From the two-wheeler space, we have been closely tracking ‘Hero MotoCorp’ as it maintained its sturdy structure by showing series of higher highs higher lows. With Friday’s upsurge, the stock prices finally managed to traverse the ‘200-day SMA’ (Rs 2,600) for the first time after March 2021.

Sameet Chavan

May 30, 2022 / 06:42 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One

Previous Friday’s recovery was followed by a flat start last on May 23 in line with muted global cues. In the initial trade, we made a move towards 16,400 but once again the market felt some pressure at higher levels. In fact, as the week progressed, we kept descending towards 16,000 mark.

On the expiry day of May 26, the early morning gains disappeared in a flash and due to aggravated selling, the Nifty went on to test 15,900 around the mid-session; but suddenly, the buying emerged at lower levels with full force. This resulted in a massive recovery across the broader markets to reclaim 16,200. In fact, on Friday, the gains extended towards 16,350 to conclude the week with slightly over half a percent gains.

In last three consecutive weeks, our markets made several attempts towards 15,900 – 15,700; but fortunately, despite unfavourable global environment, our market showed tremendous resilience at lower levels. In fact, with last two days’ smart recovery, our market seems to have weathered the storm, at least for a time being.

Some of the heavyweight spaces like IT and Metal were deeply oversold and some sort of relief was very much overdue. Apart from this, the banking proved its mettle as we saw sheer outperformance from this heavyweight basket to pull the market from a difficult situation.

Now, we are back to higher end of the recent range i.e., 16,400 and it would be interesting to see whether the Nifty surpasses it or not. In our sense, it’s a matter of time and we would see the Nifty traversing this level to test 16,600–16,800 this week.

Despite all this, we are not completely out of the woods yet, because a lot of global issues are yet to stabilise. Hence, we advise traders to not get complacent and keep assessing the situation on a regular basis.

As far as immediate supports are concerned, 16,200 followed by 16,000 should provide cushion on any intra-week weakness. Hopefully, global markets come out of the challenging phase soon, which will attract strong buying in our markets going ahead.

Here are two buy calls for next 2-3 weeks:

Hero MotoCorp: Buy | LTP: Rs 2,719.80 | Stop-Loss: Rs 2,568 | Target: Rs 2,920 | Return: 7.4 percent

In last month or so, the automobile space seems to be in a different zone altogether. When the entire market was feeling the heat of global sell off, this basket has outperformed by a fair margin.

From the two-wheeler space, we have been closely tracking ‘Hero MotoCorp’ as it maintained its sturdy structure by showing series of higher highs higher lows.

With Friday’s upsurge, the stock prices finally managed to traverse the ‘200-day SMA’ (Rs 2,600) for the first time after March 2021.

If we look at the broader picture, we can see prices precisely oscillating within the boundaries of ‘Falling Channel’ on the daily chart. This price configuration took 15 months which has finally been broken in the upward direction with volumes.

Hence, we recommend buying this stock around Rs 2,700 – 2,680 for a trading target of Rs 2,920. The stop-loss can be placed at Rs 2,568.

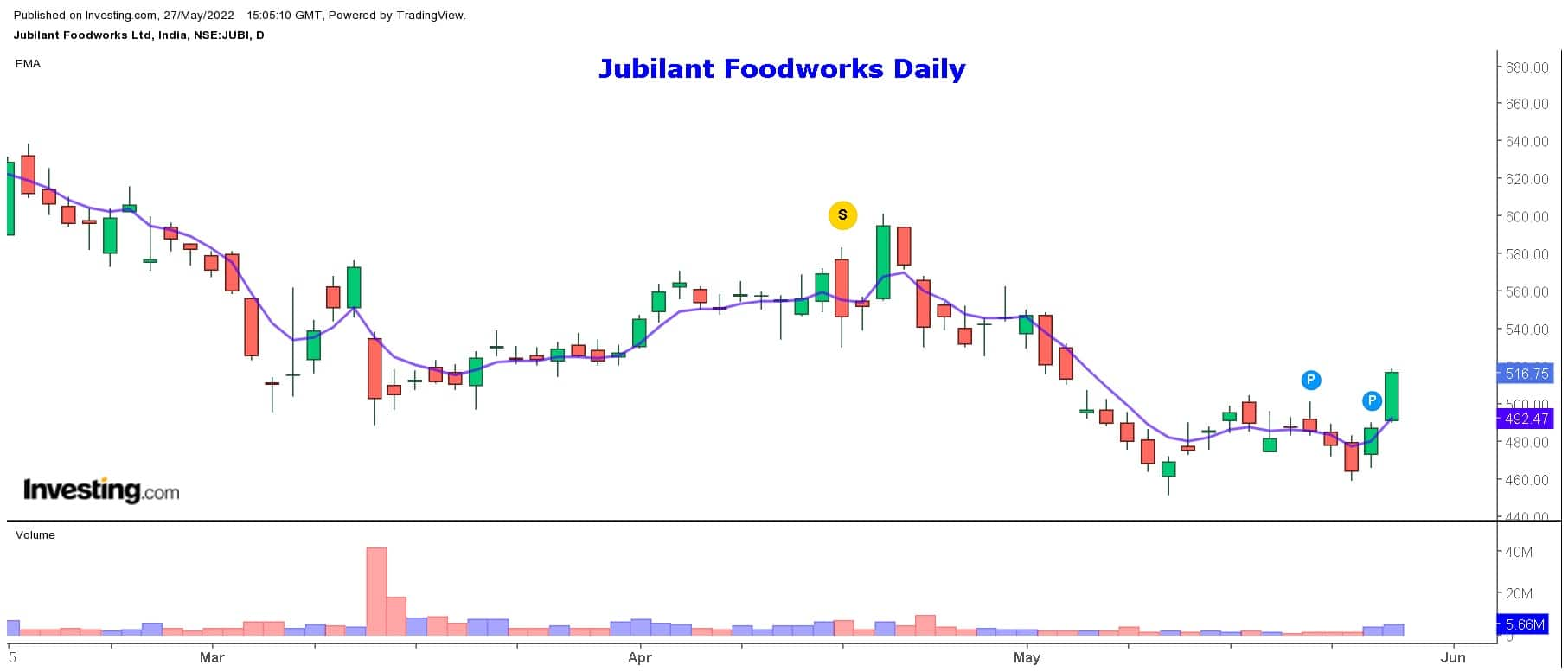

Jubilant Foodworks: Buy | LTP: Rs 516.75 | Stop-Loss: Rs 488 | Target: Rs 550 | Return: 6.4 percent

This counter has undergone a massive price correction in last 8 odd months. In this process, the stock prices tumbled more than 40 percent and reached its ‘200-SMA’ (Rs 438)) on weekly chart. Fortunately, the correction seems to have arrested around it and with last two days’ price action, the stock is showing some early signs of short-term relief.

On the daily time frame, the stock confirmed a breakout from the ‘1-2-3′ pattern along with sizable volumes. In this process, it has successfully managed to traverse the ’20-day EMA’ (Rs 571) as well.

We recommend buying on a decline for a near term target of Rs 550. The strict stop-loss needs to be placed at Rs 488.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Download your money calendar for 2022-23 here and keep your dates with your moneybox, investments, taxes