The banking index has been showing outperformance and is continuing its uptrend after some consolidation. Among private sector banks, Axis Bank is showing strength and has given a breakout above its previous swing high resistance.

Sunil Shankar Matkar

December 12, 2022 / 07:51 AM IST

Representative image

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] < 0){ // $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); // $ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); //} if(resData[stkKey][‘percentchange’] >= 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] < 0){ $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); //$ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); $ (‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); } $ (‘#volumetxt_’+articleId).show(); $ (‘#vlmtxt_’+articleId).show(); $ (‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]); $ (‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]); $ (‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]); $ (‘#rightcol_’+articleId).show(); }else{ $ (‘#volumetxt_’+articleId).hide(); $ (‘#vlmtxt_’+articleId).hide(); $ (‘#stkvol_’+articleId).text(”); $ (‘#td-low_’+articleId).text(”); $ (‘#td-high_’+articleId).text(”); $ (‘#rightcol_’+articleId).hide(); } $ (‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’); } } } }); } $ (‘.bseliveselectbox’).click(function(){ $ (‘.bselivelist’).show(); }); function bindClicksForDropdown(articleId){ $ (‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){ stkId = jQuery.trim($ (this).find(‘a’).attr(‘stkid’)); $ (‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’); $ (this).find(‘a’).addClass(‘active’); stockWidget(‘N’,stkId,articleId); }); $ (‘#stk-b-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘B’,stkId,articleId); $ (‘.bselivelist’).hide(); }); $ (‘#stk-n-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘N’,stkId,articleId); $ (‘.bselivelist’).hide(); }); } $ (“.bselivelist”).focusout(function(){ $ (“.bselivelist”).hide(); //hide the results }); function bindMenuClicks(articleId){ $ (‘#watchlist-‘+articleId).click(function(){ var stkId = $ (this).attr(‘stkId’); overlayPopupWatchlist(0,2,1,stkId); }); $ (‘#portfolio-‘+articleId).click(function(){ var dispId = $ (this).attr(‘dispId’); pcSavePort(0,1,dispId); }); } $ (‘.mc-modal-close’).on(‘click’,function(){ $ (‘.mc-modal-wrap’).css(‘display’,’none’); $ (‘.mc-modal’).removeClass(‘success’); $ (‘.mc-modal’).removeClass(‘error’); }); function overlayPopupWatchlist(e, t, n,stkId) { $ (‘.srch_bx’).css(‘z-index’,’999′); typparam1 = n; if(readCookie(‘nnmc’)) { var lastRsrs =new Array(); lastRsrs[e]= stkId; if(lastRsrs.length > 0) { var resStr=”; let secglbVar = 1; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; //var newappndStr = makeMiddleRDivNew(d); //appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId; window.open(postfolio_url, ‘_blank’); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“.linkSignUp”).click(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); }); function redirectToTradeOpenDematAccountOnline(){ if (stock_isinid && stock_tradeType) { window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=$ {stock_isinid}&ex=$ {stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’); } }

After moving closer to 18,900 level in the beginning of December, traders seem to have preferred profit taking and hence the Nifty50 is caught in a bear trap. The index lost more than 1 percent in the week ended December 9, after run-up in previous two consecutive weeks. Slightly hawkish tone by the Reserve Bank of India and caution ahead of FOMC meet weighed on market sentiment despite correction in oil prices amid global recession fears.

The index closed a tad below 18,500, the support which was being held on to for several sessions in the recent past. Overall if the same gets decisively broken then Nifty can take support at crucial 18,400-18,300 area, whereas on the other side, 18,600-18,700 zone is going to be near term resistance followed by new high, experts said.

“The Nifty is now placed slightly above the key support of ’20-day EMA’ (exponential moving average – 18,465) which coincides with previous swing high of 18,450. Hence, we continue to remain upbeat as long as 18,400 – 18,300 is not violated on a closing basis,” Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One, said.

Until then, he feels any intermediate decline should only be construed as profit booking before resuming the upward trend.

On the flipside, 18,650 – 18,700 are the levels to watch out for. The moment Nifty surpasses this, one should gear up for yet another milestone of 19,000 in the near future, the expert said.

