Mark Matthews, Head of Research Asia Pacific, Bank Julius Baer, feels that Indian market kept rising despite the 10-year US bond yield jumping from 0.5 percent in August to 1.7 percent now. Going ahead, we expect the yield to hit 2 percent by year-end, and that should be something the Indian stock market can take in stride.

As a member of the bank’s investment committee, he gives asset allocation recommendations to clients.

Matthews has been at Julius Baer since 2011. Through his 27-year banking and finance career, he has held senior positions managing the research and equity sales functions at financial institutions, including ING Barings Securities, Standard & Poor’s and Merrill Lynch in Asia.

Currently he is based in Singapore. Prior to this, he has worked in Hong Kong, Thailand and Taiwan.

In an interview to Moneycontrol’s Sunil Shankar Matkar, some pull-back is always possible, but we do not expect a 10-15 percent sell-off, barring a big global sell-off, and we don’t expect one of those.

Edited Excerpts:-

Q: Is there a possibility wherein the RBI can hike rate in FY22 though it has promised to keep rates low for some time?

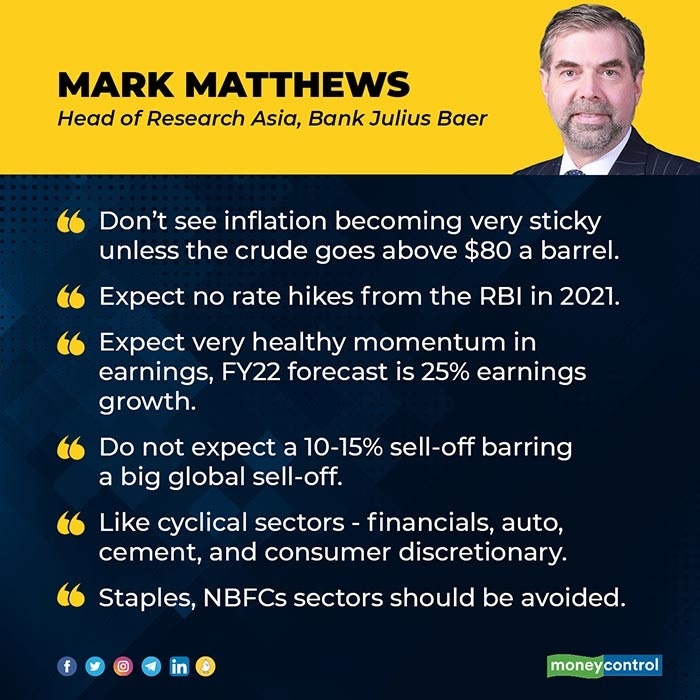

The RBI has indicated a timely unwinding of the excess liquidity it’s been providing since the epidemic began, but it also said it won’t disrupt the market. Of course, inflation is an issue here, we think there can be bouts of it (higher inflation) here and there but don’t see it becoming very sticky unless the crude oil price goes above $ 80 a barrel, which is not our expectation (we see $ 55 in 12 months’ time). We expect no rate hikes from the RBI this year.

Q: What are your broad expectations from the March quarter earnings? Do you see any more upgrades?

In the quarter that just ended, there were 2.5 upgrades for every downgrade. That kind of ratio will continue, with the advantage to the domestic cyclical companies, especially financials. We expect a very healthy momentum in earnings, and our full-year FY22 forecast is 25 percent earnings growth.

Q: The market has traded in a range for the last one month, especially after hitting a record high. Do you think this steep correction of 10-15 percent is warranted at this point of time?

Year-to-date, the Nifty is up around 6 percent, mid-caps are up around 12 percent, and small-caps are up around 15 percent. Those are good returns for less than one quarter’s investment, and so some pull-back is always possible. But we do not expect a 10-15 percent sell-off barring a big global sell-off, and we don’t expect one of those.

Q: Do you think the US bond yields will dent the sentiment in the coming months? What could be the impact on India?

We look for the 10-year treasury yield for it to get to 2 percent by year-end, and the difference between the 1.7 percent where it is now and that should be something the Indian stock market can take in stride. To recall, the 10-year yield went from 0.5 percent in August to 1.7 percent, and the Indian stock market went up, too.

Q: Which sectors are likely to stay in limelight in FY22, especially after seeing at least 60 percent rally in every sector (barring FMCG)?

We like cyclical sectors like financials, auto, cement, and consumer discretionary. IT is something we see as a multi-year positive theme, because COVID has moved those companies’ clients to an even more digital environment.

Q: FMCG was the clear underperformer in FY21 with just 20 percent gains while every other sector gained at least 60 percent. Do you think it is time to pick FMCG stocks?

We expect FMCG to continue to underperform. It is true the earnings growth is steady for them, because they sell staples that people need no matter what. But the growth is only around 10 percent per year and not enough to justify the very expensive valuations (50-70x price/earnings).

Q: Any sectors that should be avoided in the coming financial year?

Staples as per the above. NBFCs should also be avoided because the financial health of public sector banks should continue to improve and private sector banks are more competitive.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.