The paper stocks were buzzing last week as we witnessed buying interest in some of the counters with good volumes. Satia Industries has seen a breakout from a long consolidation phase and has resumed its uptrend with a ‘Higher Top Higher Bottom’ structure

Sunil Shankar Matkar

October 31, 2022 / 08:10 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] < 0){ // $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); // $ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); //} if(resData[stkKey][‘percentchange’] >= 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] < 0){ $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); //$ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); $ (‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); } $ (‘#volumetxt_’+articleId).show(); $ (‘#vlmtxt_’+articleId).show(); $ (‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]); $ (‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]); $ (‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]); $ (‘#rightcol_’+articleId).show(); }else{ $ (‘#volumetxt_’+articleId).hide(); $ (‘#vlmtxt_’+articleId).hide(); $ (‘#stkvol_’+articleId).text(”); $ (‘#td-low_’+articleId).text(”); $ (‘#td-high_’+articleId).text(”); $ (‘#rightcol_’+articleId).hide(); } $ (‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’); } } } }); } $ (‘.bseliveselectbox’).click(function(){ $ (‘.bselivelist’).show(); }); function bindClicksForDropdown(articleId){ $ (‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){ stkId = jQuery.trim($ (this).find(‘a’).attr(‘stkid’)); $ (‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’); $ (this).find(‘a’).addClass(‘active’); stockWidget(‘N’,stkId,articleId); }); $ (‘#stk-b-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘B’,stkId,articleId); $ (‘.bselivelist’).hide(); }); $ (‘#stk-n-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘N’,stkId,articleId); $ (‘.bselivelist’).hide(); }); } $ (“.bselivelist”).focusout(function(){ $ (“.bselivelist”).hide(); //hide the results }); function bindMenuClicks(articleId){ $ (‘#watchlist-‘+articleId).click(function(){ var stkId = $ (this).attr(‘stkId’); overlayPopupWatchlist(0,2,1,stkId); }); $ (‘#portfolio-‘+articleId).click(function(){ var dispId = $ (this).attr(‘dispId’); pcSavePort(0,1,dispId); }); } $ (‘.mc-modal-close’).on(‘click’,function(){ $ (‘.mc-modal-wrap’).css(‘display’,’none’); $ (‘.mc-modal’).removeClass(‘success’); $ (‘.mc-modal’).removeClass(‘error’); }); function overlayPopupWatchlist(e, t, n,stkId) { $ (‘.srch_bx’).css(‘z-index’,’999′); typparam1 = n; if(readCookie(‘nnmc’)) { var lastRsrs =new Array(); lastRsrs[e]= stkId; if(lastRsrs.length > 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); }); function redirectToTradeOpenDematAccountOnline(){ if (stock_isinid && stock_tradeType) { window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=$ {stock_isinid}&ex=$ {stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’); } }

The market seems to be gaining strength as the benchmark indices added more than a percent in the Diwali week ended October 28, on top of over 2 percent rally in the previous week. Auto, energy, infrastructure, metal, oil and gas, and select bank stocks helped the Nifty close at a one-and-half-month high.

Even the Nifty50 has started off new monthly F&O series (November) on a positive note but faced a lot of challenges at 17,800 on the higher side, while on the lower side, 17,600 seems to have acted as a good support for the entire last week. Hence, if the index decisively crosses 17,800 in coming days, then 18,000-18,100 will be easily taken out which can ultimately pave the way towards new highs, according to experts.

The Nifty50 has formed small bodied bullish candle on the daily charts followed by a ‘hanging man’ pattern in the previous day, while on the weekly scale too, there was a small-bodied bullish candle formation.

“Practically, the trading action in the previous truncated week was very dull. In our sense, markets have opted to take some breather before unfolding the next leg of the rally,” Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One said.

As far as supports are concerned, 17,600 – 17,500 are to be treated as key levels and till the time, it remains unbroken, there is no reason to worry for, he feels.

