Seventy-one years ago, Harry Markowitz revolutionized how individuals and institutions invest by drawing attention away from individual security selection and focusing it on portfolio construction more broadly. To Markowitz, which stock a portfolio held mattered far less than the mix of stocks, bonds and other broad asset classes.

Moreover, long-term benefits could be gained by holding a mix of assets that performed differently under different economic conditions. With the future inherently uncertain, investors should be prepared for whatever might come next. As others recognized and appreciated these benefits, covariance — how one asset class performs relative to another over time — rather than absolute return, took center stage.

Since then, relative correlation has become a principal consideration as asset managers determine the specific composition of their portfolios. Armed with decades of historical covariance data, investors try to choose just the right mix of stocks, bonds, real estate and other asset classes to optimize long-term returns over economic cycles.

History shows that while well-intentioned and well-grounded in the past, these thought-to-be-well-diversified portfolios frequently fail to perform as expected. The covariances which investors presume can be extrapolated into the future break down.

Balanced investors experienced this firsthand during 2022 when stocks and bonds fell together. The market behavior defied the assurances investors had received that bonds perform well when stocks perform poorly.

What these investors and their advisers both missed is that underpinning asset class performance and covariance more broadly is investor sentiment. What leads investors to buy or sell specific asset classes over time isn’t economic cycles, per se, but investors’ willingness to take certain kinds of risk — that is, how confident investors are in the prospects of what they own. As we have all witnessed, this changes frequently, often without warning.

Ahead of the 2022 equity and fixed income downturns, investors had a seemingly insatiable appetite for both stocks and bonds. Prices for both had risen together and were at or near record highs. At the same time as equity investors were stampeding into highly futuristic technology stocks, there were trillions of dollars of negative-yielding bonds.

Interestingly, U.S. investors in the early 1980s witnessed just the reverse. Then, interest in both stocks and bonds was ice cold. With inflation soaring, the economy weakening, and stagflation making headlines, few saw a reason to own either. To a far lesser degree, this was also the case in the fall of 2022.

While historic covariances may help as a starting point when establishing a strategic asset allocation for a portfolio, investors need to pay closer attention to the current sentiment relationships in what they own. Holding a portfolio in which everything is hot in investors’ eyes may be wonderful on the way up, but its downside will be punishing when mood inevitably peaks and reverses. It’s investment-confidence diversification, not asset diversification, that matters.

For this reason, investors should consider owning a mix not of assets per se, but of moods. Hold both the reviled and the beloved, along with assets with clear up and down trends. Today, that might mean pairing crowd favorites like Big Tech stocks with unloved assets like energy stocks.

There is more to this kind of confidence diversification than meets the eye. How we feel has an impact on our preferences. When confidence is high, investors naturally crave highly abstract, futuristic opportunities. When we feel good, we look at concepts like AI as representing unlimited possibility.

On the other hand, when our confidence is low, we abhor abstraction. We demand certainty. Not surprisingly then, when our mood is low, we reach for cash, gold, and other real assets. As a result, a pairing of Big Tech and energy represents not just a barbell trade in current sentiment, but one in current investor preferences, too.

Portfolio

There are other benefits to confidence diversification. It forces investors to take specific actions that run counter to their behavioral biases. They must buy out of favor assets they wouldn’t otherwise touch because the idea would be laughable, while at the same time sell those investments they would otherwise pour money into at higher and higher prices.

Confidence diversification fosters emotional discipline. Rather than being swept up by mania or panic, investors look at sentiment objectively and then act on this knowledge. They seek to own slices of all moods at all times. In a world awash in social media and the highly emotional and impulsive behavior that accompanies it, confidence diversification prevents investors from getting swept up by the crowd. As a result, they are far less likely to overbuy at the top and sell out at the bottom.

Markowitz was correct that covariance matters and that there are benefits to diversification. But historical correlations and asset allocation only take us so far. In real time, relative asset performance is driven by the relative preferences of the crowd. By better understanding what investors want — and don’t want — investors can create portfolios that are more resilient and which move with and against today’s fast acting crowd.

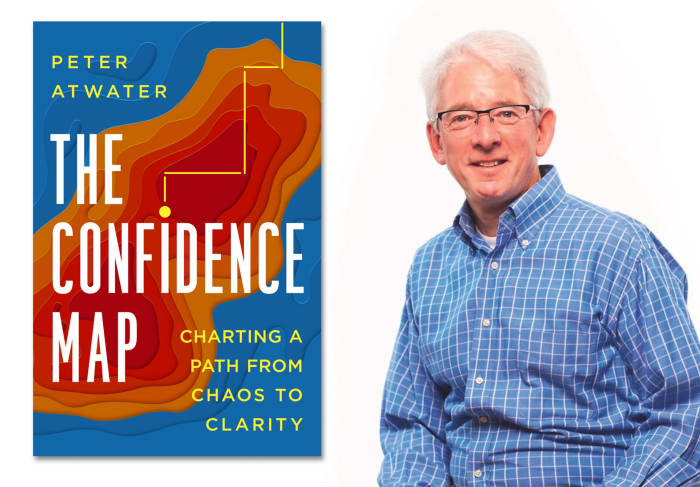

Peter W. Atwater is an adjunct professor of economics at William and Mary, and president of Financial Insyghts, a consulting firm that advises institutional investors, major corporations and global policymakers on how social mood affects decision making, the economy,and the markets. This article is adapted from Atwater’s new book, The Confidence Map: Charting a Path from Chaos to Clarity (Penguin/Portfolio, 2023).

Also read: ‘I like Warren Buffett’s approach — keep investing and just believe in America’: I’m about to retire. How do I invest a $ 400K windfall?

More: ‘No chance we’re having a soft landing’: Stock-market strategist David Rosenberg gives Powell’s Fed no credit — and no mercy