U.S. stocks were slightly lower Wednesday as traders awaiteded the minutes of the Federal Reserve’s June policy meeting, while concerns about a faltering Chinese economy dampened risk appetite.

How are stocks trading

- The Dow Jones Industrial Average DJIA, -0.36% declined 50 points, or 0.2% to 34,368

- The S&P 500 SPX, -0.21% dropped 2.6 points, or 0.1% to 4,452

- The Nasdaq Composite COMP, -0.20% dipped 12 points, or 0.1% to around 13,805

On Monday, the Dow Jones Industrial Average rose 11 points, or 0.03%, to 34418, the S&P 500 increased 5 points, or 0.12%, to 4456, and the Nasdaq Composite gained 29 points, or 0.21%, to 13817.

What’s driving markets

Traders on Wednesday have an eye on the minutes of the Federal Reserve’s June policy meeting, when interest rates were left unchanged, due to be published at 2 p.m. Eastern.

“While not much new information is expected from the minutes, the discussion details may shed light on the reasons behind the pause. Market participants will also be keen to identify the factors policymakers will consider when deciding on a potential July rate hike,” said Patrick Munnelly, analyst at TickMill Group.

Traders are pricing in an over 85% chance that the Fed will raise its key interest rate by another 25 basis points in its July meeting, according to CME FedWatch Tool.

For U.S. economic data, orders for manufactured goods rose 0.3% in May, the Commerce Department said Wednesday. This is the fifth gain in the past six months. Economists surveyed by the Wall Street Journal were expecting a 0.6% rise.

U.S. traders, returning from their Independence Day holiday on Tuesday, were also met with a risk-off tone across markets after weak data from China sparked fresh concerns about the prospects for global economic growth.

A survey of the world’s second biggest economy showed service sector activity was slower than expected in June, adding to fears that China’s rebound from the COVID lockdown last year continues to stall.

The prices of some assets typically in thrall to perceptions of Chinese demand were under pressure, such as copper HG00, -0.54%, while Sino-sensitive indices such as Germany’s DAX 40 DAX, -0.63% were leading declines in Europe.

Read: U.S. reportedly plans to restrict China’s access to cloud services. That could put Amazon and Microsoft in a bind.

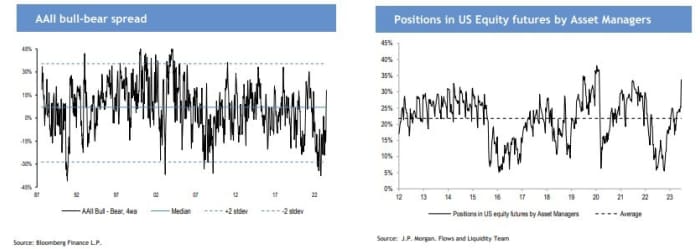

The negative shift in sentiment may leave U.S. stock market vulnerable, given recent strong gains and bullish positioning.

The S&P 500 index went into the U.S. Independence Day holiday at a 14-month high having gained 16.1% for the year so far with investors saying they are increasingly optimistic and hedge funds taking bets to levels that are well above average, analysts at JPMorgan noted.

Source: JPMorgan

From the technical perspective, the medium-term trend in equities remains bullish as the S&P 500 index hit a fresh yearly high, but risks of a pullback have been steadily increasing, according to Tom Essaye, founder and president of Sevens Report Research.

Companies in focus

- Rivian Automotive Inc. RIVN, +2.28% went up 0.5% Wednesday after Amazon.com Inc. said it had rolled out the first electric delivery vans from the electric-vehicle maker. The e-commerce giant said more than 300 new electric vans from Rivian will hit the road in Germany in the coming weeks. Rivian shares were among the EV makers that got a boost on Monday after upbeat delivery and production data from companies including Tesla Inc. TSLA, -0.32% and Nio NIO, +2.64%.

- United Parcel Service Inc. stock UPS, -1.64% fell 1.2% after the union representing thousands of workers at the global delivery firm reportedly “walked away from the bargaining table,” and unanimously rejected a contract offer by the company.

- Microsoft Corp. MSFT, +0.25% shares edged up while Amazon shares dipped. The Wall Street Journal, citing sources, reported Tuesday that the White House planned to curb Chinese companies’ access to U.S. cloud-computing services. The article said Amazon and Microsoft could be forced to ask the U.S. government for clearance to provide cloud services that use AI chips to Chinese customers.

- Nikola Corp. NKLA, +6.93%’s stock rose 5.7% Wednesday, after the company reported its second-quarter delivery and production numbers.