Rahul Singh is the CIO-Equities at Tata Mutual Fund.

Corporate earnings for the quarter ended June have been broadly in line with expectations, said Rahul Singh, chief investment officer-equities, Tata Mutual Fund.

Banks have performed better in many respects and appear to be in a sweet spot after raising interest rates, Singh said in an interview with Moneyontrol.

Information Technology (IT) services, on the other hand, experienced margin pressure and the tone of their commentary softened although their near-term demand outlook remains extremely robust.

With over 26 years of investment experience, Singh, who leads the fund management and equity research teams at Tata MF, says the Reserve Bank of India’s move to hike the repo rate by 50 basis points (bps) was currency- supportive.

He expects the rupee to remain in the 79-80 per dollar range and take broader cues from movements in the dollar Index.

With the recent Fed commentary, do you think we are largely out of the woods now and a new bull run has begun in Indian equities?

At any point of time in the markets, there are positives and negatives. The recent developments on softening commodity prices have raised the hopes that earning cuts for FY23 will bottom out before the valuation correction (in response to higher rates and tightening) is over.

So right now, markets are searching for an equilibrium and answers between the range of scenarios i.e. hard landing versus soft landing, geopolitical impact on commodities and finally the dollar index and its impact on emerging markets (EM) flows.

Also read – Vikas Garg of Invesco Mutual Fund expects repo rate at 6% by December, says inflation to stay elevated

Do you think the market is still worried about inflation?

Inflation is still a worry more so in developed markets as its more demand and supply led and has seeped into wages. It could therefore take longer to control although a scenario of soft landing has raised the probability of some moderation in inflation that is supply led.

However, the geopolitical situation and the new developments in China-Tiawan can play a big spoilsport given the impact that can have on global supply chains and hence need to be watched closely.

Has the earnings season met your expectations? Also, what are the hits and misses?

Earning season has been broadly in line with expectations. Banks have performed better in lot of respects and appear to be in a sweet spot with higher interest rates. IT services, on the other hand, have seen pressure on margins and some softening in the commentary even though the near-term demand outlook remains extremely robust. Within consumption, discretionary space and retail has stood out positively.

Also read – RBI says first loss default guarantee recommendations for digital lending are under examination

Considering the change in FII (foreign institutional investor) behaviour in July and at the start of August, can you expect FIIs to turn net buyers in August?

FII activity going forward will be dependent on the nature of the slowdown in the US and developed markets. A soft-landing which slowly brings down the input (costs) can support both earnings and valuations. This can lead to positive sentiment on India, which is also seeing a revival in deep cyclicals like industrials, capital goods and real estate.

On the other hand, a deep and long recession can lead to risk-off and a stronger dollar, which is never a good news for EMs, however strong the Indian economy might be doing relative to other markets.

The Indian rupee has recovered from its all-time lows below 80 levels against the US dollar. Do you think the worst is over now or is it a short-term reversal in trend? Also are you really worried over the steep fall in the value of the rupee against the US dollar?

The policy was largely in line with our expectations. However, there were some rumours in the market, basis which there was a sharp fall in yields. Post-policy, rates have corrected upwards and are now trading in zone of early this week (please check. word/words seem to be missing) We expect interest rates to remain range-bound (10-year benchmark G-sec in range of 7.15 percent-7.40 percent) for near term, and as systemic liquidity remains volatile, we might continue to see a flattening of the yield curve.

Also read – Siemens hits Rs 1-trillion market capitalisation for the first time

Taking inflation head-on, RBI has raised rates by 50 bps in line with our expectations. While showing faith in growth, the Monetary Policy Committee (MPC) gave higher priority to addressing inflation, maintaining financial stability… and ensuring policy does not lag behind. In doing so, RBI has shown its resolve towards meeting medium-term inflation target and ensuring stability to support medium-to-long-run growth for the economy. The endeavour to get real rates in positive territory, as mentioned earlier by RBI, gets closer with this move and we expect another 50 bps rate hike by MPC over the next couple of MPC meetings before the pause.

As we are much better relatively in terms of growth and inflation, we might not have to tighten as aggressively as western countries and hence might not need to turn around policy direction sooner, which reduces policy uncertainty. RBI has chosen to be cautious now and leave policy space for future support to growth. On INR, this move of 50 bps hike is currency-supportive and hence we expect INR to remain in 79-80/$ range and take broader direction from movements in the dollar Index.

What are the pockets that look attractive to invest now and why?

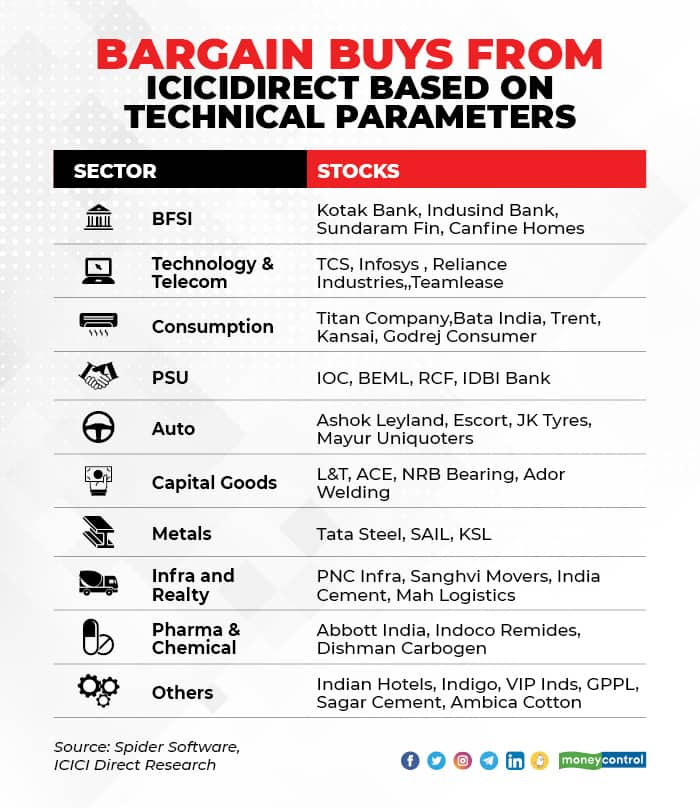

The banking sector looks to be in a sweet spot and valuations are still mid-cycle. Capital goods, industrial and manufacturing sectors are also benefiting from demand lift. Healthcare remains a structural buy. In consumption, we might see some reversal in the trend so far i.e. rural demand might recover and urban demand might stabilise after the spurt post-COVID.

Disclaimer: The views and investment tips offered by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.?