Investors tend to hound value managers about the trap of buying undervalued stocks that prove “cheap for a reason,” but “growth traps” are even more painful, according to GMO.

“It turns out that “growth traps” – companies that are priced for a level of growth that fails to materialize – are an even bigger problem in the growth universe than value traps are in the value universe,” said Ben Inker, GMO’s head of asset allocation, in the firm’s second-quarter letter, dated August 31.

Yet the term “grow traps” doesn’t seem to be a part of the “lexicon,” Inker wrote in the letter, which a GMO spokesman said was posted to the firm’s website Tuesday night.

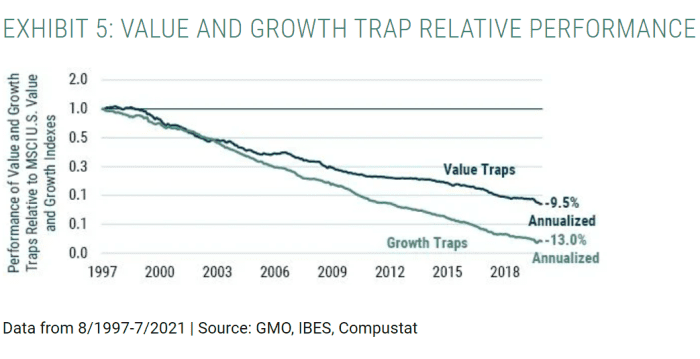

“Most of the time, the prevalence of traps in value and growth are quite similar, although interestingly in both the run-up to the internet bubble and the period of its bursting there were substantially more growth traps than value traps,” Inker wrote. “As it turns out, growth traps are even more painful on average.”

GMO 2Q 2021 LETTER

“Value traps have underperformed the value universe by a painful 9.5% per year,” Inker wrote. “But growth traps have underperformed the growth universe by a huge 13.0%.”

GMO, the Boston-based firm co-founded by legendary value investor Jeremy Grantham, said in the letter that some investors have “understandably” questioned whether “value’s run is over.” After all, value stocks are once again lagging growth stocks, a reversal that began late in the second quarter after seeing “two of the best quarters for value in at least a decade.”

“It was frankly enough to trigger nightmares for a value manager,” Inker said.

The Russell 1000 Value RLV, -0.37% index was little changed Wednesday, but showing a year-to-gain of around 18.7%, according to preliminary FactSet data. That trails this year’s gain of about 20.7% for the Russell 1000 Growth RLG, +0.31% index, which rose about 0.2% Wednesday, the preliminary data show.

The S&P 500 index SPX, -0.03% was up about 20.5% on the year through Wednesday, beating the Dow Jones Industrial Average’s DJIA, -0.21% 15.4% gain so far in 2021 and the Nasdaq Composite index’s COMP, +0.21% 18.8% advance.

In GMO’s quarterly letter, Inker took on the argument that “value recently made a nice tactical rally from October to March, but the secular trend remains in favor of growth.” That’s a “weird” argument if “secular trend” is meant to indicate growth will beat value in the “very long term,” he said.

“A belief in a permanent premium for growth stocks requires a belief that they will continually be underpriced,” Inker wrote. “No matter how wonderful a company’s prospects, there is necessarily some valuation that would make the company’s stock a poor investment.”

Read: S&P 500 keeps rising to new peaks, but the U.S. stock market looks ‘a bit ragged’

Critics of value investing also say today’s business models make most accounting data “irrelevant,” questioning “obsolete measures” like price-to-earnings and price-to-book ratios, according to the letter. GMO showed some sympathy here.

It’s true that GAAP accounting hasn’t kept up with business models more dependent on intellectual property than tangible assets, according to Inker. Book value was “a highly imperfect guide to ‘true’ economic capital” even before the internet, he said, and it’s “more flawed now.”

But according to Inker, “GMO’s Global Equity team spent 4 years painstakingly rebuilding the balance sheets and income statements of over 10,000 companies going back over 40 years, capitalizing expenditures that we believe should have been considered investments and undoing the distortions created by decades of stock buybacks.” The firm’s “forward-looking dividend discount model” positions GMO to differentiate between overvalued stocks and companies worth paying up for because of their growth potential, he wrote.

“The odds are strongly against companies trading at over 10x sales,” said Inker. “Today, a full 25% of the U.S. stock market is trading above that 10x sales multiple, far higher than any time in history apart from the peak of the internet bubble in 2000.”

Meanwhile, value appears “extremely” cheap relative to growth in U.S. large-cap stocks, according to GMO. Inker wrote that the recent reversal in performance favoring growth stocks has provided the firm’s Equity Dislocation portfolio, which was launched late last year, an opportunity to reposition its short bets against stocks with the “most egregious” valuations.

“Our conclusion remains that this is the most compelling opportunity we have seen for asset allocation alpha since the 1999-2000 internet bubble,” said Inker.