The recent low of 15,671 is not far from the current levels now and the moment we slide below it, it will create a panic kind of situation in the market. Below this, 15,350-15,200 are the next levels to watch out for, says Sameet Chavan of Angel One

Sunil Shankar Matkar

May 16, 2022 / 09:24 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

The market remained under selling pressure throughout the week ended May 13 with the Nifty50 losing 4 percent on the back a weakening rupee against the US dollar, inflation concerns, apprehensions of faster policy tightening by the central banks, and lockdowns in China.

The index made attempts two-three times to rebound but failed and closed the week way below psychological 16,000 mark and near the lows of this year (15,671), indicating bears are in strong position. Experts feel if it breaks the same low then there is a possibility of panic selling which can bring the index down to 15,200 levels in the coming days.

The Nifty50 lost 275 points from the day’s high to end with 26 points loss on Friday at 15,782 and formed a bearish candle on the daily charts. During the week, it fell more than 600 points and saw a bearish candle formation on the weekly scale.

“‘The recent low of 15,671 is not far from the current levels now and the moment we slide below it, it will create a panic kind of situation in the market. Below this, 15,350-15,200 are the next levels to watch out for,” Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One, said.

On the flipside, he feels 16,000-16,200 has now become a stiff hurdle. The first sign of relief is possible only above these levels. Till this time, one should avoid trading aggressively in the market, he suggested.

“If we take glance at the weekly time frame chart, we can see sheet anchor in the form of ’89-EMA’ (exponential moving average) placed around 15,600. Historically, this moving average has proved it’s mettle and has provided cushion to severe falls. It would be very interesting to see how market behaves around it,” Chavan said.

Hence, although the trend is strongly bearish at this moment, Sameet advised investors with a slightly broader time frame, should start nibbling in quality propositions in a staggered manner.

Here are the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the May 13 closing prices:

Expert: Nandish Shah, Senior Derivative & Technical Analyst at HDFC Securities

Coromandel International: Buy | LTP: Rs 883 | Stop-Loss: Rs 820 | Target: Rs 1,000 | Return: 13 percent

The stock price has broken out from the symmetrical triangle on the weekly chart. Primary trend of the stock is positive as it is trading above its all-important short term and long-term moving averages.

Momentum oscillators like RSI (relative strength index) and MFI (money flow index) are placed above 60, indicating strength in the current uptrend of the stock. We expect current outperformance of the stock to continue for the coming weeks.

Delta Corp: Buy | LTP: Rs 222 | Stop-Loss: Rs 205 | Target: Rs 250 | Return: 13 percent

The stock price has reached near to the support of 100 weeks EMA (exponential moving average) which is placed at Rs 220 odd levels. Primary trend of the stock is positive as it is trading above its 100 and 200 days EMA.

The stock price has corrected nearly 35 percent from the recent high and reached near to the multiple support level. MFI Oscillator is placed above 60 on the weekly chart, indicating strength in the stock.

Bharat Electronics: Buy | LTP: Rs 219 | Stop-Loss: Rs 205 | Target: Rs 240 | Return: 10 percent

Primary trend of the stock is positive as it is trading above its 200 days EMA. Stock price has corrected nearly 15 percent from the recent high and reached near upward sloping trendline support. MFI Oscillator is placed above 60, indicating strength in the stock.

