Eligible taxpayers in 13 states will have the opportunity to test out the Internal Revenue Service’s foray into free tax preparation this upcoming tax season, the agency announced Tuesday.

Taxpayers who want to try out the pilot program will need to have relatively simple tax returns. They’ll also need an invitation from the tax agency in order to participate, the IRS said.

In May, the IRS announced it would test a program that will let people file their taxes for free directly with the agency, instead of using paid options like tax software or an accountant.

The goal of the pilot program is to see if the federal tax collector can feasibly get involved in tax return preparation. The prospect of the IRS offering free tax prep has been panned by Republican members of Congress, and by tax prep companies that stand to lose customers — including H&R Block HRB, -0.02% and Intuit INTU, -0.19%, the company that owns TurboTax.

This past tax season, individuals and businesses spent an average of $ 250 and 13 hours preparing their taxes, according to IRS estimates.

Now the federal tax collector is sketching out some of the details about how the closely-watched free pilot program is going to work.

The program will be open to certain taxpayers in nine states that have no state-level income tax. That’s Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Wyoming and Washington. The program will also be available to certain taxpayers in four states with their own income taxes. That’s Arizona, California, Massachusetts and New York.

At this point, the IRS tax prep platform is only equipped to handle very simple returns with income from W-2 wages, Social Security income, jobless benefits and interest income under $ 1,500.

It can also handle claims for several credits, like the Earned Income Tax Credit and the Child Tax Credit, as well as deductions such as the widely-used standard deduction, the student loan interest deduction and the educator expense deduction.

“We still have much more work in front of us,” IRS Commissioner Danny Werfel told reporters Tuesday at a briefing about the pilot program.

The IRS still needs to determine how many tax returns the program can handle and how it will invite taxpayers to use the product, he said. The agency plans to slowly roll out the test run to determine what works and what doesn’t work, Werfel said.

The IRS anticipates that at least several hundred thousand taxpayers will choose to participate in the free program, an agency said. The Treasury Department directed the IRS to build the pilot program.

The web-based program will be available in English and Spanish. It’s usable on computers and smartphones, and will have a set number of customer service representatives trained to troubleshoot user problems.

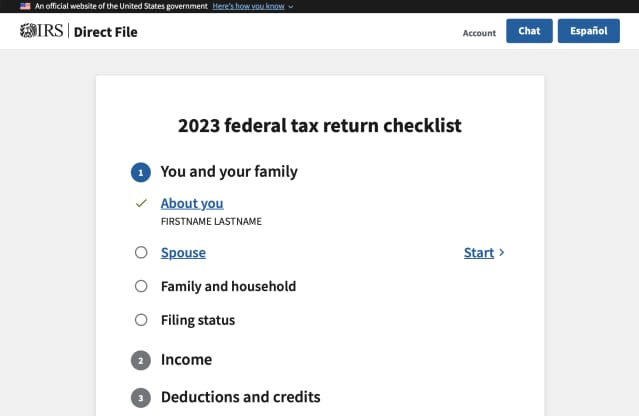

A sneak peek at IRS-run federal income tax return filing program.

Courtesy Treasury Department/IRS

“I can’t stress enough, if direct file is pursued further after the pilot, it would be just another choice taxpayers have to help them prepare their income tax returns,” Werfel said. “It would be an addition to existing options, such as the use of a tax professional, commercial tax software, Free File or another option.”

The Free File program is an existing IRS partnership with certain tax software companies that lets people under a certain income threshold file their taxes for free, but few eligible taxpayers use the program.

While some consumer advocates staunchly support the idea of a free IRS-run tax prep option, skeptics maintain that it wouldn’t help taxpayers.

TurboTax maker Intuit has been an outspoken critic of the program and has questioned whether the IRS can fairly collect taxes and provide taxpayers with a refund that’s as big as can be. H&R Block and Intuit did not immediately respond to a request for comment.

When the IRS announced the plans in May to press ahead with a test program, Intuit said the estimates on the cost of the program were “laughable.”

When Congress passed the Inflation Reduction Act last summer, it set aside $ 15 million to study whether a direct file program was doable. More than $ 11 million of the $ 15 million has been earmarked for use through early July, according to a report this month from the Treasury Inspector General for Tax Administration.

The watchdog report said the IRS may have overstated the amount of consumer interest in having the agency prepare income tax returns.

After the Treasury watchdog’s report came out, Jason Smith, a Republican from Missouri who chairs the Ways and Means Committee, said it underscored the “trust gap” between the IRS and the public.

“The Biden Administration’s so-called ‘study’ into establishing a direct e-file system was a foregone conclusion designed to further their goal of inserting the IRS into every aspect of Americans’ lives,” he said.