At the start of 2023 and following a tough year, Christopher Tsai, president and chief investment officer of Tsai Capital, didn’t think technology would generate a 50% return for his $ 110 million portfolio.

The portfolio’s bumper 2023 is thanks to investing in the right companies, with the market in agreement, meaning momentum played a part, said Tsai in an interview with MarketWatch on Monday. “But these are businesses that we’re planning on owning for many, many years,”

Tesla TSLA, +1.33%, Apple AAPL, +2.11%, Amazon.com AMZN, +1.41% and Alphabet GOOGL, +1.33% are his top four stocks due to “durable competitive advantages,” but have also seen rapid growth and were cheap when purchased.

“We own 21 companies and I think it’s important to point out that we’re not just tech,” he said, rattling off other picks like Nike NKE, +0.23%, Visa V, +0.07% and Mastercard MA, +0.11% and Hershey HSY, -1.41%.

And non-tech holdings Accenture ACN, -0.18% and No. 5 stock Costco COST, +1.05% are both up double digits this year. He owns the latter partly due to insights from Berkshire Hathaway’s BRK.B, -0.46% late vice chairman Charlie Munger, who he dined with in 2018.

Tsai recalls the Costco enthusiast and “mentor” telling him that paying 25 time pretax multiple for the retailer “wasn’t unreasonable at all.”

Munger also told him this: Sometimes to make money, you need to “sit on your ass.” And “you don’t want to do too much, but when a good opportunity comes around the corner, you want to swing hard.”

“In other words, you want to put a lot of capital to work. That’s been our approach,” said Tsai, whose portfolio has returned 7.43% annualized net of fees, versus 6.87% for the S&P 500 index SPX since its 2000 inception. And during that rough dot-com start, Tsai made money by investing in “hated old economy” stocks such as auto supplier Genuine Parts GPC, -2.40% and Berkshire Hathaway, which lost half of its value at the time.

He also credits generations of knowledge. From his father — the late Gerald Tsai Jr. who pioneered momentum trading and started Fidelity Investments’ first aggressive growth fund in 1958 — he learned to “position yourself with the wind at your back.”

Christopher Tsai’s grandmother Ruth Tsai pictured in Hong Kong in 1957.

Christopher Tsai

His grandmother Ruth Tsai, the first woman floor trader on the Shanghai Stock Exchange and who “made a killing” until the arrival of Japanese troops in 1941, passed down wisdom about preserving capital during bear markets. One of her favorite sayings: “When the tide goes out 10 feet, a large boat and a small boat both go out 10 feet.”

He sees Amazon AMZN, +1.41%, Alphabet and Microsoft MSFT, +0.92% as “equivalent of the railroads during the time of Rockefeller and Cornelius Vanderbilt” by controlling the cloud. Their services operate the infrastructure that enabled the cloud, with lots of data still on those servers. “We are in the early stages of this cloud evolution, so I like those names,” he said.

As for AI, Tsai says he missed out on Nvidia NVDA, +2.33% by not being “smart enough to understand that company early on.” But he’s betting on those “selling the picks and shovels” of the AI revolution, like Amazon AMZN, +1.41%, Alphabet and Microsoft MSFT, +0.92%, who can all “piggyback” on that.

Read: Nvidia and Microsoft CEOs say industrial companies will benefit most from AI. Here are stocks to put on your watch list.

And Tesla is also a leading AI company, thanks to its “data and ability to analyze data over its Dojo computing network. And Tesla’s combining that during a period when the whole world will continue to move toward electric vehicles.”

Tsai also draws parallels between Tesla and Costco, who he notes have both created competitive economic “moats.” And as they gain scale, they increase profit and margins but pass that back to the consumer via lower prices, hence generating demand.

Drawing on Munger and others, he says a big blind spot he sees among investors now is overlooking what they own. “Think about companies that you already know well, let them compound for you, let them work for you, instead of just jumping to the next shiny thing.”

Read: After best stretch since 2020, what history says about how much further stocks can climb

Best of the web

The end of exercising and President RFK Jr. Outrageous predictions for 2024

Tesla employee turned whistleblower doubts safety of the popular EVs

Pentagon wants to root out shoddy drugs, but the FDA is in the way.

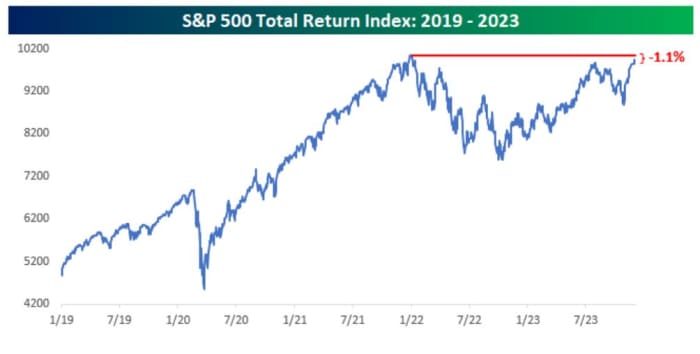

The chart

The S&P 500 is sitting 4% away from getting back to prior highs from early 2022, but on a total return basis — those generated by dividends and price changes — “the market is knocking on the door of new record highs,” says Bespoke Investment.

Their chart shows the S&P 500 total return index is 1.1% away from its prior record high from 1/3/22. “In addition to nearing its prior highs, the pattern of the S&P 500 looks a lot like a cup and handle which technicians consider to be a bullish formation,” says Bespoke.

Bespoke Investment Group

Random reads

Scientists glimpse an Antarctic iceberg three times the size of New York City,

Climate envoy John Kerry’s slight emissions problem.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.