With wars between Russia and Ukraine and between Israel and Hamas, an investor might expect oil prices to soar because of the potential for supply disruption. But that hasn’t happened. The front-month contract price for West Texas Intermediate crude oil CL.1, +3.06% CL00, +3.05% has declined 9% this year, and it is down nearly 10% over the past two years.

William Watts provides this explainer about contango and backwardation — two commodity-market forces investors need to understand.

More about oil and other commodities markets:

The ARKK ETF has had a stellar 2023, but you might be able to do better

MarketWatch illustration/iStockphoto

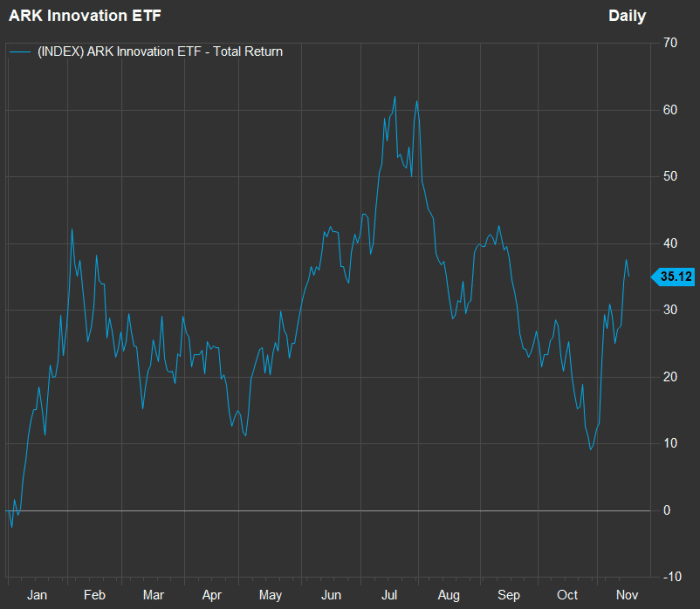

Let’s look at two charts showing total returns for Cathie Wood’s Ark Innovation exchange-traded fund ARKK. First, year-to-date:

FactSet

That is a pretty wild ride, but it’s excellent performance when compared with the the SPDR S&P 500 ETF Trust SPY, which has returned 19% this year. Then again, ARKK has trailed the Invesco QQQ Trust QQQ, which tracks the Nasdaq-100 Index NDX and has returned 46% this year.

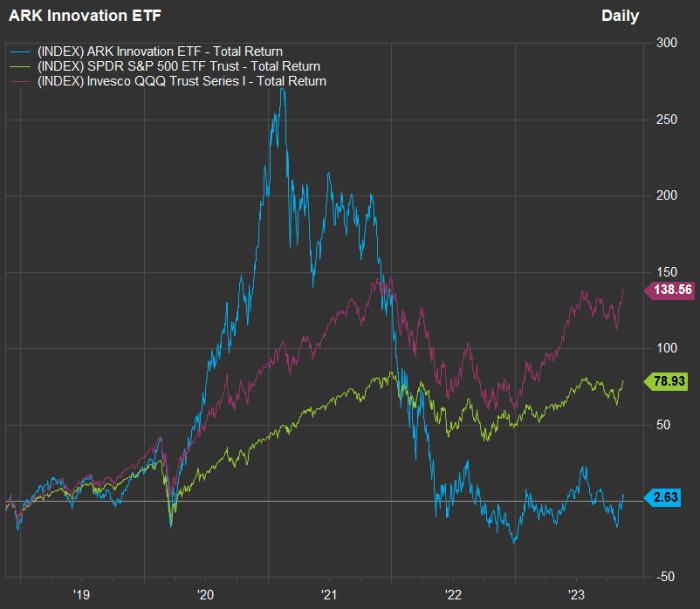

Now take a look at a five-year chart for all three ETFs:

FactSet

ARKK was an amazing highflier before investors grew nervous late in 2021 about the expected rise in interest rates to push back against inflation. The tech-stock rally reversed before the Federal Reserve’s policy change in March 2022.

In this week’s ETF Wrap, Christine looks at ARKK’s bullish technical trading pattern with the help of Frank Cappelleri, founder of CappThesis.

Wood’s strategy of taking concentrated bets on innovative technology companies can lead to a boom-and-bust pattern. Mark Hulbert shares a lower-risk strategy investors can use to focus on the same companies, aiming for better long-term performance.

More from Mark Hulbert:

- Stock traders take note: There’s hope for market timing, after all

- Don’t be fooled: Huge one-day stock rallies are more common in bear markets

You might be able to avoid paying taxes on Social Security income

Beth Pinsker explains how to manage your taxes on Social Security.

Something else to think about as we approach a Dec. 7 deadline: Medicare’s Meena Seshamani answers your questions about open enrollment.

How about a 6% rule, instead of the old 4% rule?

Higher income means wider smiles.

Getty Images

The old 4% rule for retired investors is meant to help people to plan to withdraw a moderate amount from their retirement accounts each year to cover living expenses while making sure they never run out of money.

But with interest rates now at their highest level in decades, Brett Arends considers how a 6% rule might be viable for your retirement-income plan.

More retirement coverage:

- This is the worst part of retirement

- Three reasons why millions of older Americans live in poverty and aren’t getting the help they need

What lies ahead for the Magnificent Seven?

The S&P 500’s performance this year almost entirely reflects its heavy weighting to seven companies whose stocks have soared: Apple Inc. AAPL, -0.34%, Microsoft Corp. MSFT, -1.53%, Amazon.com Inc. AMZN, +1.02%, Nvidia Corp. NVDA, -0.40%, Alphabet Inc. GOOGL, -2.20%, Meta Platforms Inc. META, -0.31% and Tesla Inc. TSLA, +0.69%. Together, these companies make up about 29% of the S&P 500 SPX, which is weighted by market capitalization.

Joseph Adinolfi considers what it would take for the “Magnificent Seven” to stage a repeat performance in 2024.

More about the Magnificent Seven and related companies:

Earnings season often means sloppy reporting by companies

Each earnings season, investors expect publicly traded companies to report their results in a way that can make for easy comparisons with prior periods. Companies are required to report according to generally accepted accounting principles, or GAAP, but will also provide adjusted numbers that can shed a better light on core results — if they exclude one-time noncash items, for example.

But an emphasis on non-GAAP numbers can also confuse investors. For example, the commonly used Ebitda stands for earnings before interest, taxes, depreciation and amortization. But some of those items are important enough to send a company reeling — a high level of debt can be critically important if maturing debt is rolled over at much higher rates.

Ciara Linnane takes many large U.S. companies to task for burying key numbers, overemphasizing non-GAAP reporting or doing other things that make it difficult to understand their results.

Sticky situations for people, their relationships and their money

MarketWatch illustration

Quentin Fottrell — the Moneyist — digs deeply into financial and legal considerations to help people with difficult questions about relationships and money. He has been busy:

This could be a good time to jump into these funds that have high dividend yields

Michael Brush makes the case for two closed-end funds that have dividend yields close to 12% and trade at discounts to the value of their holdings.

More investment picks: 10 ‘better values’ in the stock market, selected for the next two years

Company news and reactions

Here’s a sampling of opinion following earnings reports and other corporate developments:

You might regret doing this

It is better to be creative with your passwords.

Getty Images/iStockphoto

Jeremy Binckes reports that yes, people are still using “password” for their password.

Want more from MarketWatch? Sign up for this and other newsletters to get the latest news and advice on personal finance and investing.