File image of an Air India aircraft

Full-service airlines Air India and Vistara have increased their share of domestic passenger traffic in May and June and reduced the dominance of low-cost carriers such as IndiGo.

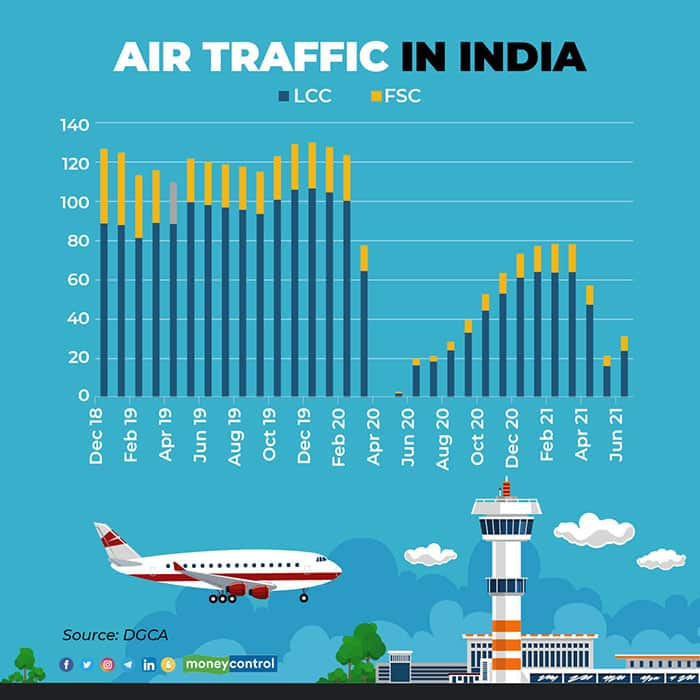

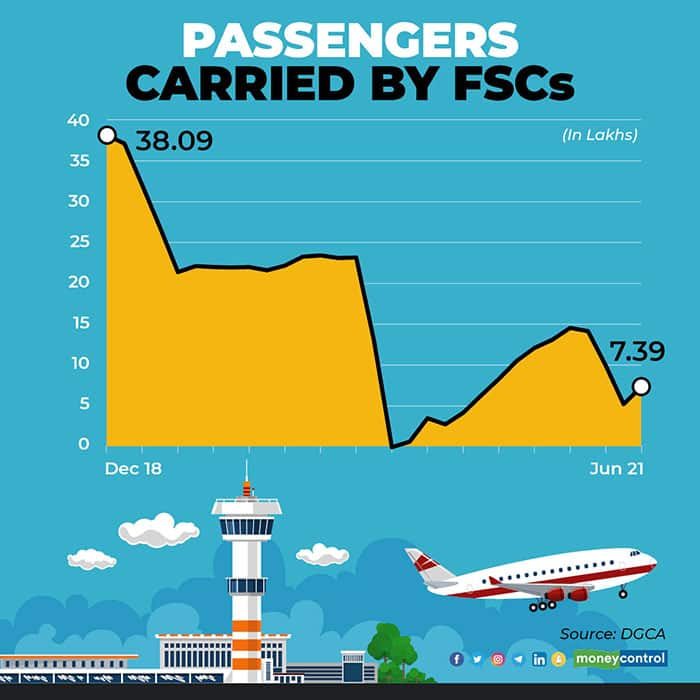

Data from the Directorate General of Civil Aviation (DGCA) shows that full-service carriers carried 23.74 percent of domestic passengers in June and 24.87 percent in May, which is the highest share of these airlines since the exit of Jet Airways. Low-cost carriers had a market share of more than 80 percent for 24 consecutive months.

Low-cost carriers (LCCs) have expanded significantly in the past decade, led by IndiGo, which grabbed the space vacated by Kingfisher that collapsed in 2012 and lured young people for leisure travel and visits from large cities to hometowns.

Kingfisher and Jet Airways also tried to board the LCC bandwagon but their low fares were not matched with commensurate cost cuts. This increased their losses, which forced them to wind up their LCC offerings and eventually, the airlines also.

The demise of Kingfisher coincided with Jet Airways losing the top position in the market and LCCs grabbing more than half the market. Now, nearly a decade later, IndiGo alone controls half the market.

In December 2018 full-service carriers Jet Airways, its subsidiary Jetlite, Air India and Vistara, had a market share of 30.01 percent. Jet Airways started cutting back capacity in January 2019 and suspended operations in April 2019. The government decided to distribute the slots to other airlines based on capacity addition. While Vistara went out of its way to induct the B737s and add capacity, IndiGo and SpiceJet added far more capacity and the market share started tilting even further towards LCCs.

As pandemic struck, both Air India and Vistara adopted caution, which helped LCCs raise their market share to a record 86.8 percent in July 2020. With market stabilising and Air India’s focus shifting back to a mix of domestic and international, not just repatriation flights, the two FSCs started clawing back some market share.

What suddenly changed?

How have Air India and Vistara increased market share in the last two months? Data shows that AirAsia India and SpiceJet shrank disproportionately, probably to conserve cash. While AirAsia India is not a large operation, SpiceJet’s bigger domain gave space to Air India and Vistara.

Another factor was that Air India did not shrink as demand fell. Even with just 39 percent load factor it kept flying to provide connectivity across the country.

Where will things head from here on? With SpiceJet adding flights across the country, it is likely to regain passengers. Same is the case with IndiGo. But can Vistara with its B787s being deployed on domestic routes and A321s in its fleet carry enough passengers to keep attracting more and more passengers? Possibly yes, until the fares are capped when passengers can fly both LCC and FSC at almost the same price.