Amid the COVID-19 pandemic, Indian benchmark indices surged about 70 percent in FY21. Over 200 stocks in the S&P BSE 500 index more than doubled in the timeframe which may keep investors waiting on the sidelines weary due to relatively higher valuations. However, given the recent halt in the rally and RBI’s continued accommodative stance, time may be ripe for such investors to jump in.

With that said, experts advised investors to stick to their asset allocation strategy and not get swayed by the hefty returns of riskier asset classes such as equities or even cryptocurrency.

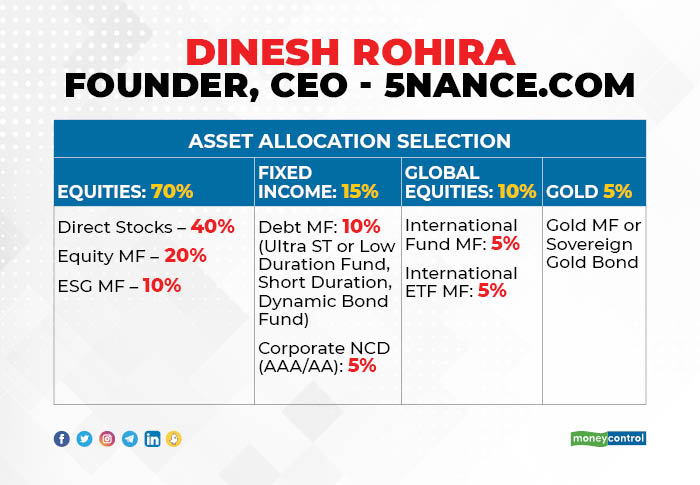

“The India equity market delivered about 78% on a one-year timeframe after passing through a rough ride since the start of March 2020 amidst the pandemic. This rally might have increased the equity weightage in portfolios that follow asset allocation strategy,” Dinesh Rohira – Founder, CEO – 5nance.com told Moneycontrol.

“As an investor, it is imperative to build the portfolio with proper asset distribution to create long-term wealth. It also keeps you psychology strong which prevents you from making irrational decisions in times of wilder market swings,” he said.

The weightage of assets in the portfolio will vary among investors depending on the current phase of their life cycle. Experts also suggest that investors should make their portfolio considering the duration of goals/objectives of investment which will also provide comprehensive suitability of the assets in the portfolio.

After a stellar rally in FY21 experts advise investors to pare down their expectations for FY22 as returns will be more normalised. Earnings recovery will be watched closely, they said.

“FY22 is going to be a year of a strong economic rebound in India, despite the short-term risks looming from the second wave. India is on the cusp of a virtuous economic growth cycle, which will culminate into stronger momentum of earnings recovery and aid the markets to perform reasonably well,” Niraj Kumar, Chief Investment Officer, Future Generali India Life Insurance Co. Ltd told Moneycontrol.

“However, at incumbent levels, markets are indeed pricing in quite an amount of earnings expansions expected in FY22. Thus, post the stupendous rebound, we believe investors should expect more normalised returns over medium to long run, which would be in line with the normalised earnings growth,” he said.

The idea before constructing a portfolio or adjusting the current one is that it should be able to serve the long-term needs of the investor. Equity has proved time and again a major asset to create long-term wealth.

We spoke to various experts and they have given us 3 portfolio options to consider for FY22:

Expert: Dinesh Rohira – Founder, CEO – 5nance.comInvesting through Equity MF especially in Index Fund or ETF will benefit investors from low cost and market-driven returns.

Fixed Income: Despite being in the limelight in the recent past for all the wrong reasons, there are still lucrative schemes/NCDs which offer stability and growth prospects in portfolios. This asset will enable investors to sail through market volatility and hedging against equity assets in a portfolio.

Global Equities: It will act as a hedge against the domestic market, and also provide opportunities for investors to participate in global companies which have stronger growth potentials.

Gold: The investment in gold-driven schemes will enhance stability in a portfolio when market trends are negative.

