The bond market is the main question preoccupying strategists at the moment. Even after the big drop in yields following the jobs report, the 10-year yield BX:TMUBMUSD10Y has climbed 24 basis points over the last three weeks, and the 30-year BX:TMUBMUSD30Y has jumped 31 basis points.

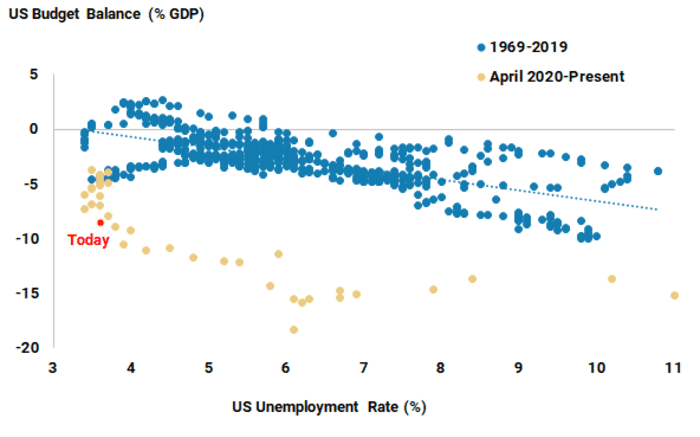

Mike Wilson, Morgan Stanley’s strategist who seems to never miss an opportunity to recall how wrong he’s been this year on the stock market, says the U.S. has rarely posted such large deficits when the unemployment rate is so low. “If fiscal policy is showing such little constraint in good times, what happens to the deficit when the next recession arrives,” he asks. The recent backup in yields should start to call into question equity valuations, he says.

Morgan Stanley/Haver Analytics

The team at BNP Paribas say the recent increase in yields is not an overshoot, though they do admit being caught by surprise by the speed and nature of the move. “We think there is a clear argument for a further rebuild of term premium, biasing curves steeper and keeping long-end yields stickier into an eventual downturn,” say strategists led by Sam Lynton-Brown, global head of strategy.

That’s similar to what Bill Ackman said last week, when he said he was shorting 30-year Treasurys. Right now, estimates of term premium, like this one from the New York Fed, are negative. That is, investors are not seeing the risks in holding longer-term paper versus shorted-dated securities.

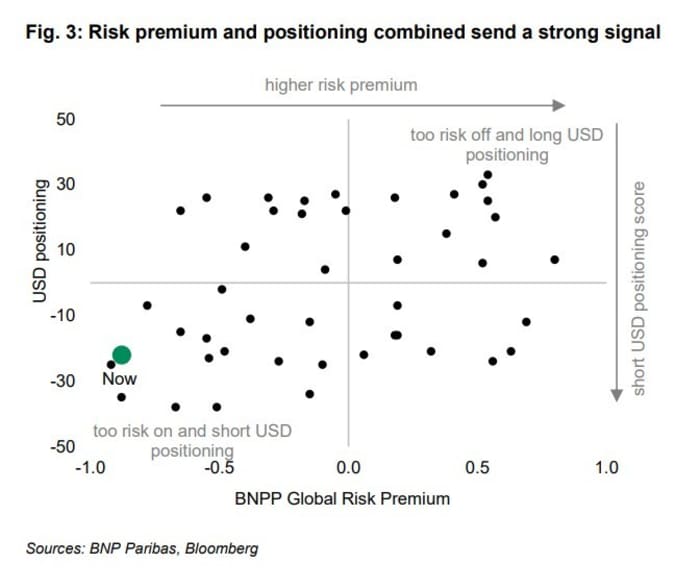

In a note entitled, “summer risk burnout,” BNP sees scope for another risk-off week, following the 2.3% decline in the S&P 500 SPX. Its model of the global risk premium still points to caution, while extended short U.S. dollar positioning is historically extreme. Plus, they say, its seasonality analysis shows the next two weeks is typically bullish for the dollar, bullish for currency volatility — which it says is a leading indicator — and moderately bearish for equities.

