Alok Kumar Agarwal of Alchemy Capital Management

Alok Kumar Agarwal of Alchemy Capital Management expects the RBI to take one more interest rate hike in February and then hold the peak policy rate at 6.25-6.5 percent for the most of 2023, as it gauges the impact of monetary tightening on inflation.

“We do not expect a rate cut in 2023 as of now, based on the data sets available to us,” he says in an interview to Moneycontrol.

Among sectors, Alchemy is positive on banks, autos, industrials, and manufacturing, says the portfolio manager with more than 20 years of experience in finance and markets, primarily in equity research and fund management.

Unlike other countries, he believes the combination of reasonable valuations, earnings visibility, and economic strength is working in India’s favour. Hence, India is likely to continue its outperformance in the coming times, he feels.

What are the risk factors for Indian equity markets as we entering into 2023?

At $ 563 billion, foreign exchange reserves reflect a 10-month import cover. Beyond a certain point, RBI might not be able to support the INR. We could withstand over $ 100 billion decline in foreign exchange reserves in CY22 caused by the RBI selling US dollars and a negative balance of payments. The import cover, however, might be severely reduced if foreign reserves were to decrease by the next $ 25–30 billion. This may affect the banking sector’s liquidity, which may then negatively affect interest rates, deposits and credit growth, tax receipts, and government spending. It may also prompt the RBI to take punitive rate action to safeguard the INR and stop outflows. On a hedged basis, interest rate differences are already too small.

The ongoing Quantitative Tightening (QT) has ensured that ‘Growth at any price’ is passe’. However, relevant growth, which continues to be scarce, could still be chased, albeit at reasonable prices/premiums.

Nifty is trading at 18x – one year forward earnings as of December 26, 2022, this is 5 percent premium to the last 10-years’ median valuation, ~15 percent below historic highs touched in October 2021. Valuations being higher than historical averages is also a risk that may lead to lower tolerance earnings misses.

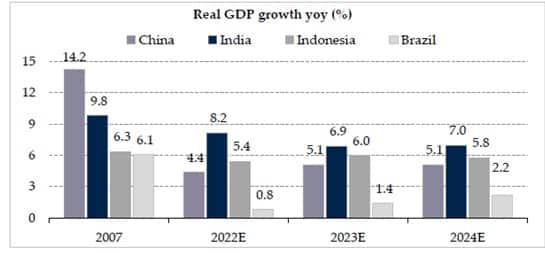

India’s GDP growth projected to be highest vs. Emerging Markets (EMs)

Source: IMF, DAM Capital Research. Data as on 31st Oct 2022

Source: IMF, DAM Capital Research. Data as on 31st Oct 2022

Do you expect the RBI to take one more rate hike in February and take a pause in the following meetings? Also is there any possibility of an interest rate cut in the second half of 2023?

We expect the RBI to take one more hike (possibly) in February 2023 and then hold the peak policy rate at 6.25-6.5 percent for most of 2023, as it gauges the impact of monetary tightening on inflation. CPI inflation is already at a year low of 5.9 percent. It is expected to stay above 5 percent for most of FY2024, which may preclude any quick pivot by the RBI.

Other central banks will probably follow a similar approach as inflation will likely stay above the target of central banks for an extended period of time.

We do not expect a rate cut in 2023 as of now, based on the data sets available to us.

Most of the experts do not expect a recession in US, but see a recession in several nations in the European region. Do you think so? Your thoughts?

Recent US economic data continues to display robust strength with Q3CY22 US GDP growth coming at 3.2 percent. We believe that US economic indicators still show a fairly strong economy, especially for the critical labour market. Meanwhile, elevated core inflation in the US may result in ‘higher-for-longer’ rates despite the recent decline in headline inflation. The market is gradually adjusting to this possibility given the US Fed’s constant hawkish messaging on the economy and inflation.

According to the European Commission’s autumn economic forecast, the eurozone and most EU countries have headed to an economic recession in the last quarter of 2022.

In our view, Inflation is expected to average 9.3 percent in the EU and 8.5 percent in the eurozone for 2022.

“The EU is amongst the most exposed advanced economies (to high prices), due to its geographical proximity to the war and heavy reliance on gas imports from Russia,” the European Commission said in a statement.

