, Golden says really we aren’t any closer to one than a year ago when the first rate hike landed, due to a still strong job market. On that note, he also swats away Wall Street fears that the Fed is hiking into a “seemingly overvalued stock market,” as this Bank of America table chart shows that’s been the norm since the 1970s:

Golden also wants to debunk fears that higher rates and higher inflation that defined the bear market of 2022, will do the same for 2023. Firstly back-to-back market drops are a rare thing, and now back to his initial point, that markets really are “forward-discounting mechanisms.”

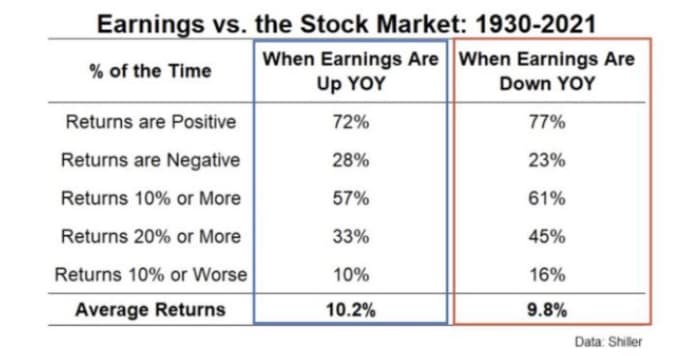

He notes how earnings per share rose in 2018 and 2022, yet the market fell in both years, which likely means markets were forward discounting the chance of earnings per share slowdowns in 2019/2023. His chart below shows how markets have been higher 77% of the time since 1930, despite weaker earnings:

Golden adds that one of the biggest down years in market history was in 1974, when EPS was sharply higher on a year-over-year basis. He says this pretty much flies in the face of strategists like Morgan Stanley’s Mike Wilson who has insisted that stocks are headed lower due to falling forward expectations.

“Hope that the Fed does go too far, and does find it purposefully necessary to drive a recession seems to be the last bastion of hope for the belief that new lows can be achieved during the current cycle of 2023.”

As for what investors should do, Golden told MarketWatch in an email that they’ve been buying the S&P 500 SPX, +0.31% since October, as that’s where they saw the market bottoming. And while he doesn’t expect a smooth ride higher, the strategist said they are “looking for pullbacks in large-cap/growth as an opportunity to increase leverage.”

While his team is more focused on the S&P 500’s performance, Golden said they are watching out for weakness to add exposure to several big name stocks, including Amazon.com AMZN, +0.28%, PayPal PYPL, +0.30%, Boeing BA, +1.17%, Visa V, +0.36%, JPMorgan JPM, +0.87% and the healthcare Select Sector SPDR XLV, -0.30% to name a few.

The markets

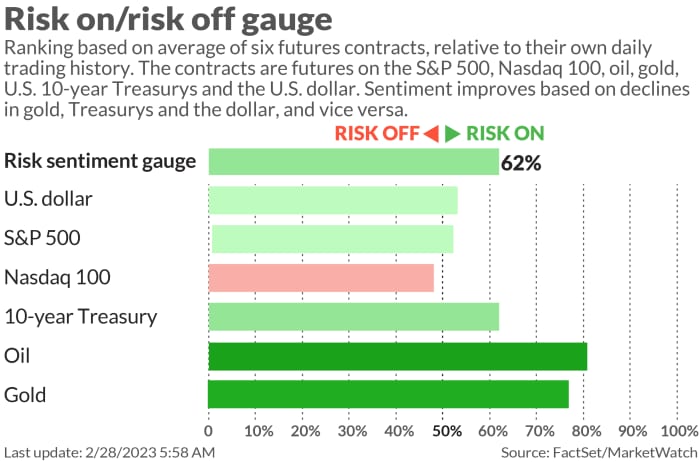

Stock futures ES00, +0.33% YM00, +0.31% NQ00, +0.35% are tilting higher as bond yields TMUBMUSD10Y, 3.948% TMUBMUSD02Y, 4.811% creep up. The dollar DXY, -0.06% and oil prices CL.1, +2.40% are higher, while gold GC00, -0.50% is falling.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily. Also follow MarketWatch’s live markets blog for all the latest action.

The buzz

Target TGT, -0.09% stock is rising on a profit beat and revenue growth, though the retailer’s outlook was a big miss. AutoZone AZO, +1.25% stock is down on a profit miss, and Norwegian Cruise NCLH, +0.61% shares are falling after a wider-than-forecast loss. Advance Auto Parts AAP, +1.28% is due to report.

Theater owner and meme stock AMC AMC, +22.74%, whose shares surged 20% on Monday, HP HPQ, +0.58%, Rivian RIVN, +6.52%, Novavax NVAX, -1.70%, First Solar FSLR, +2.44% and Luminar LAZR, +6.23% will report after the close.

Zoom shares ZM, -0.28% are up after an earnings beat and upbeat forecast from the videoconferencing group.

Baytex Energy BTE, +1.57% is buying Ranger Oil ROCC, +0.15% for $ 2.5 billion, including debt.

Robinhood HOOD, +1.36% has received a subpoena over its crypto business from the Securities and Exchange Commission.

Investors have made Tesla TSLA, +5.46% boss Elon Musk the world’s richest man again.

Opinion: Why Tesla investor Ross Gerber backed down from his activist push for a board seat

U.S. trade in goods, along with advanced retail and wholesale inventories are due at 8:30 a.m., followed by the S&P 500 Case-Shiller home price index at 9 a.m. and consumer confidence at 10 a.m. Chicago Fed President Austan Goolsbee will speak at 2:30 p.m .

The White House says federal agencies have 30 days to get rid of TikTok. And the Feds have warned tech companies against “AI hype.”

Best of the web

How a luxury apartment complex in Turkey became an earthquake death trap for a soccer star and hundreds of others.

The best U.S. metro area for first-time home buyers is this Texas pandemic boomtown.

A year into Ukraine’s war, it’s getting harder to find homes for the animals left behind.

Amazon will soon allow employees to use stock options as collateral for home loans.

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

| TSLA, +5.46% | Tesla |

| AMC, +22.74% | AMC Entertainment |

| BBBY, -3.27% | Bed Bath & Beyond |

| TRKA, +32.13% | Troika Media |

| GME, -2.25% | GameStop |

| APE, -5.09% | AMC Entertainment Holdings preferred shares |

| NIO, +0.32% | Nio |

| NVDA, +0.92% | Nvidia |

| AAPL, +0.82% | Apple |

| BABA, +0.28% | Alibaba |

Random reads

All hail ‘bare-minimum Monday’?

Wanted: Hip U.K. musicians for King Charles’s coronation.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton