FOMC meeting next week will be highly watched by global market. In-line with ECB, FOMC is expected to maintain the accommodative policy.

Vinod Nair

July 25, 2021 / 03:41 PM IST

Indian market started weak shadowing the global sell-off. World market was varied by high inflation and rising Covid-19 cases. Slackening economic growth in the US, led to reports of likely downgrade in GDP growth supporting dump trades. Sharp fall in crude & US bond yields reflected the rising concerns over fall in future growth. Central Banks meetings, ECB this week & FOMC next week also added vulnerability, assuming uncertainties over a possible change in easy money policy due to all-time high inflations.

Domestically, banks & auto sectors led the downtrend as initial quarterly results suggested weakness in asset quality & volume growth due to second wave impact. Western markets’ attempted to recover from the sell-off on Tuesday, which provided some comfort to domestic market but selling continued due to trading holiday on Wednesday. FIIs continued as key sellers while MFs & retail inflows investors supported the market.

Post the initial sell-off, global markets continued to hold on its gains owing to solid earnings reports and turned its focus on the European Central Bank’s policy announcement, stated on Thursday, which was steady as expected and tweaked its inflation guidance in-line with the rising prices. It provided a hope that Fed will continue its supportive policy in the upcoming meet despite rising inflationary pressure. It helped the market to not wary about policy change.

After the Indian market correction on Monday & Tuesday, it opened with a strong foothold on Thursday as global market sell-off completely reverted. High F&O activities did help the market to improve its momentum.

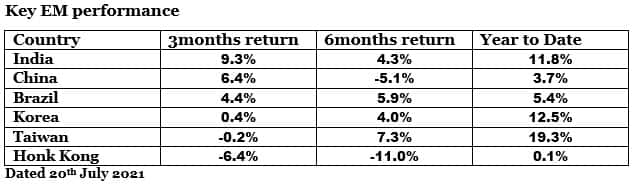

Today, global market is concerned about delta variant consequence on economic recovery. But based on the success of vaccination in developed countries, the risk of third wave is reducing. As a result, delta to trigger a big risk-off is low. But it is already impacting the performance of other Asian peers due to slowdown in economic growth & FII selling.

In India, FIIs are in selling mode since April 2021. They have net sold about around Rs 30,000 crore of equity during the last 4 months. This is because of the overall policy of FIIs to cut exposure in emerging markets, in that India seems the least impacted due to low degree of selling & high domestic inflows. Please note that the best Asian performers like Taiwan & Korea have started consolidating.

This weakness can spread to Indian market too in the short-term, which is today protected by high domestic inflows, good Q1 results, and attractive IPO offers. Rather than the impact of delta variant, a fall in liquidity due to a change in easy money policy by central banks will be the biggest risk. FOMC meeting next week will be highly watched by global market. In-line with ECB, FOMC is expected to maintain the accommodative policy. The dots in the meeting can provide an idea about the time and amount of reducing in bond purchasing program.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.