In the week gone by, it was expiry of consolidation where Nifty traded in broader range of 18,050-17,650. The broader market experienced high volatile moves last week as we witnessed few gaps-ups and gap-downs.

A little up move in the middle of the week did raise investors’ hope, but was unable to push Nifty above 18,000. During the October expiry only, Nifty touched fresh all-time high of 18,594. After struggling around the 18,000-level, Nifty shut shop last week with moderate gains of 1.14 percent at 17,916.

Meanwhile, Bank Nifty also witnessed consolidation. With gain of over 0.81 percent last week, Bank Nifty closed around 39,632.60. Bank Nifty over the week traded between 40,300 and 39,250. On the OI (open interest) front, long build up was witnessed in the Bank Nifty over the week gone by.

Further diving into the Nifty’s upcoming weekly expiry, call writers are showing aggression by building more positions as compared to put writers.

Nifty immediate resistance stands at the 18,000-level where nearly 30 lakh were added – highest among all – followed by vital resistance at 18,300 levels with 25 lakh shares. On the lower side, immediate support level is at 17,500 where nearly 20 lakh shares were added, followed by 17,000 with addition of 32 lakh shares.

Looking at the Bank Nifty’s upcoming weekly expiry data, immediate resistance stands at 40,000 (13 lakh shares) followed by 41,000 (18 lakh shares). Whereas, on the downside, 39,000 (9L shares) stands as the immediate support level and followed by 38,000 (7L shares) as the vital support level.

India VIX, fear gauge, decreased by 9.50% from 17.45 to 15.751 over the week. India VIX is trading near the lowest level of pre-covid crash. Cool off in the IV has given relaxation to market. Further, any downticks in India VIX can push the upwards momentum in Nifty.

Looking at the sentimental indicator, Nifty OI PCR for the week has increased from 0.745 to 1.076. Bank Nifty OIPCR over the week increased from 0.604 to 0.737 compared to last Friday. Overall data indicates more of put writers over put writers in Nifty.

Moving further to the weekly contribution of sectors to Nifty. Most of the sectoral indices have contributed positively such as Auto, FMCG, IT and PSU Bank has collectively contributed nearly +120 in the Nifty 33 points gain. Whereas, heavyweights like PVT Bank and OIL collectively contributed nearly 100 points on the negative side

Looking towards the top gainer & loser stocks of the month in the F&O segment. Canara Bank topped by gaining over 18.3%, followed by Oberoi Realty 15.8%, Aditya Birla Fashion 13.7%. Whereas, IRCTC has lost over 9.6%, PI Industries -6.70 %, Reliance Industries -3.80% over the week.

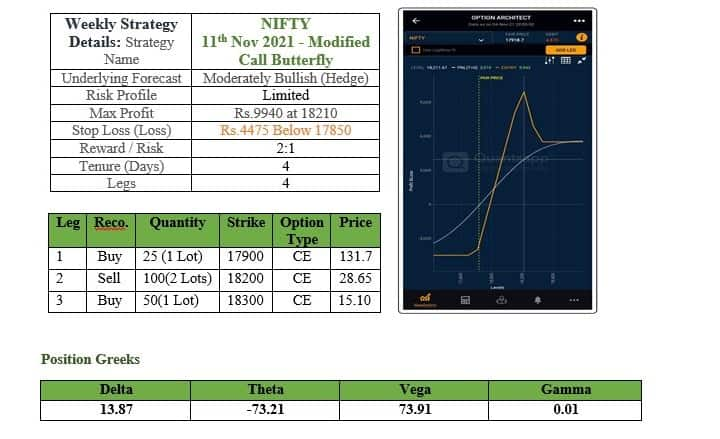

Considering the bullish momentum, the upcoming week can be approached with a low-risk strategy like Modified Call Butterfly in Nifty.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.