As the benefit of the recent moderation in commodity costs starts to accrue in 2HFY23E, sectors like Industrials, autos, and building materials may contribute too. Hence, Alchemy Capital Management senses that the bulk of earnings downgrades have already been done, says Alok Agarwal, who sees scope for some earnings upgrades in the second half of the year with potential margin recovery.

Alchemy Capital Management believes the banking sector’s balance-sheet is the strongest in the last 9 years, especially in terms of credit cost potential.

The portfolio manager with more than 20 years of experience in finance and markets, primarily in equity research and fund management, says the risk-reward looks attractive in the banking space, with potential for both upgrades and rerating.

Hence, Alchemy believes that banks with strong liability franchises and large branch networks would benefit more as maintaining deposits growth in a rising rate environment will be a key challenge.

Domestic macro has gradually been improving but risk-reward is unfavourable now. What are your thoughts?

India is in a sweet spot compared to most other major economies – both developed and emerging.

In the past, a 10 percent fall in forex reserves had led to a demand impact. However, over the past year, forex reserves had fallen more than 15 percent or around $ 100 billion, about 3 percent of GDP, but that has not led to demand impact. Banking system credit growth is at a nine-year high. INR has been stable despite Dollar Index being at a 20-year high and rise in current account deficits. Domestic liquidity has not dried, and markets have been relatively stable, given the record selling by FIIs over the last one year.

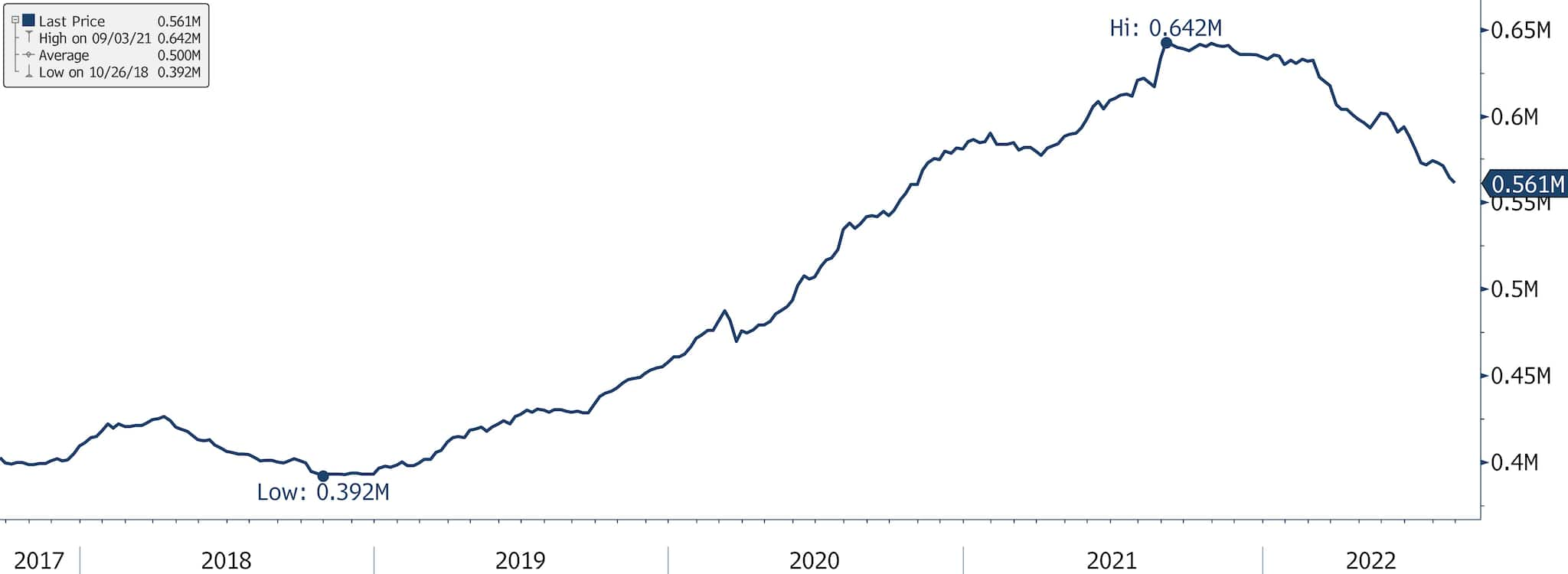

The government’s spending continues to be strong and tax collections buoyant. India’s inflation is lower than US and EU for a record 18 months now and hence, interest rates have not spiked. India’s 10-year yield is only 370 bps more than US’ 10-year yield – this is the lowest spread in the last 13 years (versus average of 520bps and highs of 700 bps).

Spread between India 10yr and US 10yr yields

Source: Bloomberg

Source: Bloomberg

The key cushion was excess savings led by the about $ 200 billion accretion to the forex reserves over September 2019 to February 2022 – this is significant for a chronic importing country like us. This led to surplus liquidity of Rs 8 lakh crore built over this period and excess SLR (statutory liquidity ratio) with banks of 10 percent of deposits. This empowered RBI to protect INR by selling US dollar this year (about $ 40 billion). Despite RBI soaking up domestic liquidity as well as higher CAD/ FII selling, domestic liquidity in the banking system is still surplus to the tune of Rs 1.25 lakh crore – hence bond yields/ deposit rates have not surged.