Traders are advised not to get carried away by such small declines. Rather it’s better to focus more on thematic moves, especially from the broader end of the spectrum, Sameet advised.

Let’s take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the December 9 closing prices:

Expert: Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

Thermax: Buy | LTP: Rs 2,057 | Stop-Loss: Rs 1,875 | Target: Rs 2,350 | Return: 14 percent

The stock is in the last leg of a corrective pattern. It could drop to Rs 1,950 or Rs 1,960 levels, where it has seen key support since March 2022.

Technically, it will mark the second low in the last two months. Our advice is to buy the stock 50 percent at current levels and the balance at Rs 1,950 with a final stop-loss at Rs 1,875 and we can keep a target of Rs 2,350 or Rs 2,450 in the medium term, which is the pullback level for the stock.

HDFC Bank: Buy | LTP: Rs 1,631 | Stop-Loss: Rs 1,590 | Target: Rs 1,722 | Return: 5.6 percent

It is forming a triangle consolidation formation between Rs 1,640 and Rs 1,590 range. It has shown a trending move from Rs 1,365 levels.

The overall formation is suggesting that the current formation is a continuation formation and on the dismissal of Rs 1,642, it will jump to the level, which lies between Rs 1,675 and Rs 1,722.

Buying around Rs 1,630 and Rs 1,620 is appropriate with a stop-loss at Rs 1,590.

Divis Laboratories: Sell | LTP: Rs 3,274 | Stop-Loss: Rs 3,350 | Target: Rs 2,978 | Return: 9 percent

The stock is forming a series of lower top and lower bottom. On weekly basis, the stock closed below Rs 3,330 level, which was last week’s low.

It is negative for the stock and it may witness further weakness till the next level, which is at Rs 2,978. The stock closed on a weekly basis at Rs 3,274 and based on technical analysis, the downside is favourable for short sellers with a stop-loss at Rs 3,350.

Expert: Subash Gangadharan, Senior Technical & Derivative Analyst at HDFC Securities

Aditya Birla Sun Life AMC: Buy | LTP: Rs 449.55 | Stop-Loss: Rs 430 | Target: Rs 490 | Return: 9 percent

Aditya Birla Sun Life AMC has corrected from a high of Rs 503 touched in September 2022. The stock recently found support around the Rs 400 levels in October 2022. This is close to the previous intermediate lows, indicating a double bottom formation. The stock has subsequently bounced back and made higher bottoms in the last few weeks.

Last week, the stock broke out of a trading range on the back of healthy volumes, which is encouraging. Momentum readings like the 14-day RSI (relative strength index) too have bounced back and are in rising mode now.

With the intermediate technical setup too looking positive, we believe the stock has the potential to move higher in the coming weeks. We recommend a buy between Rs 440-460 levels, with a stop-loss at Rs 430 and target at Rs 490.