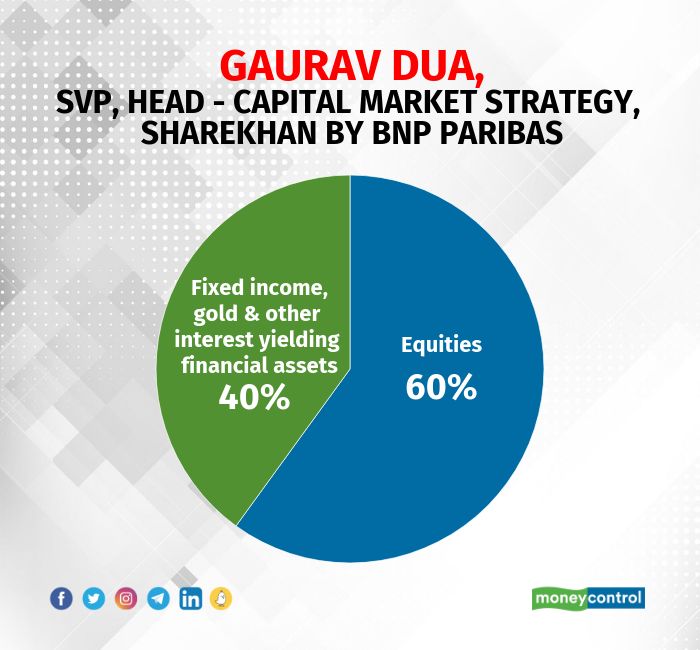

Gaurav Dua, SVP, Head – Capital Market Strategy, Sharekhan by BNP Paribas

The asset allocation depends upon individual risk profiles and investment goals. But as a thumb rule, we suggest the 60/40 rule where the 60% allocation goes to equities and the rest of 40% be divided between fixed income, gold & other interest yielding financial assets.

Despite the sharp rally in FY2021, we believe that equities would outperform all other asset classes in FY2022 as well because we are at the cusp of a cyclical uptrend in the economy with low interest rates, comfortable liquidity, and continued revival in the economy along with a surge in the corporate profits over the next two years.

We expect healthy double-digit returns in equities over the next two years.

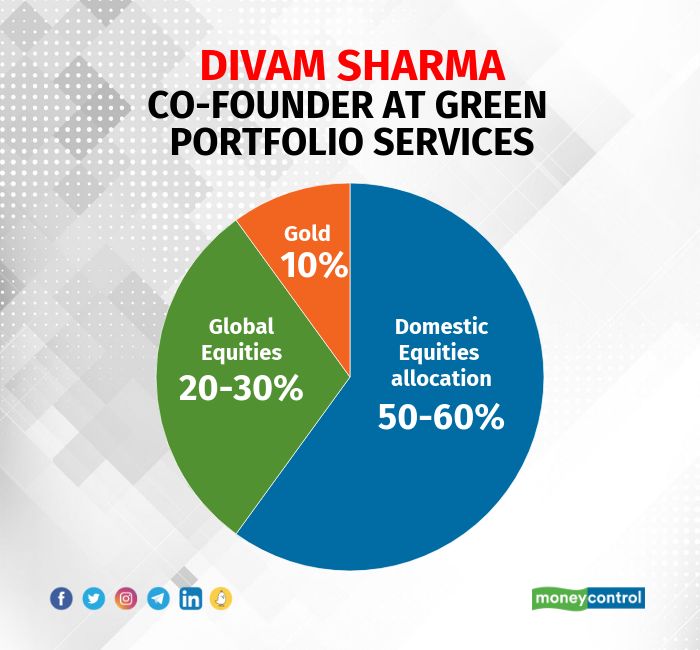

Expert: Divam Sharma, Co-founder at Green Portfolio Services

In FY22, the global liquidity will continue to drive equities particularly emerging market equities like India.

We suggest a 50-60% allocation towards domestic equities while a 20-30% allocation towards global equities. Investors should look at value stocks as they will outperform in the coming year. Allocation to Gold and Fixed Income shall be 10% each.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.