Indian markets remained volatile in the first week of March but bulls managed to remain in control and helped benchmark indices close with gains of over 2.5 percent each for the week ended March 5, but the big action was seen in the small & midcaps.

The S&P BSE Sensex rose 2.6 percent while the Nifty50 rallied 2.8 percent for the week ended March 5, compared to 3.05 percent gains seen in the S&P BSE Midcap index, and 3.8 percent surge seen in the S&P BSE Smallcap index.

Broader markets remained largely resilient despite the volatility seen in the benchmark indices. The Nifty50 failed to hold on to the crucial support of 15000 on weekly basis towards the close of the trade of Friday.

Experts are of the view that smart money is moving from largecap to small & midcaps which are better placed to leverage on India’s growth story. And, the momentum is likely to continue in the near future.

“Broader markets performed well as compared to large caps as they have not participated in recent volatility. In my opinion, Smart money is shifting in selective mid and small-cap stocks where investors are looking for lucrative valuations and future growth,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited told Moneycontrol.

“Midcap cement stocks, specialty chemical stocks along with PSEs helped broader markets to do well. I believe momentum might continue in this space for next week too,” he said.

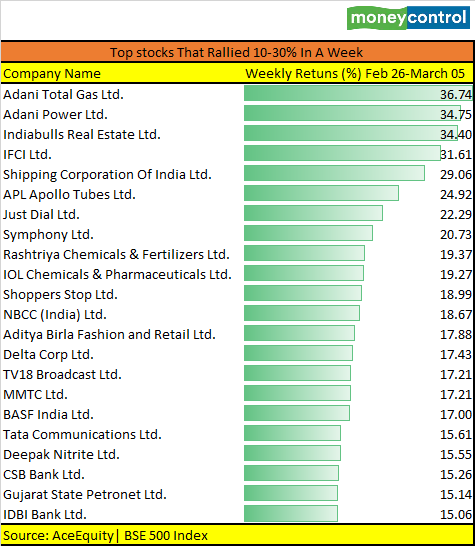

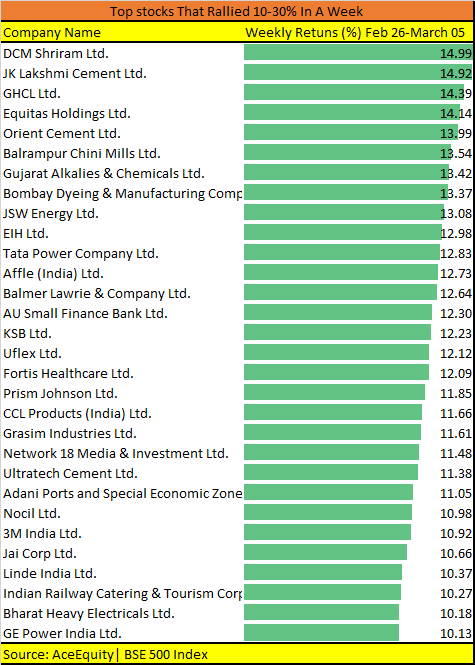

There are over 50 stocks in the S&P BSE 500 index that rose 10-30% in the week gone by. These include BHEL, Adani Ports, UltraTech Cements, JSW Energy, Delta Corp, Symphony, JustDial, Adani Power, and Adani Total Gas among others.

The coming week will be a truncated one as the Indian market will remain shut on Thursday, 11 March on account of Mahashivratri.

On the macro front, investors will watch out for the Industrial Production Data for the month of January, and Inflation data for the month of February which will be out on Friday, 12 March.

On the global front, movement in bond yields, Dollar Index, as well as the upcoming US Fed meeting in Mid-March will be key triggers for equity markets.

“In the coming week, the market will be mainly focusing on the expectations on whether the Fed, in its upcoming meeting, will maintain its accommodative stance in a rising bond yield market,” Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

“Additionally, Fed’s measures to maintain low-interest rate and high liquidity will also provide relief to the market sentiments,” he said.

Sectorally, the action was seen in Infra, energy, banks, metal, IT, healthcare stocks while marginal profit taking was visible in the telecom space.

“Base metals especially copper prices hitting multi-year highs built the momentum in metal stocks, as the street is hoping for profit margins to improve significantly in coming quarters,” says Garg of CapitalVia Global Research Limited.

“Public Sector Enterprises (PSE) stocks witnessed traction in this week especially power and energy stocks where significant buying is seen. Banking stocks traded with positive momentum in the week but profit booking in the latter half of the week paused rally,” he said.

Technical View:

The Nifty50 failed to hold on to the crucial support of 15000 towards the close of the week. Despite the market closing in the positive territory, the mood was sluggish.

A substantial jump in the long-term treasury yields and upward activity in the dollar index towards 92, resulted in weakness across the globe, suggest experts.

The Nifty/Sensex closed below the crucial supports of 14950 and 50500 respectively. The Bank Nifty has narrowed down the trading range and closed at an unchanged level on a weekly basis.

Technical experts are of the view that the Index has strong support near 14700, and 50,000 on the S&P BSE Sensex. Hence, a bounce-back could be expected from these levels.

“The dollar index has formed a series of higher high and higher low that could be the cause of concern as it controls or curtail inflows for emerging markets. On a daily basis, the market has formed the long-legged Doji formation, which is an indication of indecisiveness,” Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities told Moneycontrol.

“However, in the short term until the market is not breaking 15280 levels our bias should be on the downside. In the coming week, we could see, Nifty/Sensex touching minimum 14750/50000 or 14550/49300 levels,” he said.

Chouhan further added that on the higher side, 15150/51200 and 15280/51600 would be major hurdles. The focus should be on FMCG and Auto companies.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.