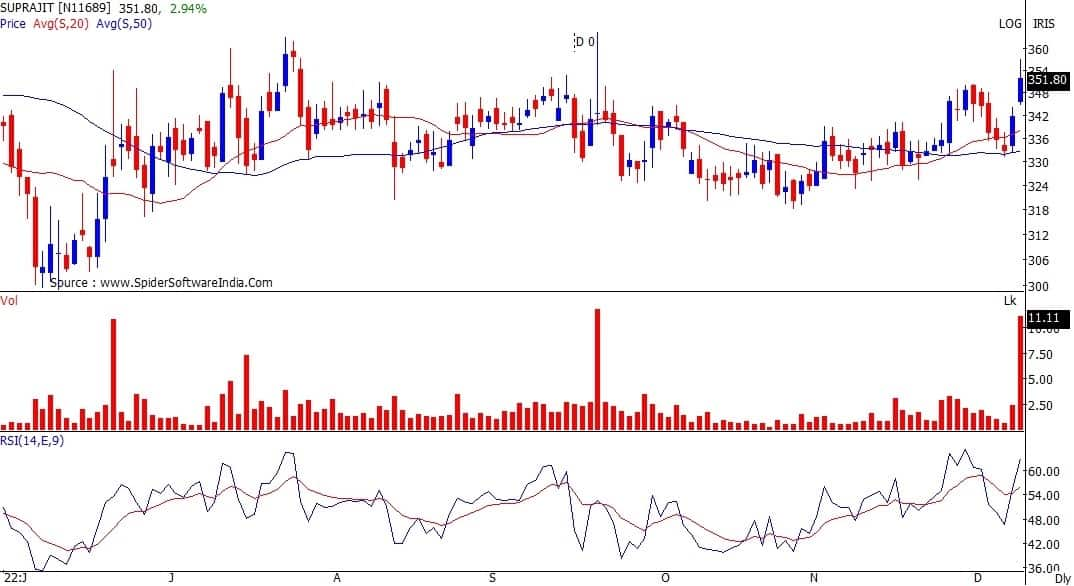

Suprajit Engineering: Buy | LTP: Rs 350.8 | Stop-Loss: Rs 332 | Target: Rs 382 | Return: 9 percent

After correcting from a high of Rs 470 in January 2022, Suprajit Engineering found support around Rs 272 levels in March 2022. These are strong supports as they are just above the 200-day EMA.

The stock has since then been climbing higher and making higher bottoms in the process. This week, the stock also broke out of its recent trading range on the back of huge volumes, indicating it is set to move higher in the coming weeks.

Technical indicators are giving positive signals as the stock is trading above the 20 and 50-day SMA. Momentum readings like the 14-week RSI too are in rising mode and not overbought, which implies potential for further upsides.

With the intermediate setup too looking attractive, we expect the stock to move up towards its previous intermediate highs in the coming weeks. One can buy between Rs 348-355 levels, with a stop-loss at Rs 332 and target at Rs 382.

Bata India: Sell | LTP: Rs 1,679 | Stop-Loss: Rs 1,739 | Target: Rs 1,580 | Return: 6 percent

Bata is in a short term downtrend as it has been making lower tops and lower bottoms for the last several weeks. Recently, the stock broke down below its recent supports and also reacted from the 20-day SMA last week. This indicates that the downtrend looks set to continue.

Technical indicators are giving negative signals as the stock is now trading below the 20-day and 50-day SMA. Momentum readings like the 14-day RSI are in decline mode and not oversold, which implies potential for more downsides.

We therefore expect the stock to correct further in the coming sessions. One can sell between Rs 1,670-1,684 levels, with a stop-loss at Rs 1,739 and downside target at Rs 1,580.

Expert: Jatin Gohil, Technical and Derivative Research Analyst at Reliance Securities

Asian Paints: Buy | LTP: Rs 3,227 | Stop-Loss: Rs 3,030 | Target: Rs 3,580 | Return: 11 percent

The stock consolidated after retracing 50 percent of prior up-move (Rs 2,560-Rs 3,546) and witnessed a range breakout. The stock also closed above its 20-week EMA and rose to 9-week closing high.

Its weekly Stochastic is positively poised; its RSI gave buy signal, while its MACD (moving average convergence divergence) is on the verge of a bullish cross-over.

The stock has potential to move towards Rs 3,490 initially and Rs 3,680 subsequently.

In case of any decline, the stock will continue to find support at around its 50 percent Fibonacci Retracement level of prior up-move.