On the flipside, “it’s a matter of time, we would see Nifty surpassing 17,800 to retest the psychological junction of 18,000,” the market expert said.

Chavan advised traders to remain upbeat and keep a close watch on the thematic moves which may get unfolded in the first half of the forthcoming week.

Let’s take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the November 28 closing prices.

Expert: Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

L&T Finance Holdings: Buy | LTP: Rs 80.15 | Stop-Loss: Rs 70 | Target: Rs 88 | Return: 10 percent

The stock is in a corrective pattern since March 2021. Since April 2022, it has tried to break the supply line several times but it has failed. However, over the past month, the stock narrowed trading activity, which would result in an upward breakout.

The strategy should be to buy 50 percent at current levels and the remaining 50 percent at Rs 72, with a stop-loss below Rs 70. On higher levels, it would rally up to Rs 88 and Rs 100 levels in the short to medium term.

Max Healthcare Institute: Buy | LTP: Rs 430.35 | Stop-Loss: Rs 390 | Target: Rs 500 | Return: 16 percent

Technically, the stock is absorbing the selling pressure, which is at Rs 430. It has also recorded several bottoms between Rs 400 and Rs 390. Based on it, we can expect an upward movement in the stock.

The oscillators are supporting the formation of the daily and weekly charts. Buy at current levels and remaining at Rs 410 with final stop-loss below Rs 390. At higher levels, there is room to move towards Rs 500 with major resistance at Rs 460.

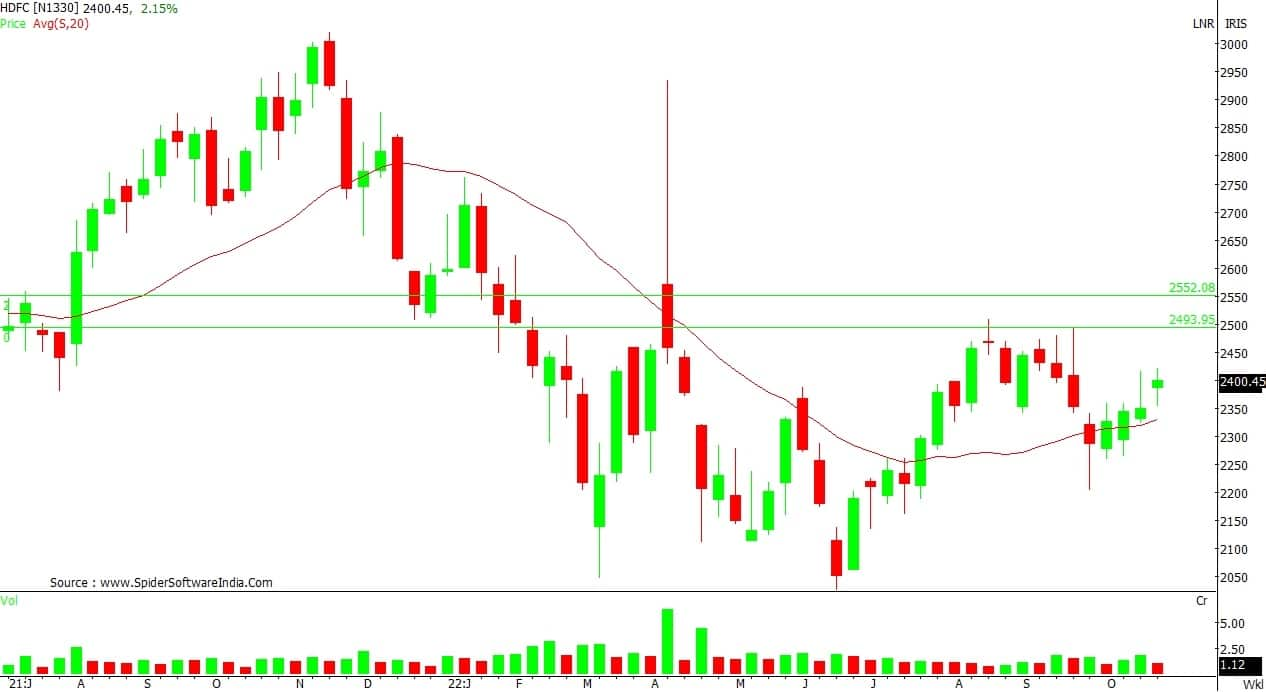

HDFC: Buy | LTP: Rs 2,400.45 | Stop-Loss: Rs 2,350 | Target: Rs 2,550 | Return: 6 percent

It is in a rising corrective pattern. On a weekly and daily basis, the stock has formed a promising bullish consolidation pattern.