BNP also brings back a story that was at the forefront of minds when the debt ceiling was lifted, namely the reversal in liquidity conditions. The French bank points out that most of the global move there relates to European banks having to repay loans to the European Central Bank in June. “The market reacts with a lag to liquidity contractions – peak cumulative impact on key assets is usually reached between 8-12 weeks of a liquidity shock.”

The markets

U.S. stock futures ES00, +0.28% NQ00, +0.42% were moving higher early on Monday. The yield on the 10-year Treasury BX:TMUBMUSD10Y was 4.10%.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

While you were at the beach this weekend, Berkshire Hathaway BRK.B, -1.08% reported its second-quarter results, and the takeaway was that operating profits rose by 6%.

There wasn’t too much commentary so we’ll hand the analysis over to the blog Rational Walk: “During the annual meeting, Warren Buffett said that he expects the majority of Berkshire’s non-insurance businesses will report lower earnings in 2023. However, higher interest rates have benefited Berkshire’s holdings of treasury bills. As a result, barring major catastrophes, Mr. Buffett expects (but did not promise) that operating earnings will increase in 2023. So far, this prediction appears to be playing out.”

The consumer price index is due Thursday, but ahead of that, consumer credit data is due for release at 3 p.m.

Monday’s result calendar includes Tyson Foods TSN, +0.34%, and after the close, Paramount Global PARA, +3.58%, kicking off a big week for the media sector.

Trucking company Yellow YELL, -0.83% filed for bankruptcy. Its stock last week surged 405%.

Best of the web

Indiana tests if the heartland can transform into a microchip hub.

America’s self-storage addiction.

Some Wells Fargo deposits disappeared last week in what the bank calls a technical problem that was resolved.

Top tickers

Here are the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, -2.11% | Tesla |

| TUP, +35.51% | Tupperware Brands |

| NIO, -4.79% | Nio |

| TTOO, -28.57% | T2 Biosystems |

| AMC, +0.41% | AMC Entertainment |

| AAPL, -4.80% | Apple |

| AMZN, +8.27% | Amazon.com |

| NKLA, -26.36% | Nikola |

| PLTR, -2.73% | Palantir Technologies |

| NVDA, +0.37% | Nvidia |

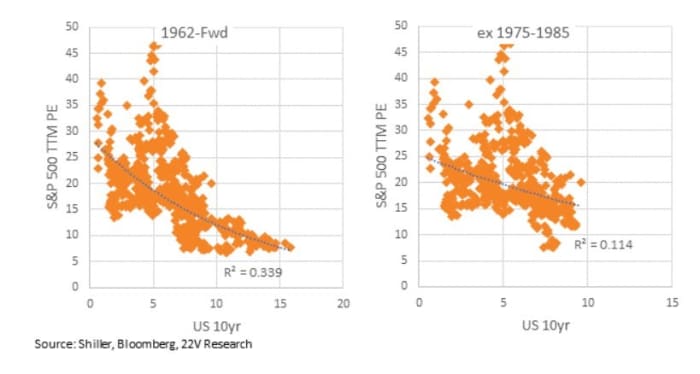

The chart

Much has been made that stocks look expensive relative to the 10-year yield. Dennis DeBusschere of 22V Research pushes back on that view, charting the relationship between price-to-earnings ratios and the 10-year yield back to 1962 — and also doing that when removing the 1975 to 1985 experience that featured stagflation and the Volcker Fed. “What is obvious from the charts, the current level of the 10-year yield, or even higher from here [5% to 6%] does not automatically suggest much lower PEs. Other factors, like cash return, earning growth, financial condition expectations, etc., are the larger driver of PEs.”

Random reads

A man made nearly $ 300,000 — returning doors he didn’t buy to The Home Depot.

The latest trash talk on the hypothetical cage match been Zuck and Musk.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.