India Forex Reserves

Source: Bloomberg

Source: Bloomberg

As a result, demand has not been impacted, and credit growth is picking up. Higher demand and economic activity are resulting in stronger GST/ other tax collections remaining buoyant. This has given the government strength to absorb higher fertiliser, oil, and food prices, which, in turn, has kept some check on inflation pressures.

Do you think the global risks will remain elevated for the rest of the financial year? Also, will that be able to stop Indian markets from making record highs in the coming months?

In terms of risk, the key monitorable for India is crude prices. If, for any reason, crude was to go back to the highs seen this year, a lot of the advantages mentioned earlier run the risk of getting reduced significantly. Forex reserves at $ 553 billion are at nine-month import cover. Beyond a point, RBI may not be able to support the INR. The same virtuous cycle can convert itself into a vicious cycle in such a case.

In terms of markets, the ongoing Quantitative Tightening (QT), has ensured that ‘Growth at any price is passe’. However, relevant growth, which continues to be scarce, could still be chased, albeit at reasonable prices/premiums.

Going by the recent inflation readings in US and Fed statements, the expectations are that the rate hike cycle and QT are likely to continue for a few more quarters. US inflation continues to remain high at 8.3 percent YoY in August. Core CPI rose 0.6 percent MoM, compared to consensus expectation of 0.3 percent. That corresponds to an annualised rate of 7.0 percent, a long way from the Fed’s price target.

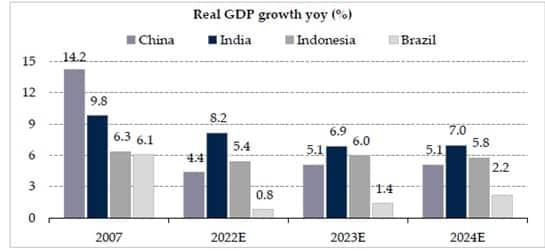

India is amongst the fastest growing economy, with the most effective shock absorbers in current times. Nifty earnings are expected to grow at 15 percent CAGR over the next two years – higher than any other major economy. Hence, the absolute and relative strength of India is likely to continue keeping it a preferred investment destination.

Despite all unexpected risks from inflation to war to record FII selling seen in the last one year, Indian markets are barely 3-4 percent away from all-time highs. A slight let up in some of these external difficulties and our markets can potentially roar.

India’s GDP growth projected to be highest versus EMs

Source: IMF, DAM Capital Research

Source: IMF, DAM Capital Research

Do you expect a cut in further consensus earnings estimates for FY23 and FY24, given the rising interest rates, elevated inflation, lower-than-expected economic growth in Q1FY23, likely slowdown or recession in developed markets and quantitative tightening?

In Q1FY23, Nifty earnings were below expectations. Miss in heavyweights, Oil & Gas drove the aggregate miss. Around 14 out of 20 sectors have either met or beaten expectations. Like in Q4FY22, profit in Q1FY23 was almost entirely driven by BFSI, aided by moderation in credit cost. Oil & Gas dragged the aggregates while Consumer, Metals, and Cement have beaten expectations. Metals, Healthcare, and Cement reported a YoY decline in earnings, while IT earnings were flat in Q1FY23.

Profit for Nifty rose 23 percent YoY (estimates 31 percent), led by BFSI. Excluding BFSI, profit grew 18 percent YoY (estimates 28 percent). As a result of the fall in margins and earnings miss, consensus estimates have been cut by 2-3 percent for both FY23 and FY24. Despite the cuts, Nifty earnings are expected to grow at 15 percent CAGR over FY22-24E.

The bulk of the miss in non-financials came from a fall in margins, owing to rising commodity prices. With most commodity prices correcting in the current quarter, a significant amount of the margin miss may likely reverse in the second half of the year. In Financials, the credit cost is expected to stay low for both FY23 and FY24 but the credit growth at nine-year highs of 15.5 percent is surprising on the upside, something that may not be fully factored in the estimates.

Overall demand seems to be healthy (Q1FY23 revenue ahead of estimate by about 5.2 percent with 102 out of 219 ex-financial Nifty-500 companies reporting revenue beat over 5 percent). The RBI Industrial Outlook Survey also suggested sequential expansion in production volume and new orders in Q2FY23, which is likely to sustain till Q4FY23.

Domestic inflation is expected to decline in 2HFY23 on base effects, assuming the average crude oil remains under $ 100 a barrel. The probability of a ‘peaking’ inflation scenario has increased in the past few months with (1) correction in global agriculture and metals prices, (2) moderation in crude oil prices and (3) normal monsoons so far.

Given that inflation may be headed down in the second half, we do not expect too many hikes by RBI in the current rate cycle. The cumulative rate increase of 175-200 bps may not have a significant impact on demand and the rate increase will be on the lower side versus the major domestic market and emerging market economies/countries.