Based on it, the stock may move towards Rs 2,500 or Rs 2,550 levels in the near future.

As per the trend line, the stock should not fall below Rs 2,350 level, which should be the final stop-loss to hold the long position.

Expert: Jatin Gohil, Technical and Derivative Research Analyst at Reliance Securities

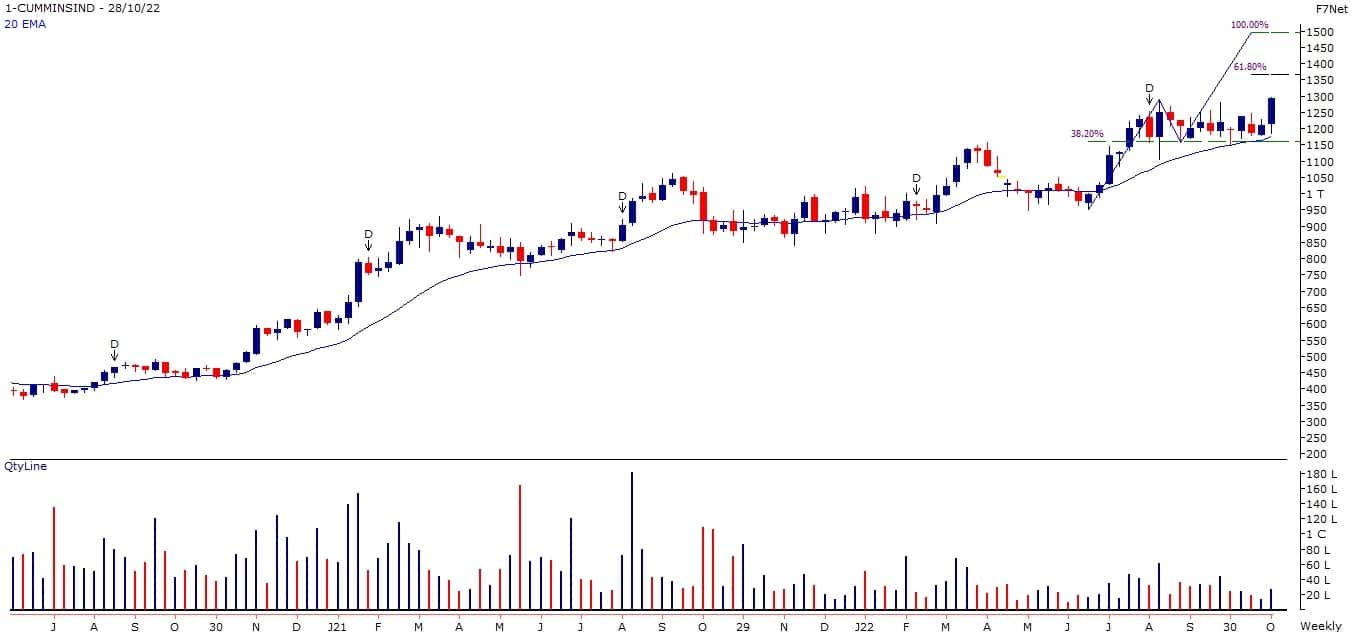

Cummins India: Buy | LTP: Rs 1,293 | Stop-Loss: Rs 1,177 | Target: Rs 1,495 | Return: 16 percent

The stock is in the strong up-trend, as it oscillated around its 38.2 percent Fibonacci retracement level of prior up-move (Rs 951-1,289) and also, its 20-week EMA (exponential moving average) and poised for a fresh rise.

