We’ve all read headlines claiming Indian equity markets are at all-time high and have given outstanding returns in the last 1 year. But when you compare it to the returns given by other geographies in the world, only then you realise what part of growth have you missed.

For Indians, it is a new concept to diversify their investments across geographies, but internationally, it is a very common sight to see asset managers allocate a large chunk of their portfolio to emerging and other developed market equities, to make sure if their native country doesn’t perform well in a particular circumstance, remaining part of their portfolio fares well and hence, balances the overall portfolio returns.

Diversification helps

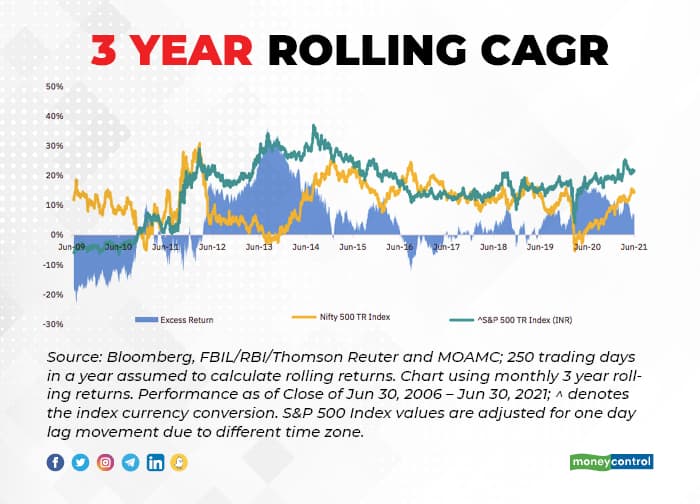

Below graph shows if an investor would have invested on any date in the last 13 years and stayed invested for 3 years, what kind of returns would have been made in the Indian & US Markets.

There were multiple instances when Indian markets performed poorly, but international markets fared well and vice versa. And hence, investing across geographies helps balance your portfolio returns efficiently.

Depreciation of Indian Rupee adds to the Return

Back in 2008, USD to INR was 50. In 2021, USD has appreciated to Rs 74. Rupee depreciation adds to the returns to international investments.

Investing in Global Equities – Directly via NYSE vs. Indian Mutual Fund Route

Indian MFs have recently lined up with a bunch of NFOs offering exposure to global equities but they are able to offer only a selective exposure to global markets like S&P 500, FAANG, etc. If an investor wants to take selective exposure to themes like electric vehicles, artificial intelligence, clean-tech, DNA technologies, etc. investing in stocks directly via NYSE is the only option.

Many financial advisors and Fintech platforms are available today enabling direct US Stock Investment and hence, take concentrated bets in these emerging sectors.

Exciting Themes and ETFs to invest in US

1. Electric Vehicles

Catalyst: Biden Administration to chase the dream of making 50% of new US auto fleet electric by 2030 (Announced on 5th Aug 2021)

ETFs in the EV space like Global X Autonomous & Electric Vehicles (DRIV) have delivered 74% return in the last 1 year, compared to S&P 500 which just gave a 32% return.

2. Crypto currency & Blockchain technology

With bitcoin capturing the headlines for quite some time now, we are all eager to have some exposure into this new asset class. Some of the stocks listed on NYSE offer an interesting approach to gaining exposure in Crypto currency & Block chain technology and have performed exceedingly well in the last 1 year.

3. US’s iconic USD 1 Trillion Infrastructure bill

Sectors such as Steel, Materials, Technology Infrastructure, Financials are going to be major beneficiaries of the US’s biggest in decades Infra Bill and can be played very efficiently through ETFs like iShares US Infrastructure ETF.

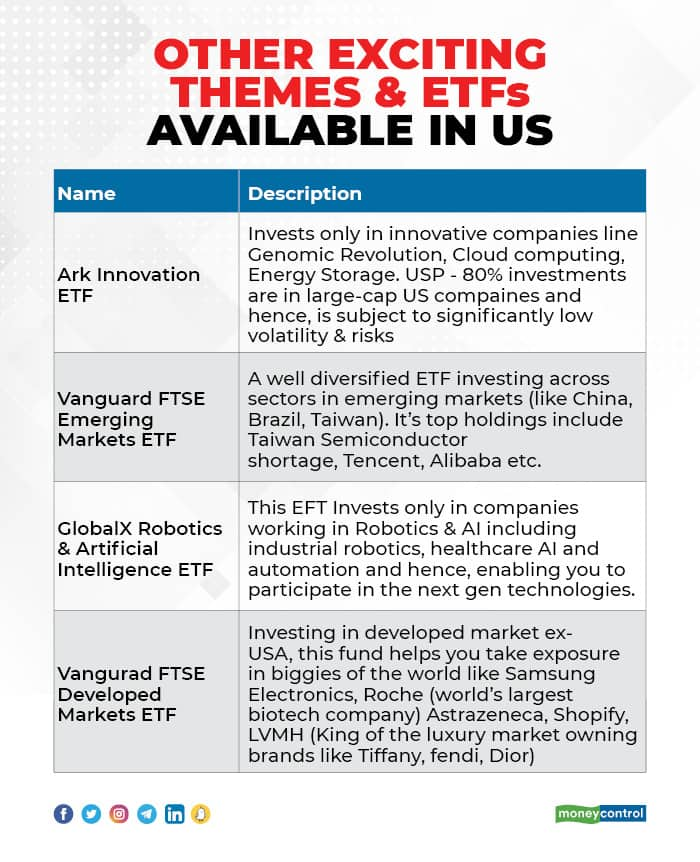

4. Other exciting themes & ETFs available in US

ETFs are a very good way to take exposure in international markets as they offer you a diversified basket of companies and operate on very low costs. Some of the popular ETFs listed on NYSE are –

Key to Investing in US Equities

However, the key to investing in US, like any other equity markets is to create a diversified portfolio across sectors and companies and in a staggered way to make sure you win through averaging.

In the current markets, due to high valuations, uncertainty around delta variant and inflation concerns; we recommend following the barbell investment strategy, that is, have exposure to both – growth stocks (like technology) and cyclical (like financials, consumer discretionary).

Legal Aspect

Under the Reserve Bank of India’s liberalized remittance scheme (LRS), Indians can invest up to $ 250,000 (Rs. 1.85 Crore per annum in today’s terms) in global stocks and bonds in a year.