The Dow Jones Industrial Average will likely conclude its historic 13-session winning streak on Thursday.

Barring a late-day rally that pushes the average back into the green, the streak will be remembered as the Dow’s longest stretch of daily gains since 1987. What’s more, it will have come within one session of tying the Dow’s record 14-day winning streak from 1897, or more than 125 years ago.

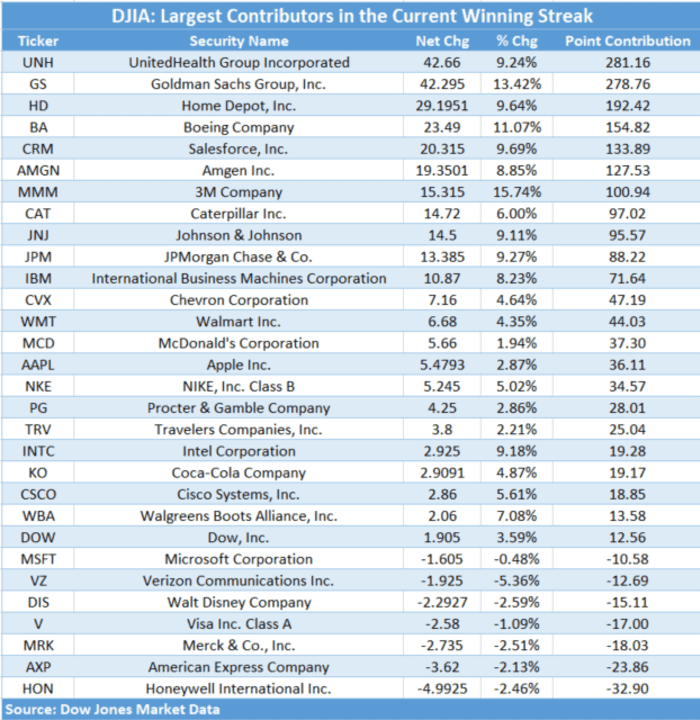

Still, the streak has left many on Wall Street astonished. But what companies helped propel the Dow higher?

An analysis from Dow Jones Market Data shows UnitedHealth Group Inc. UNH, -0.27%, the most heavily weighted company in the Dow, contributed the most points to the Dow during the streak, adding 281.16 points to the blue-chip average on a net basis through noon Eastern Time on Thursday. A strong earnings report earlier this month helped drive UnitedHealth’s shares higher.

See: UnitedHealth’s shares on track for biggest gain in over two years after earnings beat expectations

Unlike the S&P 500 and Nasdaq 100, which are weighted by market capitalization, the more old-fashioned Dow is weighted by share price. UnitedHealth’s shares closed at $ 508 on Wednesday, according to FactSet data.

Goldman Sachs Group GS, -0.77% and Home Depot Inc. HD, -0.01% were the second- and third-biggest contributors before the Dow turned lower Thursday afternoon.

It’s notable that Apple Inc. AAPL, -0.68% and Microsoft Corp. MSFT, -1.97%, the only two members of the so-called “Magnificent Seven” group of megacap technology stocks included in the Dow, contributed surprisingly little to the streak. Microsoft shares actually weighed on the index, while Apple kicked in just 36.11 points through Wednesday’s close.

See: Amazon is the cheapest of the Magnificent Seven stocks by this important measure

See the complete breakdown below::

Dow Jones Market Data

After trading higher for most of Thursday’s session, the Dow DJIA, -0.60% tumbled into the red in afternoon trading following reports that the Bank of Japan might tweak its policy of yield curve control at its policy meeting, which concludes Friday in Tokyo. The blue-chip gauge was off by 145 points, or 0.4%, at 35,377 in recent trade.