“The energy crisis is eroding households’ purchasing power and weighing on production.”

The European Central Bank has raised interest rates three times this year to tackle the rising prices.

The bank could continue to raise interest rates, which may impact commercial banks, resulting in mortgages and credit cards becoming more expensive.

Do you think the Union Budget 2023 is going to be populist as well as progressive one?

The government would try to do the balancing act, where in they would want to spend where possible, but not be too populist as well.

The absence of the Covid and Ukraine war led-spend of about Rs 3 trillion which is likely to ease fiscal pressure in FY24, and that’s nearly 1 percent of GDP.

The government can either pass on this benefit as cut in taxes (populist) or deploy it in Government Capex (progressive).

Do you expect significant upside in oil prices if China reopens economy?

The ongoing reopening of the Chinese economy after a prolonged period of ‘zero-Covid’ policy has the potential to further increase market volatility in the near term. A sharp surge in Covid-19 cases in China, resulting in a sharp increase in hospitalizations and deaths, may test the government’s resolve. Any policy reversal will strain global supply chains again as well as deepen the prevalent weakness in the Chinese economy.

On the other hand, continued reopening, if Covid-19 were to remain under control or even otherwise, may spur pent-up demand and result in a revival of global commodity inflation, especially Crude oil. A sharply rising crude oil price could be detrimental to India’s interests.

Any themes that you are betting the most for 2023?

We are positive on Banks, Autos, Industrials, and Manufacturing.

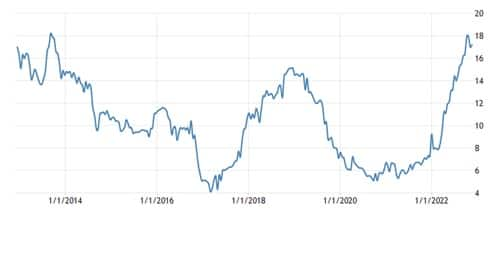

The Banking sector’s balance sheet is amongst the strongest it has been in the last 10 years, especially in terms of credit cost potential. Further, the system credit growth has surprised all with 10-years high number of 17.2 percent YoY till November 2022, indicating continued improvement in economic activity.

Banking system credit growth Source: Tradingeconomics.com | Reserve Bank of India

Source: Tradingeconomics.com | Reserve Bank of India

We believe that higher LDR (Loan to Deposit Ratio), increasing share of unsecured retail credit in the total loan mix and faster repricing of floating rate loans vs. deposits will support NIM (Net Interest Margin) expansion in the coming quarters. Banks with a higher share of floating loans and strong liability franchise will be bigger beneficiaries.

Improving fundamentals and earnings visibility are coming at a time when the sector bore the brunt of record FII selling as it forms nearly one third of the FII portfolio. The risk-reward looks attractive to us, with the potential for upgrades and rerating. We believe that banks with strong liability franchise and large branch networks would benefit more as maintaining deposits growth in a rising rate environment will be a key challenge.

Auto: Volumes improved across segments on a weak base. Realizations improved across most companies on account of price hikes taken to offset higher commodity prices. Demand remains healthier for passenger vehicle (PVs), commercial vehicle (CVs) and premium 2Ws (2-wheeler) vs entry 2Ws. Margins are expected to improve sequentially as commodity prices are cooling and volumes are improving.

In two-wheelers, premium segment volumes are expected to improve gradually, with further improvement in semi-conductor supplies. In the PV segment, volumes are expected to improve consistently aided by a strong order backlog coupled with an expected stable semi-conductor chip supply. CV segment is expected to report sustained momentum driven by improved economic activity level, infra projects, further improvement in fleet utilisation levels and replacement demand.

