““We now foresee a deeper and longer property downturn.””

Wall Street’s darkening view on China continued on Monday as UBS strategists joined JP Morgan Chase & Co., Barclays, Morgan Stanley and Nomura in cutting the country’s growth prospects amid a property downturn.

China’s CSI 300 index XX:000300 fell 1.4% to start the week, as the downgrade coincided with more conservative-than-expected moves on lending rates by the People’s Bank of China, which last week cut its key policy rates as data showed a slowing in the country’s growth in July. Property managers also fell in China.

The KraneShares CSI China Internet ETF KWEB, a popular vehicle for investing in China, has dropped 11% this year.

The one-year loan prime rate (LPR) was lowered by 10 basis points to 3.45%,while the five-year LPR was held at 4.2%, the People’s Bank of China said.

A team of UBS strategists led by Ning Zhang said the China government’s policy support has disappointed. And while the July Politburo meeting pointed to more moves, notably for the troubled property sector, “there has been no announcement of meaningful fiscal spending and property easing has been relatively piecemeal and modest.”

UBS now sees China growth at 4.8% in 2023 and 4.2% in 2024. “We now foresee a deeper and longer property downturn, revising our 2023 forecast of property new starts down to a 25% decline and real estate investment to a 10% decline,” said Zhang.

The country’s sluggish recovery from its COVID lockdowns has been a dead weight for that sector in particular, whose poster child has been property developer Country Garden Holdings 2007, -2.63%.

Roiling markets in China and at times elsewhere, the company’s list of woes is long: failing to make bond interest payments and suspending trading for bonds; warning of a first-half loss of up to RMB55 billion ($ 7.62 billion), and getting cut further into junk-bond territory by Moody’s Investor Service.

Read: Troubled Country Garden will be dropped from Hong Kong’s Hang Seng Index

Adding to this, China’s second-largest developer, China Evergrande Group EGRNF,, filed for Chapter 15 bankruptcy protection in New York last week. Some are concerned that a grim outlook for the property sector will soon spread to other important energy and technology sectors.

Banks under pressure

As for the disappointment over lending rates, strategists at Societe Generale pointed out the dilemma for a government that wants to stimulate the economy and banks whose profits are under pressure.

The LPR is the rate charged by banks to their best clients, said Michelle Lam and Wei Yao, with many new and outstanding loans are based on that 1-year LPR, which is set by banks. The 5-year, meanwhile, has influence on mortgage pricing, and is set by 18 commercial banks who propose a rate to the PBOC monthly.

“We think the smaller-than-expected adjustments in today’s LPR highlights that banks’ interest margins are under immense pressure,” said the strategists in a note. As of the second quarter of this year net interest margins of commercial banks were down from 1.91% in the fourth quarter of 2022 to 1.74%, the lowest on record. And SocGen predicts “more downward pressure is yet to come.”

China bank’s falling net interest margin.

Societe Generale

“The PBoC has said that it will continue to guide banks to lower the interest rates on existing mortgages – in a bid to lower households’ debt burden but also to alleviate mortgage prepayment. A lower LPR certainly won’t be helpful for banks’ income,” they said.

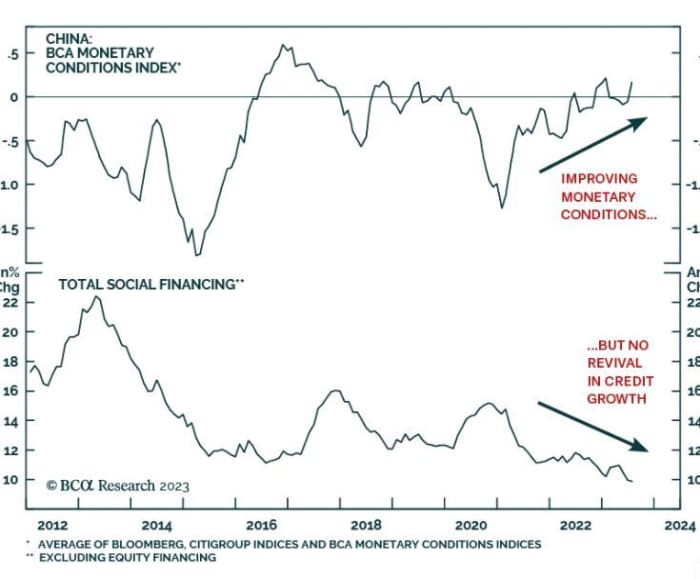

BCA Research analysts told clients in a note that China could be entering a liquidity trap, making small steps on interest rates by the PBOC an insufficient tool to boost the economy.

“In this situation, policymakers need to enact large fiscal transfers to households or undertake quantitative easing to produce a strong cyclical recovery. However, neither of these are likely at the moment,” the analysts told clients in a note.

“Interestingly, monetary conditions have eased largely due to currency depreciation. However, the rebound in credit growth has been muted due to poor credit demand, which has been dampened by low confidence among households and businesses,” said BCA.

So without “irrigation-style” stimulus and a property market and real-est ate price revival, private sector sentiment will stay sluggish and credit growth low by historical standards. “Our China strategists continue to expect Chinese stocks to fall further,” they said, offering the below chart: