The Nifty50 almost erased its previous day’s gains and closed with a 1.3 percent loss on April 22, as a correction in global peers after Federal Reserve Chair Jerome Powell hinted at a 50 bps rate hike in the policy meeting next month, dented market sentiment. Banks, Financial Services, Metal, and Pharma stocks hit hard.

The index formed a bearish candle on the daily charts as the closing was lower than the opening levels, but there was a Long-Legged Doji kind of pattern formation on the weekly scale, indicating the indecisiveness of bears. The index lost 1.7 percent during the week.

A typical long-legged Doji pattern is formed when the opening price is almost equal to the closing price but there is a lot of intraweek movement on either side.

The Nifty50 opened lower at 17,243 and remained under pressure throughout the session to hit the day’s low of 17,149, which experts feel could act as a crucial level for further downside in the coming days. The index finally settled at 17,172, down 221 points or 1.27 percent.

“Albeit, Nifty50 registered a bearish candle on the daily chart, it witnessed a Long-legged Doji on weekly charts hinting at the indecisive nature of the bears at the lower levels,” Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia said.

The expert further said a complete washout of the last Thursday’s gains with a close below 17,200 levels shall favour bears in the next trading session. Hence, it remains critical for the Nifty to sustain above 17,149 levels and a failure to do so can initially, extend the weakness towards 16,978 levels, Mazhar Mohammad said.

As markets seem to be in a high volatile phase without a proper direction, Mazhar Mohammad advised that it looks prudent to avoid index bets, at this juncture, till some signs of stability are visible.

Option data indicated that the Nifty50 could see a wider trading range of 16,800 to 17,500 levels for next week.

On the options front, there was a maximum Call open interest at 18,000 strike, followed by 17,500 strike while maximum Put open interest was seen at 17,000 strike followed by 16,000 strike. Significant Call writing was seen at 18,000 strike then 17,400 strike while Put writing was seen at 17,000 strike.

India VIX increased by 2.8 percent to 18.35 levels. Experts feel the volatility staying above 18 levels is giving discomfort to the bulls.

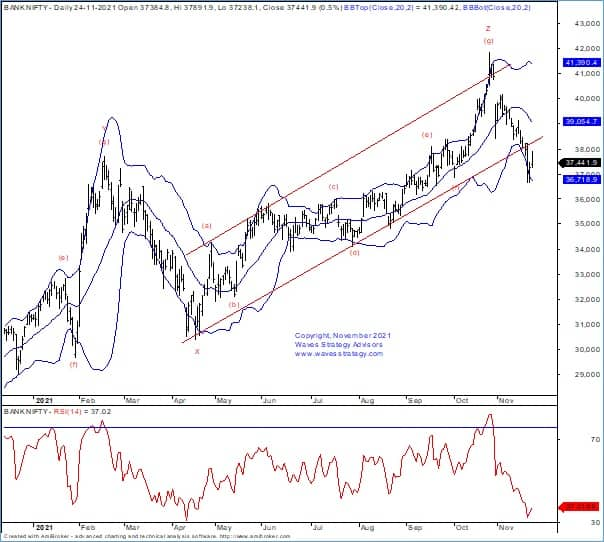

Bank Nifty opened with 300 points loss at 36,514 and remained under pressure for the entire session. It broke the crucial support of 36,000 intraday but at the close, it managed to hold the same and settled with losses of 771 points at 36,045.

The index formed a bearish candle on the daily and weekly scale. “Till it holds below 36,250, weakness could be seen towards 35,750 and 35,500 while resistances are placed at 36,500 and 36,750 zones,” Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services said.

On the stocks’ front, he said there was a positive setup in United Breweries, Mindtree, Colgate Palmolive, Adani Ports, Marico, M&M, Biocon, Maruti Suzuki, and Asian Paints while weakness was seen in Hindalco, ICICI Lombard General Insurance, Lupin, Torrent Pharma, SBI, Piramal Enterprises, Dr Reddy’s Labs, Cipla, Glenmark Pharma, HDFC AMC, RBL Bank, and Tata Steel.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Download your money calendar for 2022-23 here and keep your dates with your moneybox, investments, taxes