Good monsoons and a normal festive season after two years should augur well for consumption-oriented sectors. However, the growth is still lopsided and is being led by BFSI. As the benefit of the recent moderation in commodity cost starts to accrue in 2HFY23E, other sectors like Industrials, Autos, and Building Materials may contribute too. We sense that the bulk of earnings downgrades has already been done. There is scope for some upgrades in the second half of the year with potential margin recovery.

Are you super bullish on the banking and financial sector given the healthy balance sheets?

In our view, the banking sector’s balance sheet is the strongest in the last nine years, especially in terms of credit cost potential. Further, the system credit growth has surprised all with a nine-year high number of 15.8 percent YoY till August 2022, indicating continued improvement in economic activity. On an FYTD23 basis, credit growth is at +4.7 percent (versus YTD credit growth of 0.4 percent as of August 21).

We believe that higher LDR (Loan to Deposit Ratio), increasing share of unsecured retail credit in the total loan mix and faster repricing of floating rate loans versus deposits will support NIM (net interest margin) expansion in the coming quarters. Banks with a higher share of floating loans and strong liability franchise will be bigger beneficiaries.

Improving fundamentals and earnings visibility comes at a time when the sector bore the brunt of record FII selling as it forms nearly a third of the FII portfolio. The risk-reward looks attractive to us, with potential for both upgrades and rerating. We believe that banks with strong liability franchises and large branch networks would benefit more as maintaining deposits growth in a rising rate environment will be a key challenge.

India Banking System Credit Growth YoY

Source: Bloomberg

Source: Bloomberg

Do you think the IT space is looking attractive now though there could be near-term pressure in the space?

There is a growing fear that a potential recession may derail the structural growth story in the IT sector. However, as per Gartner, the Global IT services industry is expected to grow at 8.7 percent CAGR over CY21-26E against a long-term average of about 5 percent.

IT spending is expected to remain above normalised levels over the next five years, even if there may be an odd quarter or two of below-trend level growth.

Global companies are focusing on cloud/digital transformation and are continuing to invest there even if they have to cut expenditure in other areas.

Despite the correction, Indian IT companies are still trading at a premium to the long-term average multiple.

However, a lot of negatives are getting increasingly priced in. The Nifty IT Index is down 27 percent this year versus +4 percent for Nifty. As a result, on a one-year forward P/E basis, Nifty IT Index is now trading at a premium of just 1 percent to Nifty versus the last 10-year average of 8 percent premium and a recent peak of 54 percent premium.

While the traditional IT services businesses may see some impact of slowdown, the ER&D (engineering research & development) space may continue to see higher growth. We find only the ER&D as attractive currently while traditional IT services may have some scope for downgrades.

Nifty IT vs Nifty 50: Relative valuation, 1-yr forward PE

Source: Bloomberg

Source: Bloomberg

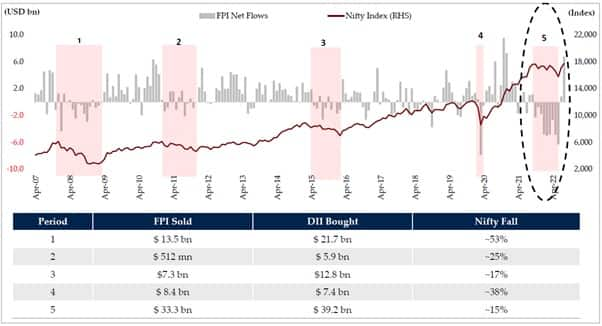

Do you expect the FII flow to remain volatile in the coming months given the subdued global environment?

Historically, markets have corrected whenever FPIs sold, even if DIIs bought more. But off-late, sticky SIPs have weathered such storms better. “Sticky” SIP flows at $ 1.5 billion average per month from October 2021 to June 2022 were 80 percent+ of total MF inflows.

Source: NSDl, BSE Website, Bloomberg, DAM Capital Research

Source: NSDl, BSE Website, Bloomberg, DAM Capital Research

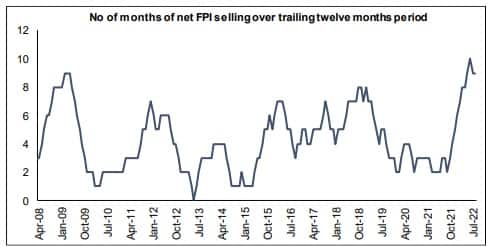

The hawkish comments by the US Federal Reserve since last year resulted in record FPI outflows from India over one year ($ 33 billion for the TTM period ending Jun 22). The massive outflow, in anticipation of the 1960s-80s type of extreme QT cycle, was probably an overreaction which is correcting via inflows seen since July 2022.

We continue to be in a QT cycle which is likely to result in bouts of volatility from FPIs although the phase of sharp selling seems to be behind us.

Since mid-July 2022, FIIs have bought over $ 9 billion in India.

The absolute and relative strength that India offers currently, is bound to keep FIIs overweight on India, premium valuations notwithstanding.

The longest stretch of selling (10 months) since the Global Financial Crisis comes to an end.

Source: Bloomberg, I-Sec Research

Source: Bloomberg, I-Sec Research

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.