The most spoken underlying during the last fortnight has been US bond yield. Opinions such as how rising bond yield is equity negative, calling for a correction, were very loud.

Despite all these opinions, the market has its own mind and it’s less than 3% away from its all-time high. If one has to see the correlation between bond yields and equity then it’s positive.

So from a statistical point of view, markets not correcting despite rising bond yields is not surprising. However, the other important part of this leg is the dollar.

Since the last three quarters, we have been witnessing US bond yield rising and it has moved from 0.5% to 1.5%, a good 100 bps jump! In the same period, the dollar index was depreciating, until the last two weeks. This is a clear case of divergence in the correlation of these underlying.

In the above charts, it’s visible how the dollar index has breached inverse correlation with bond yields. It’s known that the dollar index has an inverse correlation with equity. Hence, this divergence should not be ignored. If the dollar index continues to show strength, equities may see correction as the money starts moving into dollar-denominated assets.

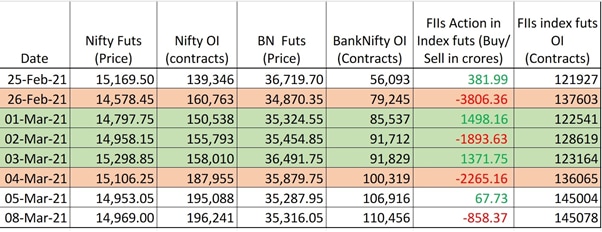

Statistics of our derivatives markets are also not very encouraging. FIIs have the capabilities to drive our markets through their liquidity. They have been positioning themselves on the short side in index futures and have been selling in cash markets.

In the above tabular data, it quite evident that fall in the market is witnessing the formation of short positions and FIIs too are shorting, whereas, when markets are bouncing it’s merely due to short covering. This again doesn’t instil any confidence to form fresh longs in the market.

But does that mean one should move out of equity? The answer is hedging. Generally, we hear the word hedging when markets are already down by double-digit and the cost of hedging has gone off the roof.

Ideally, hedging of a portfolio should be done when markets are at higher levels when there is some degree of uncertainty, and the cost of hedging is not very high. All these ingredients are present at this point in time.

It’s difficult to make accurate entry and exit in the market but hedging your portfolio at an appropriate time is quite manageable. Now is the time.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.