This could lead the stock towards its 61.8 percent Fibonacci Extension level of prior up-move initially and 100 percent level subsequently, which are placed at Rs 1,365 and Rs 1,495, respectively.

Spike in volume and rise in future open interest signals that major market participants are in favour of the bulls.

In case of any decline, the stock will continue to find support at around its 20-week EMA. Fresh long position can be initiated at current juncture and on dips towards Rs 1,270 for a desired action.

Power Finance Corporation: Buy | LTP: Rs 114 | Stop-Loss: Rs 106 | Target: Rs 128 | Return: 12 percent

Continuing its prior rising trend, the stock rose to 6-week closing high. The stock bounced after forming base above its psychological level Rs 100. On the medium-term chart, the stock has formed a bullish reversal pattern-rounding bottom.

The stock has potential to move towards Rs 124 initially and Rs 128 subsequently.

The key technical indicators are positively poised on medium-term as well as short-term timeframe charts. On the lower side, the stock will find support around its upper band of the base, which is placed at around Rs 106.

Fresh long position can be initiated at current juncture and on dips towards Rs 112 for a probable rise.

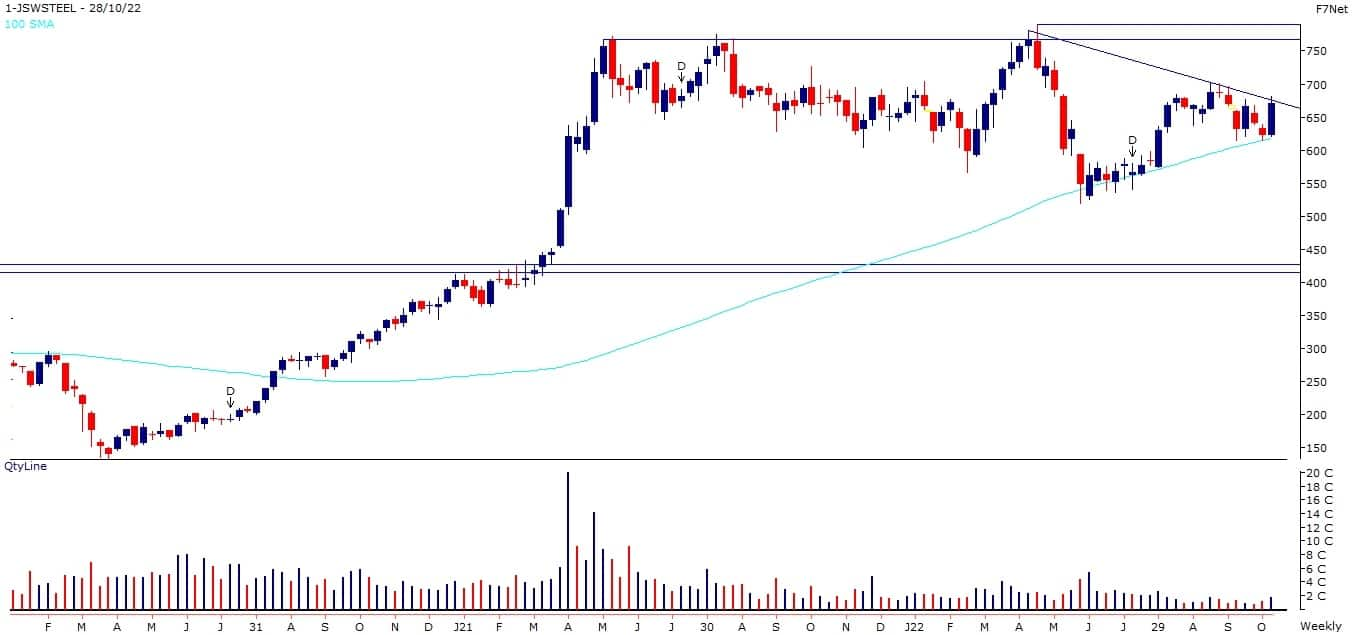

JSW Steel: Buy | LTP: Rs 670 | Stop-Loss: Rs 634 | Target: Rs 790 | Return: 19 percent

The stock again respected the upward sloping 100-week SMA and poised for a trendline breakout. This could take the stock towards its lower band of the supply zone initially and its upper band of the supply zone subsequently, which are placed at Rs 765 and Rs 790, respectively.