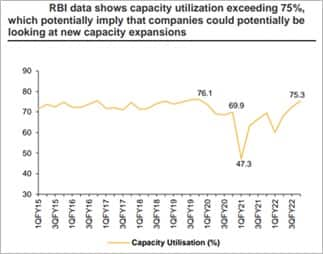

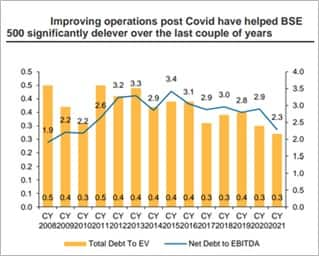

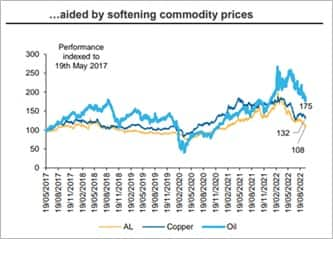

Industrials: While public Capex led by the government is already on, the private Capex is expected to pick up soon. Drivers of Capex spend: Increasing capacity utilization (exceeded 75 percent), deleveraged corporate balance sheets (BSE500 companies Net Debt to EBITDA is down from 3.4x to 2.3x in last 6 years), strong revenue collection by government and softening commodity prices are aiding Capex activity. High interest rates could be a dampener.

Source: Macquarie Research, October 2022

Source: Macquarie Research, October 2022

Source: Macquarie Research, October 2022

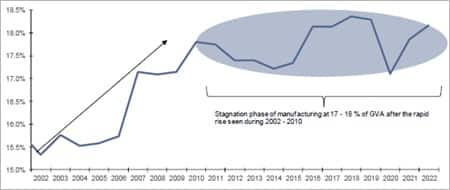

The manufacturing sector’s share in the Indian economy reached the pre-covid level of ~18 percent of GVA (Gross Value Added) in FY22 and is poised to hit an all-time high in the medium term.

Manufacturing as a percent of GVA

Source: National account statistics 2022, Isec-research | Data as on 31st March 2022

Source: National account statistics 2022, Isec-research | Data as on 31st March 2022

We observe nascent signs of Capex cycle recovery, with recovery in the real estate cycle, government policy initiatives (esp. the PLI schemes), continued FDI inflows and China+1 related export opportunities.

The geo-political tensions have increased the urgency to become self-sufficient in terms of energy and defence requirements, which are large opportunities for manufacturing in India.

Organised sector has been gaining market share in manufacturing.

Source: National account statistics 2022, Isec-research

Source: National account statistics 2022, Isec-research

The top manufacturing sectoral contributors to GVA (as on 31st Dec’21) in the corporate sector in India’s economy are: transport equipment (11.6 percent), chemicals (10.5 percent), iron & steel (9.3 percent), pharmaceuticals (8.6 percent) and food products (7.5 percent).

With renewed Government focus on manufacturing and self-reliance, we have already seen action in areas like defence and PLI schemes. We remain positive on the manufacturing theme in India for the coming years.

How do you sum up the year passing by?

2022 showed the world how strong and resilient Indian economy and markets are. The year witnessed a lot of unexpected risks from inflation to war to record FII selling. Yet, the Indian markets have handsomely outperformed their regional and developed peers. A slight let up in some of these external difficulties and our markets can potentially roar.

In USD terms, Nifty is down 8 percent this year (+2.6 percent local currency terms) compared to a 19 percent decline in S&P500 and a 23 percent decline MSCI Emerging Markets Index.

This outperformance is attributable to a number of important factors, including:

a) Robust corporate earnings growth over the past two years (Nifty profits increased by 70 percent during FY20-22), and expectations for a healthy performance over FY22–24.

b) Resilient domestic equity inflow (YTD DII equity inflow of USD34b – the highest ever), especially with highest ever FII outflow in a single calendar year (YTD FII outflow of $ 16.5bn)

c) Smart macroeconomic management by the RBI and the government, has enabled India to stand out in a chaotic and fear-filled global economy.

Unlike other countries, we believe the combination of reasonable valuations, earnings visibility, and economic strength is working in India’s favour. India is likely to continue its outperformance in the coming times.

Do you see any possibility of a big bull run in the coming year? Also what kind of returns you expect from equity markets in 2023 over 2022?

India is amongst the fastest growing economies, with the most effective shock absorbers in current times. Nifty earnings are expected to grow at 15 percent CAGR over the next 2 years – higher than any other major economy. Hence, India’s absolute and relative strength is likely to continue keeping it a preferred investment destination.

Given the fact that we are in the midst of a Quantitative Tightening cycle, it’s difficult to imagine expansion in valuations. Even at long term average valuations, markets may show decent upside potential in 2023, while superior stock selection can lead to even better returns.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.