fando

Shubham Agarwal

The Nifty has moved 1,300 points in just five trading sessions. SBI moved 45 percent in the last five trading days. This doesn’t end here, about 60 of the 141 stocks in F&O moved more than the Nifty in the five sessions. This invites a practical trading hurdle—gap openings leave you with the only choice to buy higher, which means high risk.

Do you hesitate to buy a stock when it is up 3%+ for the day?

The hesitation is obvious as the risk is high and the fact is these stocks continue to trend to gain the highest. A call ratio backspread can fix the hesitation.

Reasons to use call ratio backspread over long call:

Higher ROI (return on investment)

Low capital requirement

Lower risk

What is call ratio backspread?

To initiate a call ratio backspread, you Sell 1 Call Option (preferably 40 delta) and Buy 2 OTM strike call options, with no compulsion but my choice being 30 delta. Note, since we are buying 2 call options while selling only 1, the net risk is limited.

When to initiate the strategy?

An option trader can add significant value to their portfolio by choosing the right strategy in the right market scenario. I term this the yield of mathematics. This strategy is best suited when the underlying move is expected to be very fast. The idle scenario to initiate the strategy will be when:

a. An instrument opens with a gap, yet you want to participate in anticipation of further directional move

b. A fast move or breakout is expected in a stock based on patterns or other developments

c. A stock has correctly very deep and is expected to pullback sharp

d. First half of the expiry. Buying option will mean more theta outflow and since the first half of the expiry will have low theta decay, this zone will be safest to participate.

Let’s understand this with an example

For example, a stock is moving and we want to participate in the fast up-move. Traditionally, we know buying a long call will make money, now let’s compare that to a call ratio backspread. Since this is a trading bet, for this example we consider holding the option for intraday.

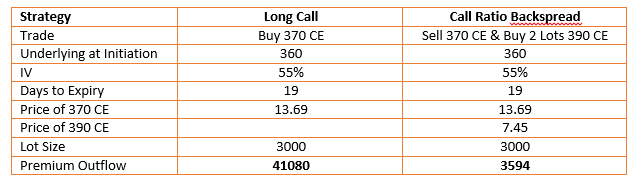

Assume the stock is SBI trading at 360 with an implied volatility of 55 percent

Strategy comparison at initiation

Consider the above table, compared to a long call, a call ratio backspread will cost only 9 percent in premium outflow. Note, there can be some exposure margin charged by brokers on the spread but still will have a significant benefit of low margin requirement.

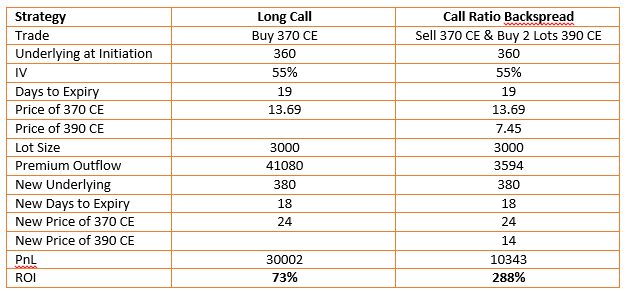

Strategy Payoff with Rs 20 move in underlying and 1-day Theta decay

The above example shows that the spread will have a higher ROI. Note, in the case of adverse movement, the spread will correct more but yet the reward to risk will still be higher than a long call, making it a better choice in the short term.

Summary

The call ratio backspread can add to higher ROI for extremely short-term trades and when moves are wild. Practicing the strategy can add a significant tool in an option trader’s arsenal.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.