Expert: Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

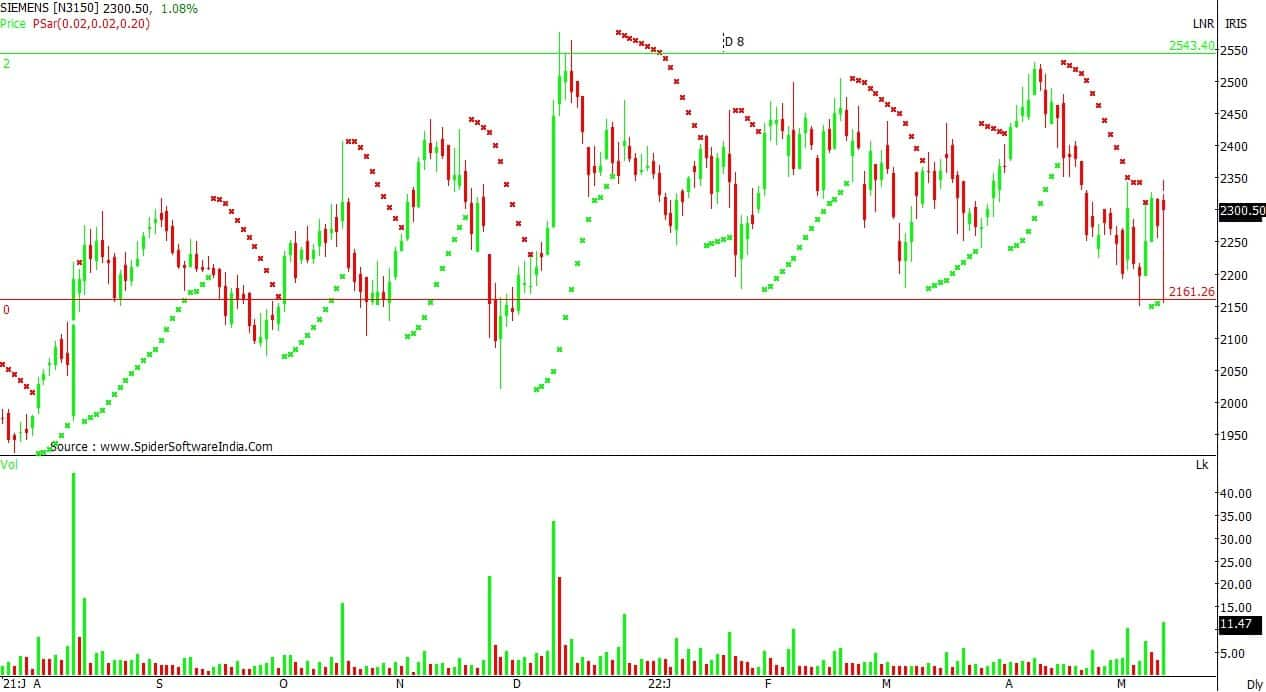

Siemens: Buy | LTP: Rs 2,300.5 | Stop-Loss: Rs 2,100 | Target: Rs 2,550 | Return: 11 percent

The stock is forming a rectangle consolidation formation between Rs 2,550 and Rs 2,150 levels. The stock rebounded on positive news- flow after hitting a low of Rs 2150.

The entire sector is performing well and the stock is forming a bullish pattern which would help take the stock to Rs 2,550 in the near term. It is a buy at current levels and more on dips. Place the last stop-loss at Rs 2,100.

