A top economist at JPMorgan Chase & Co. JPM, -0.21% no longer expects a recession to arrive in the U.S. before the end of 2023. He doesn’t expect one in 2024 either, but said the risk of a potential downturn remains elevated.

Michael Feroli, chief U.S. economist at JPMorgan, on Friday officially abandoned the bank’s earlier recession forecast, putting the largest U.S. bank by assets more in line with others on Wall Street in thinking that a recession might be avoided even though the Federal Reserve has increased rates to a 22-year high.

Explaining his view in a Friday client note, Feroli cited improving third-quarter data, waning inflation and the increasing likelihood that the Fed will succeed in its effort to tame inflation without cracking the U.S. economy.

Congress’s temporary resolution of the debt-ceiling standoff in June, as well as U.S. authorities’ efforts to shore up the U.S. banking system following the collapse of Silicon Valley Bank, also factored into Feroli’s decision.

In particular, he cited strong productivity data released earlier this week as one example of how labor supply is returning to a state of equilibrium. All of these developments helped inspire his decision to raise his forecast for third-quarter GDP growth to 2.5% from 0.5%.

The productivity of American workers and companies rebounded in the second quarter and grew at a 3.7% annual pace, according to official government data.

The rate surpassed economists expectations. According to Feroli, U.S. stocks may already be anticipating a further boost to productivity driven by the advent of the artificial-intelligence craze.

While Feroli has removed the recession call from his base case, he acknowledged that risks of a downturn persist. Should inflation reaccelerate, it could provoke the Fed into more interest-rate hikes, which could bring down the economy.

“While we and the markets think it is done, it probably wouldn’t take much of an upside inflation surprise for the FOMC to deliver the extra rate hike that was signaled in the June dots, with perhaps even more to come,” he said.

To be sure, even if a recession is avoided, Feroli expects growth to slow to a “subpar” pace as tighter bank-lending standards and less bountiful government spending take a toll.

As for the Fed policy, Feroli expects the central bank will start cutting rates again in the third quarter of 2024.

“The Fed reliably cuts rates in recessions. However, last week Chair Powell indicated that with rates now in restrictive territory, even absent a recession they have scope to adjust the funds rate lower in the event inflation comes down — which both he and we project,” he said.

“So while we don’t foresee a rapid cutting cycle we do look for policy rates to be adjusted lower beginning in 3Q24.”

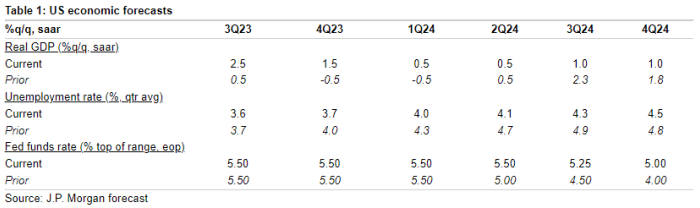

Here’s a breakdown of Feroli’s revised forecasts for unemployment, GDP growth and the fed-funds rate:

JPMORGAN

A recession call had been a bedrock of JPM’s house views for months, with it codified in Feroli’s 2023 outlook published late last year. It was integral to the banks’ equity strategists bearish outlook on the stock market.

See: Goldman chief economist sees reduced chance of recession and dismisses inverted-yield-curve worries

The bank isn’t alone. Economists and strategists at Goldman Sachs Group GS, +0.02%, Apollo APO, +0.24% and elsewhere have dropped or tempered their recession calls, which were a consensus view among Wall Street economists heading into 2023.

Stocks closed lower Friday, with the Dow Jones Industrial Average DJIA and S&P 500 SPX posting their first weekly loss in three weeks, shedding 1.1% and 2.3%, respectively, since Monday. The Nasdaq Composite Index COMP booked its biggest weekly percentage drop since March 10, falling 2.9%, according to Dow Jones Market Data.