HCL Tech, one of the top four Indian IT services companies, will come out with its numbers for the second quarter of the fiscal on October 12 and analysts expect a constant currency growth of 3.2 percent on a quarterly basis.

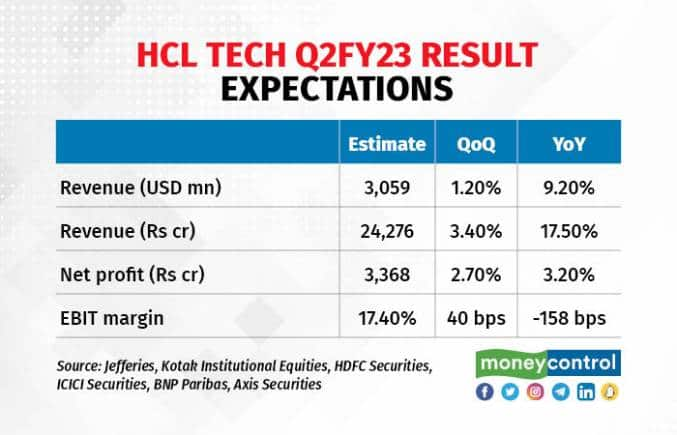

Consolidated profit after tax (PAT) for HCL Tech may jump 2.7 percent on a sequential basis to Rs 3,368 crore in the second quarter of FY23 (July-September). Consolidated revenue is expected to increase 17.5 percent on-year to Rs 24,276 crore, aided by rupee depreciation. The numbers are based on an average of estimates of six brokerages polled by Moneycontrol.

Global brokerage firm Jefferies is estimating a 20-basis-point inorganic contribution from Confinale and Quest Informatics acquisitions, both announced in May.

The company had recorded a consolidated net profit of Rs 3,263 crore during the corresponding period last year when its consolidated revenues stood at Rs 20,655 crore. HCL Tech had registered a PAT of Rs 3,281 crore during April to June 2022 period on a revenue of Rs 23,464 crore.

Products and platforms business

Due to seasonal weakness, analysts are expecting products and platforms business to take a hit. According to ICICI Securities, a decline of 10 percent sequentially in the P&P business might overshadow decent performance in IT and ER&D (Engineering, Research & Development) segments.

Also Read: HCL Tech to scale up Brazil operations, to hire 1,000 people in 2 years

Kotak Institutional Equities pegs the products business revenue at $ 303 million, declining both on-quarter and on-year. “Products will be an area of focus, noting high discretionary component and transition of the business model to as-a-service construct,” it said.

P&P business forms 12.1 percent of the company’s portfolio while IT services forms 72.1 percent and ER&D forms 15.8 percent.

Margins

EBIT margin is set to increase by 40 bps sequentially, despite wage revisions as well as planned on-boarding of 10,000 freshers in the quarter. The headwinds will be more than offset by tailwinds from an increase in utilization rates, pyramiding, pricing improvement and moderation of sub-contractor costs, according to research reports from ICICI Securities and Kotak Institutional Equities.

Jefferies and Kotak Institutional Equities have worked out the EBIT margin at 17.4 percent, while ICICI Securities estimated it at 17.2 percent.

Also Read: Options Trade | An earnings-based non-directional options strategy in HCL Technologies

The Street is also expecting HCL Tech to maintain its FY23 guidance of 12-14 percent constant currency revenue growth and EBIT margin of 18-20 percent. The total contract value (TCV) of net new deal wins in the quarter is expected to come in at $ 2 billion.

In dollar terms, revenue is expected to grow by 1.2 percent QoQ factoring in 200 bps cross currency headwinds.

Factors to watch out for

Investors will be keenly monitoring management commentary on demand outlook in face of macro headwinds.

“HCL Tech is dependent on large deals for growth. So, we will be watching out for deal activity in the market. Trends in the ER&D business is also important to track as the segment is discretionary-heavy and prone to cuts in a slowdown,” Kotak Institutional Equities said in the report.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.?