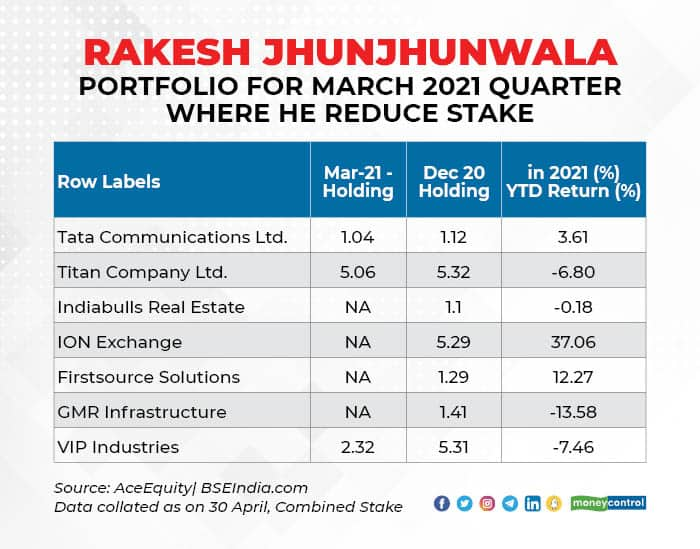

Stocks in which the Big Bull reduced stake include Tata Comm, Titan, and VIP Industries. Stocks in which his stake was cut below 1% include Indiabulls Real Estate, ION Exchange, Firstsource Solutions, and GMR Infra.

Rakesh Jhunjhunwala

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

Rakesh Jhunjhunwala, the Big Bull of D-Street, reduced stake in seven companies in the March quarter compared to the December quarter of FY21, data collated from AceEquity showed. Jhunjhunwala, who is widely followed by retail investors in India and is known for picking multibaggers, sequentially reduced in three companies and cut stake below 1 percent in four companies in Q4 FY21.

Jhunjhunwala makes investments in Indian companies under the following names: Jhunjhunwala Rakesh Radheshyam, Jhunjhunwala Rekha Rakesh, Rakesh Jhunjhunwala (in a personal capacity), Rekha Rakesh Jhunjhunwala, and RAKESH JHUNJHUNWALA (in the capacity as a partner of RARE Enterprises).

After hitting a record high in February, stock markets turned volatile amid a rise in COVID cases that pushed many states to put in place partial lockdown. Companies in which the big bull slashed stake are from sectors like travel, IT, real estate, infra.

Stocks in which the Big Bull reduced stake include Tata Communications, Titan Company, and VIP Industries. Stocks in which his stake went below 1 percent include companies like Indiabulls Real Estate, ION Exchange, Firstsource Solutions, and GMR Infrastructure.

Please note that this is not an exhaustive list of Jhunjhunwala’s portfolio but only a list of companies in which he holds over 1 percent stake. Also, shareholders only have to list to exchanges the holdings where their stake is more than 1 percent, Hence, Jhunjhunwala’s shareholding in Indiabulls Real Estate, ION Exchange, Firstsource Solutions, and GMR Infrastructure is not known.

Click here to view Rakesh Jhunjhunwala portfolio on ‘Big Shark Portfolio’

Some of the companies in which Jhunjhunwala reduced stake in the March quarter could just be routine profit-booking as some of the sectors could see a negative impact due to a rise in COVID infections.

However, the trend could be more short-term in nature and things should improve once the situation stabilises on the virus front.

Jhunjhunwala in a recent interview with CNBC-TV18 in April said that markets are reading the second coronavirus wave as a blip and once vaccination is through, “the worry is going to be very little”.

Tata Communications enables the digital transformation of enterprises globally, including 300 of the Fortune 500. It helps in unlocking opportunities for businesses by enabling growth across boundaries, boosting product innovation and customer experience, improving productivity and efficiency, building agility, and managing risk.

Shareholding data suggests that mutual funds have increased holdings in the company from 0.41 percent to above 4 percent in the March quarter while FIIs increased holding from 17.6 percent to 24.4 percent in the March quarter.

Tata Communication reported a 12.5 percent fall in its Q4 net profit at Rs 270.6 crore from Rs 309.4 crore in the previous quarter. Revenue was down 3.5 percent at Rs 4,073.3 crore in the March quarter versus Rs 4,222.8 crore reported in the year-ago period.

Titan Company which was once a crown jewel in Jhunjhunwala’s portfolio is losing its sheen. Historic data suggests that Jhunjhunwala reduced stake from 7 percent back in March 2019 to a little over 5 percent in March 2021.

Titan Company reported a healthy 48.2 percent year-on-year (YoY) growth in standalone profit for the Q4 FY21, driven by the jewellery business.

Most brokerage firms maintained their buy, equal-weight or hold rating for Titan. UBS has a sell rating as the studded ratio improved sequentially but remained lower YoY, while the contribution of wedding jewellery sales normalised to FY20 levels.

Jhunjhunwala also reduced stake in VIP Industries to about 2.32 percent. Travel & tourism industry could get hit due to the rise in COVID cases across the country and increased restrictions as well as partial lockdown announced by various state governments.

Jhunjhunwala raised stake in Indiabulls Real Estate by over 1 percent in December 2020 quarter and reduced it to go below 1 percent in March even though the company reported stellar numbers in the March quarter.

The realty major posted a consolidated net profit of Rs 94.42 crore in Q4 March 2021 compared to a net loss of Rs 109.79 crore in Q4 March 2020.

ION Exchange, which has been on a stellar run in 2021, surging about 40 percent year-to-date, also saw some profit-booking by the Big Bull. Jhunjhunwala had kept the stake constant at 5.3 percent for the last 6 quarters.

Firstsource Solutions, in which Jhunjhunwala held more than 3 percent stake back in March 2019, also witnessed a reduction in stake below 1 percent in March 2021. The company provides business process management in the banking and financial services, customer services, telecom and media, and healthcare sectors.

GMR Infrastructure has underperformed benchmark indices so far in 2021 amid delays in construction as well as infra projects due to COVID. It is a key player in developing projects in high-growth areas such as airports, energy, transportation, and urban infrastructure.

Jhunjhunwala kept the rate constant at 1.4 percent for the last 4 quarters and brought it down below 1 percent in March 2021.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.