Is Time magazine already regretting its decision for person of the year?

Not from a publicity for the magazine standpoint, or for magazine sales … okay, of course Time doesn’t regret the choice. But from a sheer impact standpoint, the jobs data saying 199,000 jobs were created in November showed that person of the year finalist, Federal Reserve Chair Jerome Powell, seems to have absolutely nailed the soft landing after the swiftest (ahem) rate hike campaign in decades. Taylor may be worth billions, but the U.S. economy is worth, at last count, $ 27.64 trillion.

Ed Yardeni absolutely buries the hard landers, the gloom and doomers who expected a nose-dive for the U.S. economy, in a new commentary for Monday. Sure, Yardeni notes, there’s a litany of valid reasons why the U.S. economy may have sunk: that rate hike campaign, the inversion of the yield curve since the summer of 2022, the years-long falling of the index of leading indicators, the declining M2 money supply in real terms.

“We’ve provided several explanations for why the hard landers and their indicators have been wrong so far,” says the chief investment strategist at Yardeni Research who coined the phrase, “bond vigilante.”

“Here’s a new one: Perhaps the Fed hasn’t been tightening monetary policy so much as normalizing it. Interest rates are back to the Old Normal. They are back to where they were before the New Abnormal period between the Great Financial Crisis and the Great Virus Crisis, during which the Fed pegged interest rates near zero.”

That implies the Fed may not lower interest rates by the four times expected by the market; Yardeni says the Fed may opt for just two cuts next year.

What Yardeni calls the earned income proxy — payroll employment in the private sector, average weekly hours and average hourly earnings — together rose 0.8% month over month, and “undoubtedly well exceeded the month’s inflation rate, boosting the purchasing power of consumers.”

He also poured cold water on those favoring the story from gross domestic income (which has been weak) over gross domestic product (which has been strong). “Some economists simply take the average of GDP and GDI,” he says, and in fact, the Commerce Department itself advises people to average the two. “For now, we see plenty of evidence to stick with our views that the economy is resilient and productivity growth is making a comeback. The stock market seems to agree with us.”

Yardeni says it is “achievable” for the S&P 500 to reach 5,400 by the end of 2024, and now has a 2025 target of 6,000 for the end of 2025 — or earnings of $ 300 per year on a price-to-earnings multiple of 20. That equates to a 14% annual growth rate for the next two years, or well above any Wall Street firm’s targets.

The markets

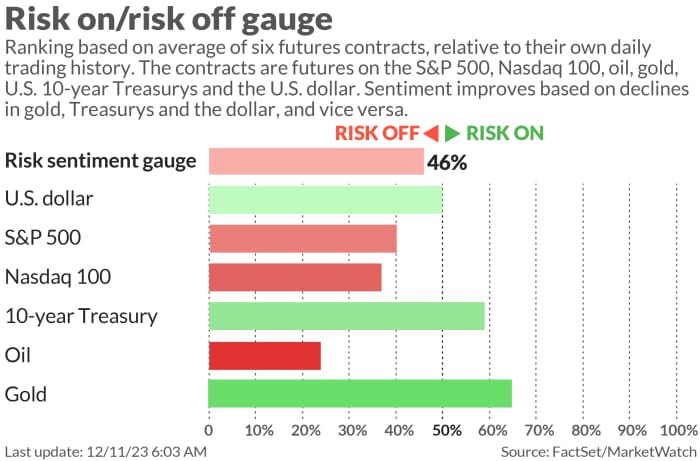

After the best S&P 500 SPX finish in 20 months, U.S. stock futures ES00, -0.10% NQ00, -0.22% were a touch weaker to open the week. The yield on the 10-year Treasury BX:TMUBMUSD10Y rose to 4.26%, ahead of a $ 37 billion auction.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Macy’s shares M, +2.35% surged after the Wall Street Journal reported that an investor group is offering a 32% premium for the retailer.

Cigna shares CI, +0.33% rallied 13% as the Wall Street Journal reported it is abandoning its pursuit of Humana HUM, +0.27%, as the company said it would make an additional $ 10 billion stock buyback.

Media tycoon Shari Redstone is in talks to sell controlling interest in Paramount PARA, +12.11% parent National Amusements to media and entertainment company Skydance, Puck and the New York Times reported Sunday.

Berkshire Hathaway-held BRK.B, +0.11% Occidental Petroleum OXY, +0.12% reached a deal to buy Midland oil and gas producer CrownRock for $ 12 billion.

Best of the web

“When JPMorgan wants to sharpen their pencils and leave the super-regionals in the dust, it’s going to happen.” Citizens CEO talks First Republic, bank regulation and loan demand.

The puzzling economics of the Shohei Ohtani $ 700 million contract with the Los Angeles Dodgers.

The Hamas leader who studied Israel’s psyche and is betting his life on what he learned.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker symbol | Security name |

| TSLA, +0.49% | Tesla |

| GME, -4.95% | GameStop |

| NVDA, +1.95% | Nvidia |

| NIO, -1.47% | Nio |

| AMC, +1.61% | AMC Entertainment |

| AAPL, +0.74% | Apple |

| PLTR, +3.19% | Palantir Technologies |

| BABA, -0.26% | Alibaba |

| AMZN, +0.37% | Amazon.com |

| AMD, +0.43% | Advanced Micro Devices |

The chart

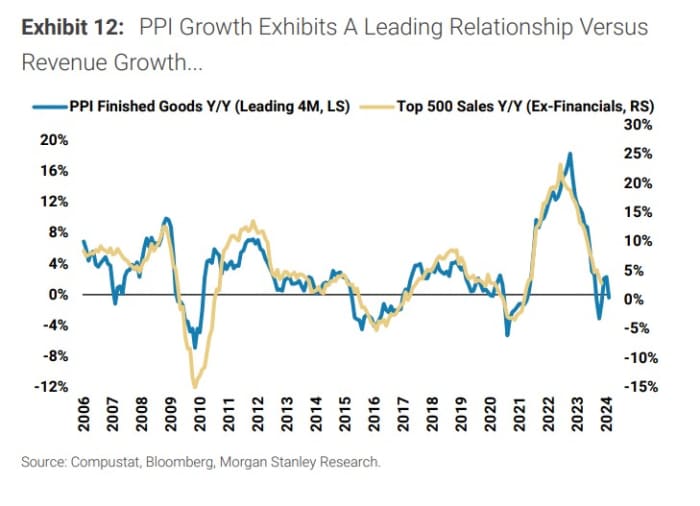

The week’s most important economic indicator is Tuesday’s release of the consumer price index, but strategists at Morgan Stanley led by Mike Wilson point out the predictive power of the producer price index, specifically the finished goods components, for how closely it tracks S&P 500 sales growth. They do note that the PPI deceleration doesn’t match the most recent survey from the National Federation of Independent Business, which suggests companies are planning to raise prices into next year.

Random reads

Has Goldman chief David Solomon started a sock trend?

The Ritz in Paris found a missing €750,000 ring — in a vacuum cleaner bag.

Here are, statistically, the most polarizing films of all time.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.