“Selling into market weakness is one of the most bearish things that corporate insiders can do.”

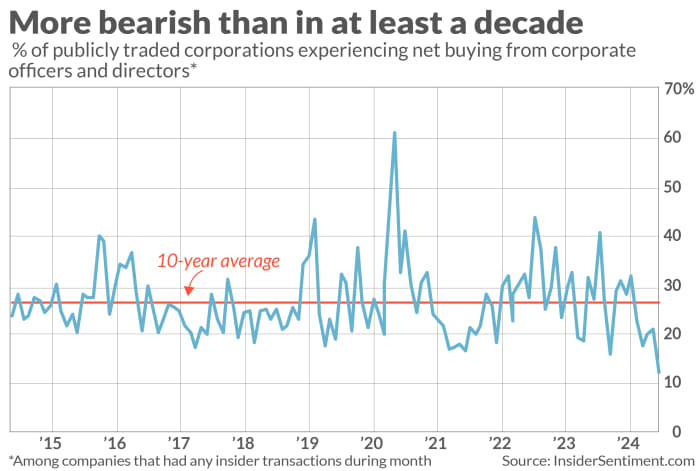

Corporate insiders as a group seem to believe there’s an above-average chance of a major U.S. stock market drop. Consider the proportion of publicly traded U.S. companies in which insiders are buying more shares than they are selling. As a percentage of companies that have had any insider transactions, this proportion for April so far has been just 12.4%, according to InsiderSentiment.com.

The InsiderSentiment.com website is based on the work of Nejat Seyhun, a finance professor at the University of Michigan and a leading analyst of insider behavior. The insider buying percentages reported on the site reflect just two of the three types of insiders that the SEC includes in the “insider” category — corporate officers and directors — since Seyhun’s research has found that following their lead is often a market-beating strategy.

Excluded from the insider buying percentage is the third type — a company’s largest shareholders — since Seyhun’s research shows that they, on average, do not have any privileged insight into their companies’ prospects.

As you can see from the chart above, the 12.4% month-to-date insider buying percentage is less than half the trailing 10-year average of 26.5% and the lowest since 2014. It’s difficult to know how April’s insider buying percentage compares to the pre-2014 period, Seyhun explained in an email, since there are some statistical issues that make the long-ago data not strictly comparable to the past decade’s. Nevertheless, he said that if insiders sell their shares for the rest of April at the same pace they did last week, this month’s reading would be one of the lowest in decades.

April’s low insider buying percentage comes on the heels of the three prior months in each of which this percentage was below average. A bull might have been able to get away with arguing that those below-average readings weren’t particularly bearish, since the stock market was surprisingly strong in the first three months of this year. It’s not unusual for insiders to take advantage of higher prices to opportunistically sell some of the shares they previously required — for reasons having nothing to do with market timing, such as buying a house or paying for a child’s college tuition.

April’s low percentage, in contrast, is more difficult for bulls to explain away, since the stock market was unusually turbulent in the first week of April, suffering several large down days. Seyhun’s research has found that selling into market weakness is one of the most bearish things that insiders can do.

The bottom line? Seyhun said to keep a close eye on insider transactions for the rest of April. Continued high levels of insider selling, he added, would increase the odds of a “negative market reaction in the near future.”

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Global fund managers are wrong on inflation, rates and bonds so far this year

Also read: With inflation running hot, Series I bonds are still a smart move for yield and tax advantages