Interest rates will still rule stocks in 2024, according to DataTrek Research.

Wall Street seems to agree that U.S. stocks will climb to fresh record highs in 2024. But the most important question for investors may still be the direction and speed of interest-rate moves.

Rate-sensitive groups of stocks with lackluster fundamentals, such as financials, utilities, staples, “may be able to outperform, at least early in the year,” if one expects interest rates “to come down quickly and permanently,” said Nicholas Colas, co-founder of DataTrek Research.

But if “one expects a bumpier ride on the rate front,” then stronger groups, like technology and tech-adjacent sectors “should do better,” Colas said in a Monday client note.

The S&P 500’s utilities, consumer staples and energy sectors have been the worst performing parts of the large-cap benchmark index so far in 2023, according to FactSet data.

With an over 10% year-to-date decline, the S&P 500’s utilities sector XX:SP500.55 has significantly underperformed the broader index’s SPX 23.6% advance.

The S&P 500’s best performing information technology sector XX:SP500.45 was up 56.5% for the same period. But its consumer staples XX:SP500.30 and energy XX:SP500.10 sectors have slumped by 2.6% and 4.1% so far this year, respectively, according to FactSet data.

Utilities and consumer staples are usually considered defensive investment sectors, or “bond proxies,” because they can help investors minimize stock-market losses in any economic downturn. Companies in these sectors usually provide electricity, water and gas, or they sell products and services that consumers regularly purchase, regardless of economic conditions.

However, utilities and consumer staples stocks were under a lot of pressure this year. A relentless climb in U.S. Treasury yields in October made defensive stocks less attractive compared with government-issued bonds, or money-market funds offering 5%, especially as the economy remained strong, pushing recession expectations out further.

Colas expects “weaker groups” to catch a stronger tailwind if rates continue to decline.

See: Markets are declaring victory over inflation for Powell, and that has some economists worried

The yield on the 10-year Treasury BX:TMUBMUSD10Y last week booked its biggest weekly decline in a year after the Federal Reserve signaled a pivot to rate cuts in 2024, which helped the S&P 500 score its longest weekly winning streak since 2017.

The S&P 500’s utilities and consumer staples sectors rose 0.9% and 1.6% last week, respectively, compared with the information technology sector’s 2.5% advance and communication services sector’s XX:SP500.50 0.1% decline, according to FactSet data.

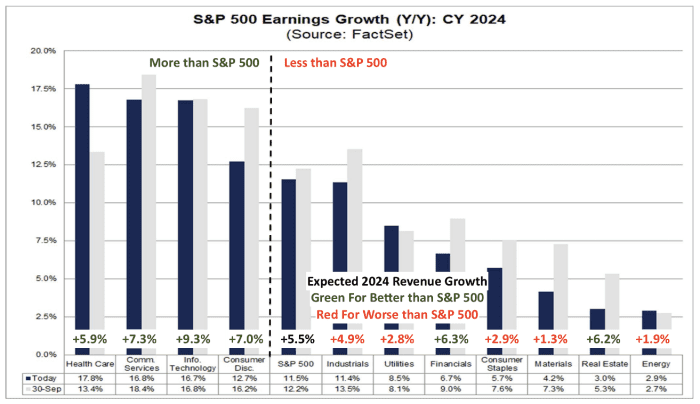

Earnings growth expectations for each S&P 500 sector in 2024 are indicated below. Sectors to the left of the dotted black line are expected to show better bottom-line results than the S&P 500 as a whole, while those to the right are expected to show weaker earnings growth.

SOURCE: FACTSET, DATATREK RESEARCH

Wall Street expects next year to see 11.5% growth in S&P 500 earnings-per-share (EPS), to $ 244, and 5.5% revenue growth, according to FactSet data.

However, there is a wide dispersion across S&P 500 sectors. The range goes from 2% revenue and 3% earnings growth for the energy sector, to 9% revenue and 17% earnings growth for the information technology sector, according to data compiled by DataTrek Research.

“Playing fundamentally weaker sectors therefore assumes even more good news on the rate front,” Colas said, adding that it still is riskier than sticking with “tried and true groups” like technology.

Moreover, sectors such as utilities, financials and consumer staples are not expected to show 10% earnings growth next year, while health care and big tech-dominated groups like communication services, technology and consumer discretionary, are expected to show much better than average revenue and earnings growth in 2024, said Colas, citing FactSet data.

U.S. stocks closed higher on Monday, with the Dow Jones Industrial Average DJIA building on its all-time high set last week. The S&P 500 gained 0.5% and the Dow Industrials closed fractionally higher. The Nasdaq Composite COMP finished up 0.6%, according to FactSet data.