Promoters of some companies used last year’s market volatility to tweak their shareholdings. Promoters increased their stakes in 20 companies and reduced their holdings in another 38 firms last year, data from AceEquity showed.

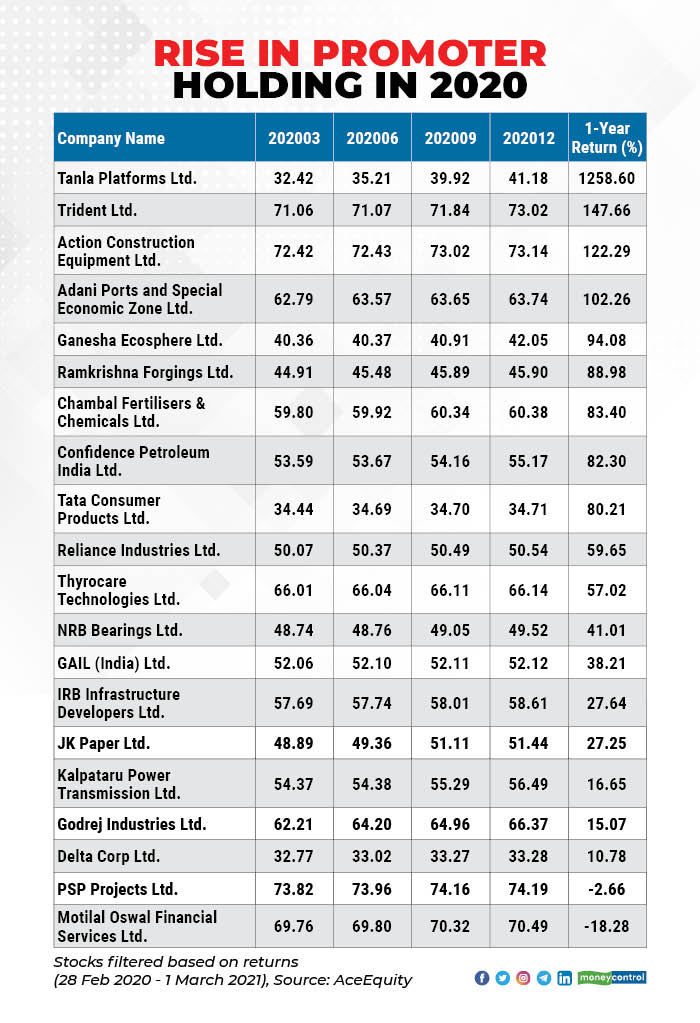

Companies in which promoters raised their stake include Delta Corp, Godrej Industries, Tata Consumer Products, Chambal Fertilisers, Action Construction Company, and Tanla Platforms.

They increased their holding in each quarter of calendar 2020, the data showed. Companies with market-cap of over Rs 1,000 crore were evaluated for data search.

Analysts said an increase in promoters’ stake is usually considered as a positive signal for the company and shareholders as it indicates their confidence about the outlook.

“Rise in promoter holding does signify brighter prospects for the company. Generally, when the promoters feel that the company is undervalued they increase their stake in the company,” Jay Thakkar- VP & Head of Equity Research at Marwadi Shares and Finance Ltd. told Moneycontrol.

“The second reason is that they are confident about the future prospects of the company. Thirdly, when the company doesn’t find any better prospects to grow inorganically then they increase the stake by the way of buyback of shares,” he said.

However, too much of an increase in the holding of promoters may not be favourable for investors, as this may lead to lesser capex planning which impacts growth prospects, he said.

Promoters decreased their stake in 38 companies with a market-capitalisation of more than Rs 1000 crore, data from AceEquity showed. But, this should not be considered as a negative sign.

“Of the 38 companies which witnessed a decrease in promoter holding, the largest decline was seen in Dish TV India, Eveready Industries, Mindtree and Future Consumer,” Gopal Kavalireddi, Head of Research at FYERS told Moneycontrol.

“Many insurance companies, banks, and other financial institutions stake sale was to meet the regulatory requirements, imposed by RBI and IRDAI. Eg: Kotak Mahindra Bank, HDFC Life Insurance, AU Small Finance Bank, etc.,” he said.

What should investors do?

The rise and fall of promoter holding should be a factor, but not the only criterion, in an investor’s decision to buy or sell equity, analysts said.

The promoter is the first and the best insider as well as an analyst of any company. A promoter incorporates the mission and vision for the company, and has a clear understanding of the business plan, growth prospects, conduciveness of the operating environment, regulatory and market support, suggest experts.

Investments are a matter of each investor’s perspective, from the point of strategy, risk propensity, investment horizon, financial capabilities, and other factors.

Following a reputed investor or a well-known entity for taking a decision on buying or selling is not a credible investment method.

Kavalireddi of FYERS suggest four factors investors’ should analyse before making a buy or a sell decision:

Qualitative & Quantitative aspects:

Cycles of growth come at regular intervals, as seen in metals, automotive, pharma, realty, infrastructure etc. Fundamental analysis involves in-depth research into the quantitative and qualitative aspects of a company.

Pedigree of management:

Promoter quality, ethics, vision, corporate governance, and shareholding changes address the softer side of an analysis.

Business Structure:

Business model, financial standing, healthy balance sheet, growth prospects, and earnings potential encompass the objective analysis.

Analysis:

It’s important to understand all of these aspects before, during, and after investing. As an investor enforces this process with various stocks and sectors, it builds a holistic experience.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.