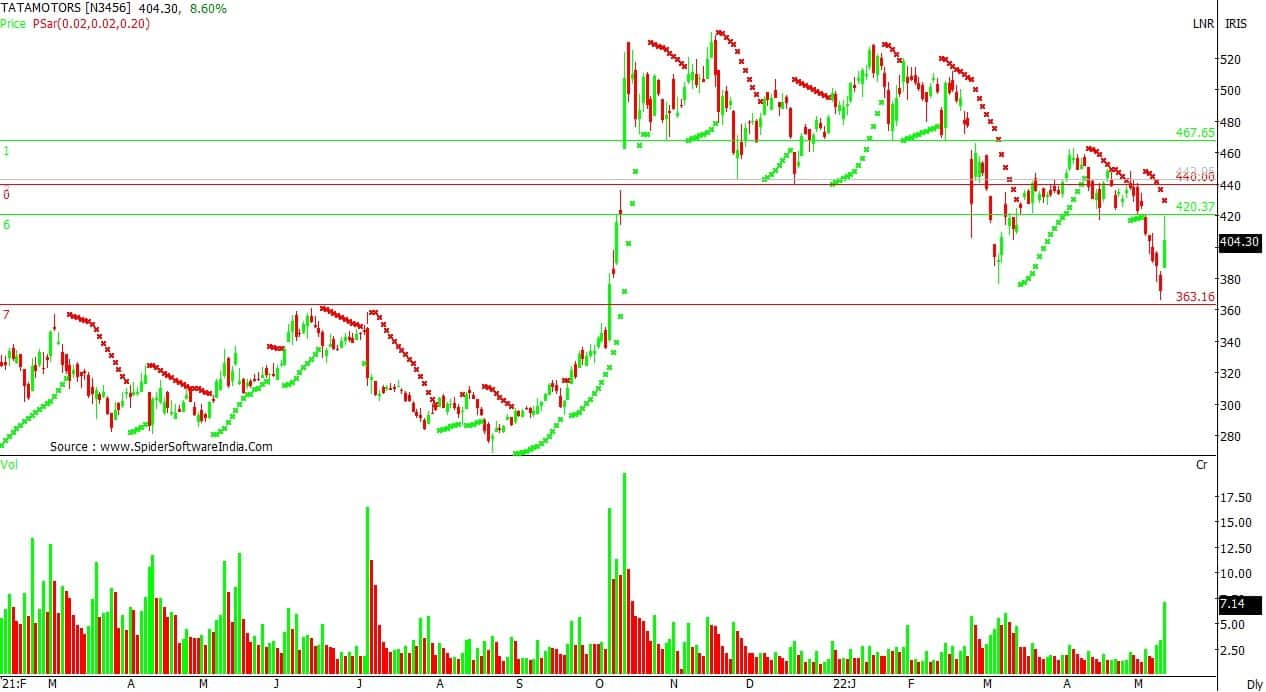

Tata Motors: Buy | LTP: Rs 404.3 | Stop-Loss: Rs 350 | Target: Rs 470 | Return: 16 percent

Since the start of the new financial year, the stock was under tremendous selling pressure, falling from the level of Rs 462 to Rs 366. However, the stock jumped sharply after the announcement of the Q4 numbers and returned nearly 50 percent of all the fall.

Technically, it is a positive for the stock, as it will strengthen the buying breadth for the stock. The strategy should be to buy at Rs 405 and more at Rs 380 on dips. However, we need to protect a long position with a stop-loss at Rs 350.

At higher levels, it will retest Rs 470 level again in the medium to long term.

Tata Steel: Buy | LTP: Rs 1,097 | Stop-Loss: Rs 1,000 | Target: Rs 1,300 | Return: 19 percent

The stock is approaching a key support area, which lies between Rs 1,050-1,100 level. Over the past 12 months, the stock has offered significant support to the stock at various times.

In the current sell-off, the stock is getting oversold by the time it reaches the support area. The ideal strategy should be to initiate long positions at current levels and more on dips at Rs 1,060.

To protect the long position, the stop-loss should be at Rs 1,000. On the higher side, the stock can again move back to Rs 1,300 levels where it has resistance of the falling trend line.

Expert: Ruchit Jain, Lead Research at 5paisa.com

Godrej Consumer Products: Buy | LTP: Rs 797.2 | Stop-Loss: Rs 744 | Target: Rs 870 | Return: 9 percent

After corrective phase, the stock has recently changes its trend as prices have formed a ‘Higher High Higher Low’ on the daily charts. On last Friday’s session, prices gave a breakout above the falling trendline resistance with good volumes.

The ‘RSI Smoothened’ oscillator also gave a positive crossover hinting at a positive momentum.

Hence, traders can look to buy the stock in the range of Rs 797-794 for potential target of Rs 870 in next few weeks. The stop-loss for short positions can be placed below Rs 744.

ONGC Futures: Sell | LTP: Rs 154.2 | Stop-Loss: Rs 162 | Target: Rs 140 | Return: 9 percent

Prices have recently consolidated in a range which has led to formation of a ‘Triangle’ pattern. The stock is on a verge of a breakdown from the support end of the pattern which is a negative sign.

Also, the ‘RSI Smoothened’ oscillator on the daily charts in hinting at a negative momentum and hence, we expect some price-wise correction in the near term.

Traders can look to sell the stock in the futures segment below Rs 153 for potential targets of Rs 140 and Rs 134. The stop-loss for this trade should be placed above Rs 162.

Expert: Ajit Mishra, VP-Research at Religare Broking

Mahindra & Mahindra: Buy | LTP: Rs 889.5 | Stop-Loss: Rs 830 | Target: Rs 1,030 | Return: 16 percent

We are seeing a mixed trend within the auto pack and M&M has been trading strongly closer to its record high despite the prevailing market correction.

The recent dip towards the support zone of major moving averages is offering a fresh buying opportunity. We recommend accumulating within Rs 880-890 levels.

Canara Bank Futures: Sell | LTP: Rs 191.75 | Stop-Loss: Rs 210 | Target: Rs 165 | Return: 14 percent

In line with ongoing correction, Canara Bank has witnessed a breakdown from a distribution pattern, after spending nearly 7 months in a consolidation range.

It has also slipped below the support zone of the trendline on the daily chart and the fresh breakdown in the banking index is added negative. We thus recommend creating shorts within Rs 195-200 zone.

Manappuram Finance Futures: Sell | LTP: 98.35 | Stop-Loss: Rs 113 | Target: Rs 82 | Return: 17 percent

Manappuram has been witnessing correction for the last six months after making a new record high in November 2021. In continuation to the prevailing phase, it has slipped below the previous swing low, indicating more downside ahead. We thus recommend creating shorts on an uptick within the 100-104 zone.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Download your money calendar for 2022-23 here and keep your dates with your moneybox, investments, taxes