The key technical indicators gave buy signal on weekly timeframe chart. In case of any decline, the stock will continue to find support at around its 100-week SMA.

Fresh long position can be initiated at current juncture and on dips towards Rs 660 for a potential up-move.

Expert: Ruchit Jain, Lead Research at 5paisa.com

Sun Pharma Advanced Research Company: Buy | LTP: Rs 251 | Stop-Loss: Rs 235 | Target: Rs 278 | Return: 11 percent

The stock has recently seen a consolidation phase wherein the ‘200 DEMA’ (days exponential moving average) had acted as a resistance. However, prices have now given a breakout above the resistance and the volumes have been good on breakout.

The RSI (relative strength index) oscillator is hinting at a positive momentum and hence, we expect an upmove in the stock in the near term.

Traders can buy the stock around current market price of Rs 251 for potential short term target around Rs 278. The stop-loss on short positions should be placed below Rs 235.

Satia Industries: Buy | LTP: Rs 153 | Stop-Loss: Rs 140 | Target: Rs 172 | Return: 13 percent

The paper stocks were buzzing last week as we witnessed buying interest in some of the counters with good volumes. This stock has seen a breakout from a long consolidation phase and has resumed its uptrend with a ‘Higher Top Higher Bottom’ structure.

Recently, the volumes have increased along with the upmove in prices which indicates accumulation by stronger hands. The price volumes breakout hints at probability of an uptrend and hence, we advise traders to look for buying opportunities in the stock.

Traders can buy the stock around current market price of Rs 152 for potential short term target around Rs 170-172. The stop-loss on positions should be placed below Rs 140.

Expert: Jigar S Patel, Senior Manager – Equity Research at Anand Rathi Shares & Stock Brokers

HCL Technologies: Buy | LTP: Rs 1,030 | Stop-Loss: Rs 960 | Target: Rs 1,150 | Return: 12 percent

The free fall started from mid-January 2022 to July 2022 which resulted in a 34 percent decline in price. On a weekly scale, the counter has formed a bullish BAT pattern with a potential reversal zone of Rs 920-940 along with double bottom near mentioned potential reversal zone which is adding more confirmation for early reversal in the counter.

Recently the said counter gave a clean breakout from its previous trading range of Rs 860-950 and closed near Rs 1,027 mark on a weekly closing basis which shows the strength in the counter.

On the indicator front, the weekly RSI (relative strength index) has formed an impulsive structure near the oversold zone along with the MACD-made bullish cross (weekly scale) which further confirms the upside in the counter. MACD is moving average convergence and divergence.

One can buy in small tranches at current levels and buy another tranche at around Rs 985-990 levels (if tested). The upside is expected till Rs 1,150 with a support at around Rs 960.

Muthoot Finance: Buy | LTP: Rs 1,047.6 | Stop-Loss: Rs 980 | Target: Rs 1,150 | Return: 10 percent

After the free fall started from November 2021 till June 2022 which resulted in a 43 percent decline in price. On a weekly scale, the counter has formed a bullish Shark with a potential reversal zone of Rs 960-990 along with double bottom near mentioned PRZ (potential reversal zone) which is adding more confirmation for early reversal in said counter.

From the indicator perspective, weekly RSI (relative strength index) has formed a complex structure along with the MACD bullish cross which further confirms the upside in the counter.

One can buy in small tranches at current levels and buy another tranche at around Rs 1,020 level (if again tested). The upside is expected till Rs 1,150 with a support at around Rs 980.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.