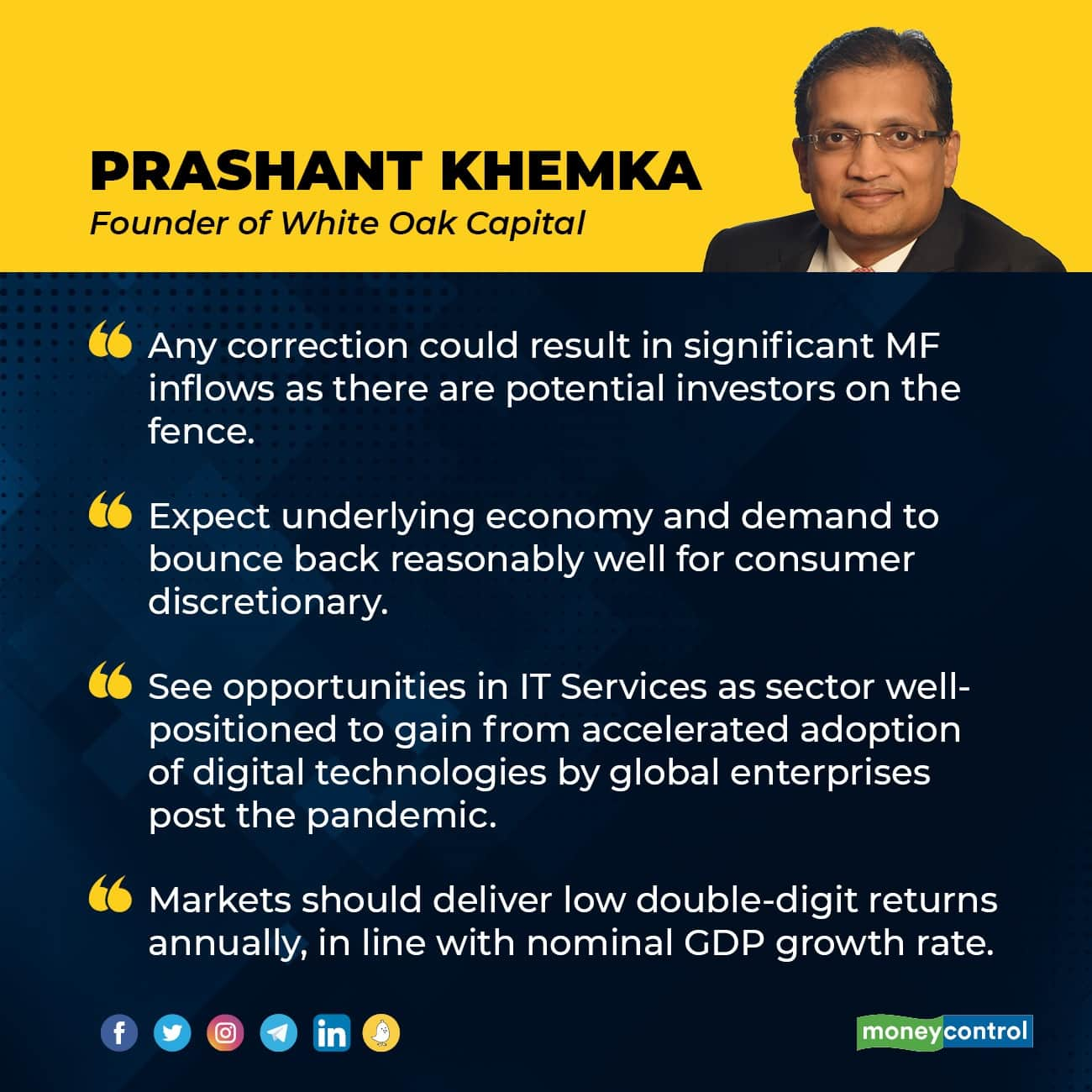

Prashant Khemka, Founder of White Oak Capital, feels the market should deliver low double-digit returns annually.

