The 4% rule is out of date, but not in the way you think it is. It actually is too conservative.

I’m referring to the retirement spending rule that was made famous by a 1994 article by financial planner William Bengen. He arrived at this rule by examining the historical performance of U.S. stock and bond markets, calculating what constant inflation-adjusted amount you could withdraw from your portfolio each year and, even in the worst case, not run out of money over a 30-year period.

There have been numerous studies in recent years suggesting that this 4% rule is way too high. One study, which I discussed last fall, looked at more history than Bengen, including for non-U.S. markets, and found that a 1.9% rule would be more realistic.

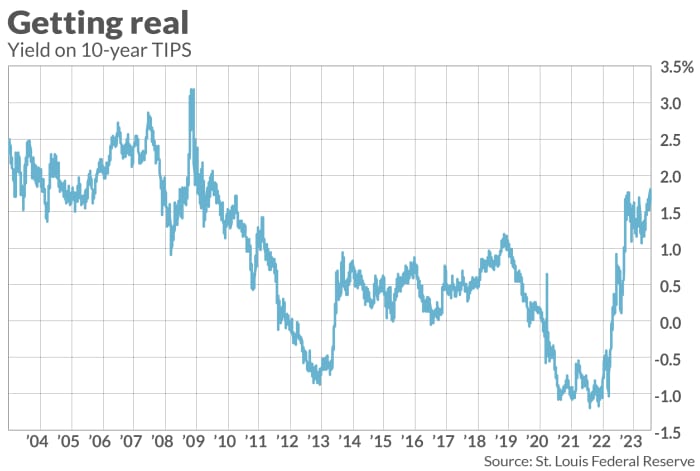

Crucially, however, this history doesn’t reflect what retirees can receive by investing in inflation-protected government bonds, which are a relatively recent creation. The first U.S. government inflation-protected bond (TIPS) was introduced in 1997, for example. Currently, given that TIPS are yielding more than at almost any other time since 2011, you can lock in a 4.3% inflation-adjusted spending rate for the next 30 years that is virtually guaranteed.

To review, TIPS pay interest above and beyond CPI inflation. Currently, for example, a 30-year TIPS yields 1.64%. By buying and holding it until maturity, your guaranteed return is 1.64% better than inflation, no matter how high or low inflation may be along the way.

The key to locking in a 4.3% spending rate is to build a TIPS ladder, with a different bond maturing in each year.

Allan Roth, the founder of Wealth Logic, an investment advisory firm, gets the credit for coming up with this strategy. In an interview, he told me that executing the ladder has become a lot easier since he introduced the approach last fall. That’s courtesy of a free website called TIPSLadder, which allows you to custom-build a hypothetical TIPS ladder by entering in a number of parameters—such as how long you want the ladder to last, how much inflation-adjusted income you want the ladder to produce each year, and so forth. The website then produces a list of exactly which TIPS you need to purchase, along with precise amounts, which you would then take to your broker to execute.

If buying individual TIPS bonds of many different maturities seems too onerous, you could pay a financial planner to hold your hand while you talk to your broker. Roth told me that while he doesn’t construct TIPS ladders, he is willing to get on the phone with clients while they talk to their broker, making sure their specific ladders are executed correctly. He told me that the process takes around 30 minutes.

If even that is too onerous, you can hope that a mutual fund or ETF gets created that will allow you to purchase such a ladder with a single transaction. Roth recently began urging the creation of such a vehicle, and Morningstar’s John Rekenthaler has jumped on board as well. However, Roth tells me that, so far, he is not aware of any such fund or ETF that is being planned.

You may not want to wait too long for that to happen, however. The key to locking in a 4.3% spending rate is that TIPS yields stay as high as they are currently. As you can see from the accompanying chart, those yields have been a lot lower much of the last two decades. Over the last five years, in fact, they were negative half of the time.

So the markets are giving us a rare opportunity to get the last laugh on history.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.