Boeing’s stock was up Wednesday, but its bonds have not recovered from a wobble seen in early January after a panel tore off a 737 Max 9 jet flown by Alaska Airlines during a flight.

AFP/Getty Images

Boeing Co.’s shares moved higher Wednesday as its chief executive arrived in Washington, D.C., for meetings with U.S. lawmakers, but the company’s bonds have not yet recovered from a recent wobble.

Boeing BA, +2.17% bonds were hit by concerns after a panel tore off a 737 Max 9 jet flown by Alaska Airlines earlier this month. On Tuesday, United Airlines Holdings Inc. UAL, +0.68% said it was rethinking its longer-term plans around Boeing’s upcoming Max 10, the biggest 737 Max jet to date, after the government’s grounding of dozens of Max 9s.

Now read: United pulls plans for Boeing’s biggest 737 Max jet, after Max 9 groundings prove to be ‘straw that broke the camel’s back’

“We fly safe planes,” Calhoun told a group of reporters on Capitol Hill. “We don’t put airplanes in the air that we don’t have 100% confidence in.” He said he was meeting lawmakers “in the spirit of transparency” and to answer their questions.

Ben Minicucci, the chief executive of Alaska Airlines ALK, -0.33%, said in an interview with NBC News published Tuesday that inspectors found loose bolts on “many” of its Boeing 737 Max 9s evaluated after the mid-flight blowout.

And on Saturday, a Boeing 757 plane operated by Delta Air Lines Inc. DAL, +0.18% lost a nose wheel as it prepared to take off from Atlanta’s main airport, according to the Federal Aviation Administration.

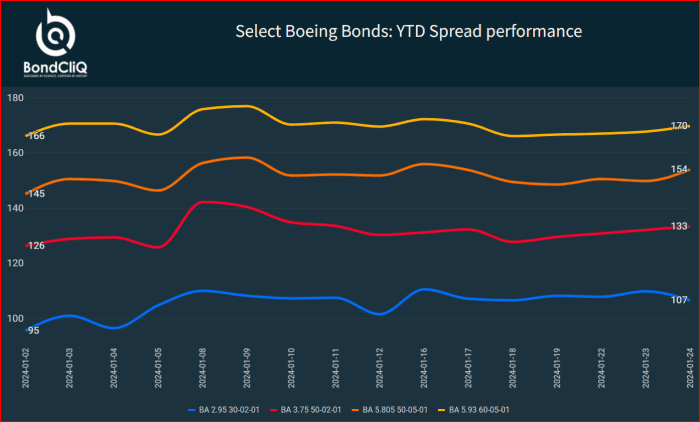

Spreads on Boeing bonds widened in early January after the Alaska Airlines incident and have not yet recovered, even as spreads on the broader high-grade market have been tightening, as the following chart from data solutions provider BondCliQ Media Services shows.

Select Boeing Bonds: Year-to-date spread performance.

BondCliQ Media Services

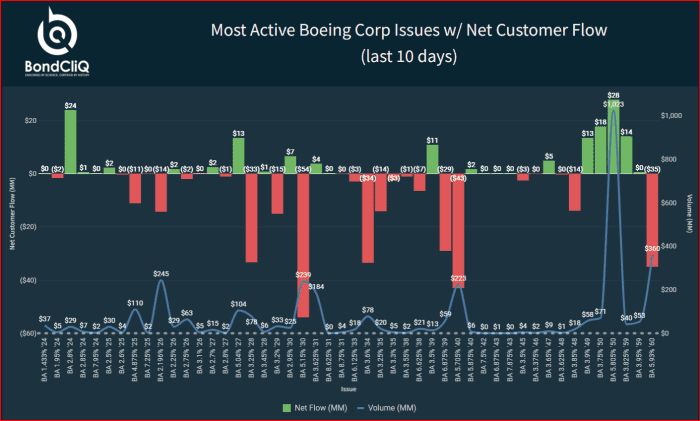

As the negative headlines have continued, there’s been net selling of the bonds over the past two weeks.

Most active Boeing Co. issues with net customer flow (last 10 days).

BondCliQ Media Services

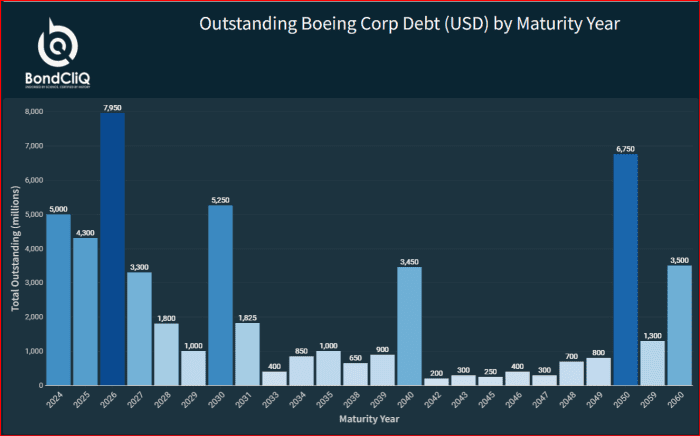

Boeing has just over $ 17 billion worth of debt that matures in the next three years.

Outstanding Boeing Co. debt (USD) by maturity year.

BondCliQ Media Services

The stock, meanwhile, was up about 2% Wednesday and has gained 18% in the last three months. However, it has lost about 17% this month to date.

Earlier this week, the FAA recommended that more of the aerospace giant’s aircraft models should have their door plugs inspected.

“As an added layer of safety, the Federal Aviation Administration (FAA) is recommending that operators of Boeing 737-900ER aircraft visually inspect mid-exit door plugs to ensure the door is properly secured,” the FAA said on its website.

The 737-900ER is not part of the new Max fleet, which has had the door-plug issues that led to the 737 Max 9’s groundings, but has the same door plug design, the FAA said.

Also read: Boeing’s stock should be in the penalty box for now, investment manager says.