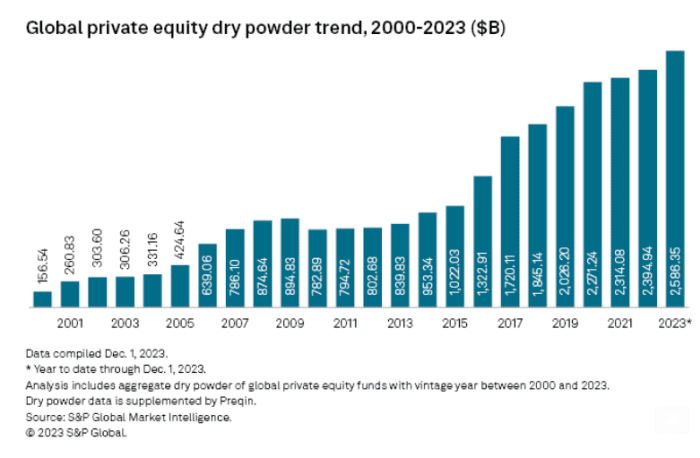

Capital waiting to be deployed, or so-called dry powder, rose 8% to a record $ 2.59 trillion in the past year, S&P said Tuesday.

S&P said the mountain of unused capital in the industry comes after a slow year in dealmaking “with limited opportunities” for firms that have raised money from investors in recent years.

Also read: Private equity: Everything you always wanted to know about this $ 12 trillion asset class but were afraid to ask

Dry powder, or unemployed capital by private-equity firms, is up by 8% in the past year, in a lackluster environment for mergers and acquisitions.

S&P

Apollo Global Management Inc. APO, -0.16% leads the list with $ 55.1 billion in dry powder, followed by $ 43.2 billion for KKR & Co. KKR, +0.49%, $ 39.44 billion for CVC Capital Partners and $ 30.9 billion for Ardian.

Blackstone Group Inc. BX, +0.06% ranks fourth with $ 29 billion in dry powder, followed by $ 27 billion for Carlyle Group Inc. CG, +0.49%, $ 24.2 billion for Clayton, Dubilier & Rice LLC, $ 24 billion for Hellman & Friedman LLC and $ 23 billion for TPG Inc. TPG, +0.25%.

“Record dry powder accumulation is rooted in the robust M&A market of the last several years,” S&P said.

Merger and acquisition activity prior to 2022 set high valuation expectations for sellers, which remained elevated even as macroeconomic conditions increasingly slowed deal activity starting last year, S&P said.

In a separate study, financial-technology company and broker-dealer Percent Securities LLC said dry powder in the private-credit space now tips the scales at $ 1.3 trillion, or about 25% of all capital available for investment.

“The large amount of dry powder across allocators indicates momentum will only continue to accelerate as firms continue to lean into the asset class,” said Nelson Chu, founder and chief executive of Percent. “We are already seeing a variety of interesting trends on the Percent platform foreshadowing the ways allocations and deal types will shift into 2024.”

Also read: Why wealthy investors put $ 125 billion into this new type of private-equity fund last year