Stocks have been closing in on record territory, which isn’t supposed to be a key worry of the Federal Reserve.

But after a dizzying three years of pandemic extremes, the stock rally has become a source of market angst, right as the Fed attempts a final chapter in its epic rate hiking saga.

“There is still a lot of money floating around that’s still in the economy,” said Colin Graham, head of multiasset strategies at Robeco. “They are going to have to speed up QT, or push rates higher to see that liquidity drain faster.”

QT is shorthand for quantitative tightening, or shrinking of the Fed’s balance sheet, which swelled to almost $ 9 trillion during the pandemic with monthly bond purchases. It has been shrinking it to about $ 8.3 trillion as bonds mature.

As a counterweight, there’s the “wealth effect,” suggesting that households become richer as higher stock prices climb, boosting spending. Low pandemic rates also encouraged a borrowing blitz by homeowners and corporations. Those long-term, fixed costs provide a huge buffer from the Fed’s rate hikes since 2022.

“The stock market continues to gallop higher,” said Sal Guatieri, senior economist at BMO Financial Group in Toronto. If surprising gains in home prices and stocks continue, “We could end up with much looser financial conditions and might make the Fed’s job more difficult overall,” he said.

That could mean further rate increases may be needed, Guatieri said, which might increase the risk of a hard economic landing.

One more hike?

The Fed has made promising headway in bringing inflation down, with U.S. consumer prices rising 3% in June on a yearly basis, down from a 9.1% peak last year. It wants the rate at a 2% annual target.

“The Fed had a much tougher job than it usually does,” said Don Townswick, director of equity strategies at Conning, in a phone interview. “Because it finally appears to be working, that’s why the market is doing well.”

It also helps that second-quarter earnings have largely held up, albeit based on lowered expectations and profits that are expected to fall for a third straight quarter. “Last, but not least, we haven’t seen the economy being knocked down to negative,” Townswick said. “We might even narrowly avoid a recession.”

Both the S&P 500 index SPX, +0.03% and Dow Jones Industrial Average DJIA, +0.01% ended Friday less than 5.5% from the highs put in months before the Fed began in March 2022 its most aggressive rate-hiking campaigns in decades.

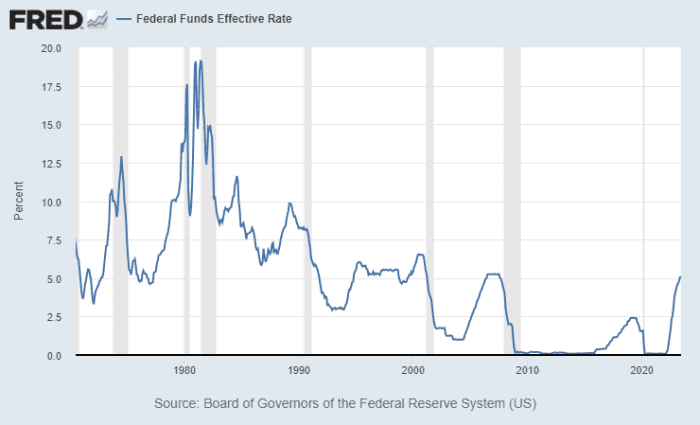

Still, rising rates (blue line) and tighter financial conditions typically don’t bode well for stock portfolios, with most tightening cycles resulting in recessions (gray lines) since 1970.

Fed rate-hiking cycles (in blue) are often followed by a recession (in gray).

Federal Reserve data

The Fed already raised its policy rate to a 5%-5.25% range, the highest since 2007, in a quick 16 months. The central bank is expected to fire off another rate increase of 25 basis points on Wednesday, but then perhaps be done.

Read: Everyone thinks the Fed’s rate hike next week will be the final one — except the Fed

Yet, with many investors still bracing for the worst, here we are. Gains this year have blunted the blow of the brutal 2022 selloff, bonds have been kicking off attractive yields and optimism around the ability of the U.S. economy to bypass a recession has grown.

“In a rate-hiking cycle, it’s always dangerous to say this time is different,” said Townswick. “But the most recent inflation numbers have made it easier to worry less.”

The Dow on Friday eked out its 10th day in a row of gains, ending the week up 2.1%, according to Dow Jones Market Data. The S&P 500 gained 0.7% for the week, while the Nasdaq Composite Index COMP, -0.22% shed 0.6% in the past five session.

“From the Fed’s perspective, they just need to balance out if they want to push the economy into a recession or not, or give more time for rate hikes to play out,” said Charlie Ripley, senior investment strategist at Allianz Investment Management.

But he also expects headwinds to consumer spending in the coming quarters, including as the pause in student loan payments ends this fall, and potentially for some areas of the broader indexes to underperform.

“There are some pockets that look a little frothy,” Ripley said of equities, especially with seven or eight companies driving major indexes higher. Shares of high-growth Tesla Inc. TSLA, -1.10% fell 7.6% for the week, after it reported earnings, but were still 111.1% higher on the year, according to FactSet.

Graham at Robeco, which has been slightly underweight equities in the past six months, had a gloomier outlook. “This is what happens coming into a recession. Everything looks fine, and suddenly it’s not.”

The big event ahead for markets will be the conclusion of the Fed’s two-day meeting on Wednesday. Manufacturing data is the highlight on Monday and a U.S. home price update for May is set for Tuesday. Friday brings another inflation update with the June Personal Consumption-Expenditure Index.

—Greg Robb contributed.