The rally this year in U.S. stocks has been centered on megacap tech stocks, but international equities have enjoyed a boom as well that is more broad based.

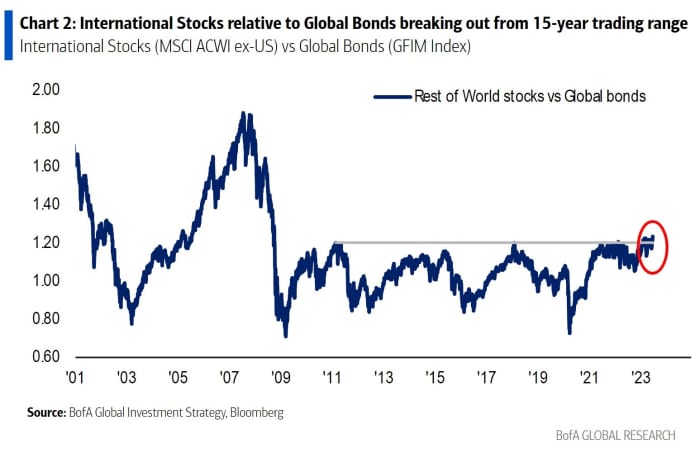

One chart capturing this rise comes from Bank of America, which plotted the MSCI all-country world index ex-U.S. vs. global bonds — and noted that it’s broken out of a 15-year trading range.

There was the biggest inflows to Japan in 12 weeks after the Nikkei 225 reached a fresh 33-year high, the Bank of America report said. The Nikkei NIK, +0.66% has gained 29% in local terms this year, while the iShares MSCI Japan ETF EWJ, -0.14% has gained 17%.

The Vanguard FTSE Europe ETF VGK, +1.36% has gained 14% this year.

Japanese and European markets each have a higher percentage of stocks trading above their 200-day moving average than the U.S., say strategists at Citi.

A popular fund to track China’s internet stocks, the KraneShares CSI China Internet ETF KWEB, +1.91%, is down by 1% this year though it’s up 71% from late October lows.