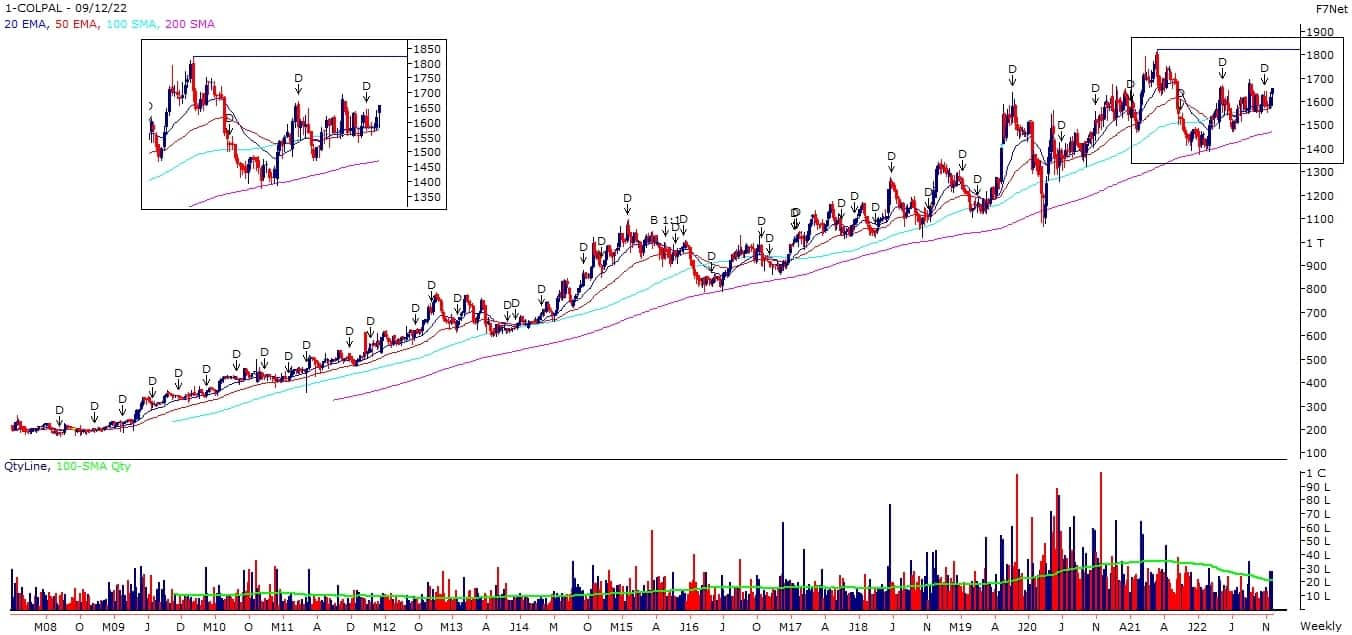

Colgate Palmolive: Buy | LTP: Rs 1,657 | Stop-Loss: Rs 1,570 | Target: Rs 1,820 | Return: 10 percent

Since couple of weeks, the stock oscillated above its cluster of moving averages (20-week EMA, 50-week EMA and 100-week SMA) and poised for a breakout.

In the last two weeks, the stock witnessed a steady rise with above average volume, which signals that major market participants were in favour of the bulls.

The key technical indicators are positively poised on medium-term as well as short-term timeframe charts. We believe the stock will rebound utilising prior consolidation and move towards its life-time-high.

On the lower side, the stock will find support around its cluster of moving averages.

Dr Reddy’s Laboratories: Buy | LTP: Rs 4,407 | Stop-Loss: Rs 4,210 | Target: Rs 4,900 | Return: 11 percent

Post a trendline breakout, the stock again tested that extended line and formed a bullish reversal pattern. The stock also found support around its 100-day SMA and reversed.

This could take the stock towards Rs 4,600 initially and Rs 4,900 subsequently.

Major technical indicators are in favour of the bulls on the near-term timeframe chart.

In case of any volatility, the stock will find support around its long-term moving averages (100-day and 200-day SMAs).

Expert: Ruchit Jain, Lead Research at 5paisa.com

Axis Bank: Buy | LTP: Rs 934 | Stop-Loss: Rs 908 | Target: Rs 985 | Return: 5.5 percent

The banking index has been showing an outperformance and it is continuing its uptrend after some consolidation phase. Within the private sector banks, Axis Bank is showing strength and has given a breakout above its previous swing high resistance.

The prices above its 20 EMA support, the volumes along the price upmove are good and the RSI oscillator is indicating a positive momentum.

Hence, we expect the uptrend to continue in Axis Bank, so short term traders can look to buy this stock around Rs 934 for potential targets of Rs 969 and Rs 985. The stop-loss for long positions should be placed below Rs 908.

Suprajit Engineering: Buy | LTP: Rs 351 | Stop-Loss: Rs 337 | Target: Rs 376 | Return: 7 percent

The stock has been consolidating within a Symmetrical Triangle pattern since last few months and prices have given a breakout from the pattern on Friday. This entire consolidation is above its weekly 200 EMA which indicates that long term uptrend is still intact.

The volumes have improved in last couple of sessions and if the stock gives a follow up move, then it could lead to a decent trended upmove going ahead.

Hence, traders can look to buy the stock around current market price of Rs 351 for potential targets around Rs 365 and Rs 376. The stop-loss for long positions should be placed below Rs 337.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.