After Q4 earnings so far, “management commentary from on-going results season suggests that companies are better prepared compared to last year to deal with supply chain disruptions due to the local lockdowns,” he said in an interview to Moneycontrol’s Sunil Shankar Matkar.

He expects the underlying economy and demand to bounce back reasonably well for White Oak’s portfolio companies in the consumer discretionary sector.

Edited excerpts:-

Q: What is your view on the AMFI’s data points on the equity flow and will the trend remain strong in coming months?

There is a significant decline in gross inflows in the month of April while quantum of redemption has remained same as last month, whereby the net flows have declined. This is also palpable from the circumspect market activity one has been witnessing ever since the second wave has emerged. Any correction could result in significant inflows as there are potentially investors on the fence.

The interesting trend of money being allocated to relatively newer categories like international funds and domestic index funds continues to gain traction. As market performance and corporate performance broadens it will be interesting to watch for sustainability of this trend vis-à-vis domestic active equity funds.

Q: Given the second COVID wave hit India drastically, what are the sectors to look at for investment now and why?

We seek to maintain a balanced portfolio of both pro and counter- cyclical stocks and sectoral weights at any point in time are an outcome of our bottom-up stock selection process.

Having said that, last year we had made modest changes to incorporate the possibility of an extended lockdown spanning several months or even longer. But this time around, we effected hardly any changes that could be linked to the second wave, although the team did add to a few of our existing positions in the private sector banks.

We expect the underlying economy and demand to bounce back reasonably well for our portfolio companies in the consumer discretionary sector, a sector where we have always found many great businesses to include in the portfolio. We continue to find opportunities in IT Services as we believe that the sector is well positioned to gain from accelerated adoption of digital technologies by global enterprises post the pandemic. Sectors that benefit from global supply chain diversification also presents opportunities, for e.g. in chemicals and in manufacturing where the Production Linked Incentive (PLI) scheme seems to be working as intended and a lot of global brands are setting up production facilities in India.

Q: Lot of experts and rating agencies lowered their economic forecast for FY22. CRISIL feels India’s growth can fall to 8.2 percent in FY22 if pandemic peaks in June, though it maintained its projection for FY22. Have you also cut down the full year projection?

The COVID situation has created some near-term uncertainties but unlike in June 2020 quarter last year, we do not foresee a severe impact on the economy or on corporate cash flows. Last year, the COVID situation appeared to be a bottomless pit. This time around, it is still a pit, but the bottom is largely identified. There is a huge difference between the two. Last year, the lockdown was much more rigorous. But this year, the states have implemented targeted lockdowns which don’t have as severe an impact on the economy.

Q: After better-than-expected earnings seasons in Q2 and Q3FY21, the Q4 earnings were largely in line with estimates, largely due to low base in the year-ago period, but downgrades were more than upgrades this time. Do you expect Q1FY22 to be wash out quarter for corporates and that will hit full year growth?

The markets have traded in the range of 30-40x current year free cash flow over the last many years, implying that the current year’s cashflow represents approximately 2.5 – 3.0 percent of the aggregate market value. Thus, as long as the pandemic’s hit to cash flows is for a definitive time period of a few months, the resulting impact on the values of the companies shall be minuscule.

Also, management commentary from on-going results season suggests that companies are better prepared to deal with supply chain disruptions due to the local lockdowns. There is likely to be some support from favourable components as well (Nifty earnings were down by 31 percent YoY in Q1FY21).

Q: Apart from COVID-19, what are other major risk factors for Indian equity markets? Do you expect consolidation to continue in the rest of the year and benchmark indices to close with moderate gains in 2021?

Our long-standing belief is that it is not only merely difficult but also impossible to predict the markets in the near term. We have zero confidence in our own ability to predict or time the market and at the same time we also have zero confidence in the ability of any of our peers in doing so.

Having said that the base case assumption for us always is that the market should deliver its time value of money in terms of return over any given period of time. Currently our expectation is that markets should deliver low double digit returns annually, which is in line with nominal GDP growth rate of the country.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.